/)

Silver and Silver Miners Outlook 2025

A brief summary of the most important trends and themes for silver and silver miners in 2025.

Inflation Boom in 2025 – Silver Beats Gold

2024 was a relatively strong year for silver with the price increase of 21.5 %. You can also say that it has been a weak year for the financial system, where the central banks have now switched sides and begun to stimulate again with lower interest rates. This has happened at the same time as the world's largest economy, the US, is pushing forward with the help of huge budget deficits. It looks like 2025 will ‘trump’ 2024 in terms of stimulus, all to create a financial growth boom.

This is a highly favourable setting for silver, which has the unique property of being the only metal to have a dual demand from both industry and investors.

Our forecast suggests that 2025 will be an even stronger year for silver than 2024. We see silver breaking through several significant levels, such as 31, 35, and 40 USD in 2025. All to break through its former all-time high from 2011, which is just below 50 USD per troy ounce (which corresponds to as much as +73%). The first major target will be to surpass 2024's peak of 35 USD (+21% from the end of 2024/25).

Main drivers for higher silver prices

Silver is a monetary metal and has been a part of human history since we started using money. In fact, there is no other currency that has been the world's main currency for as long as silver. Today, silver is in demand both by investors and the industry, as it is the most conductive metal for electricity and heat. With its unique properties, silver is increasingly used in our high-tech world, and this dual demand for silver is unique.

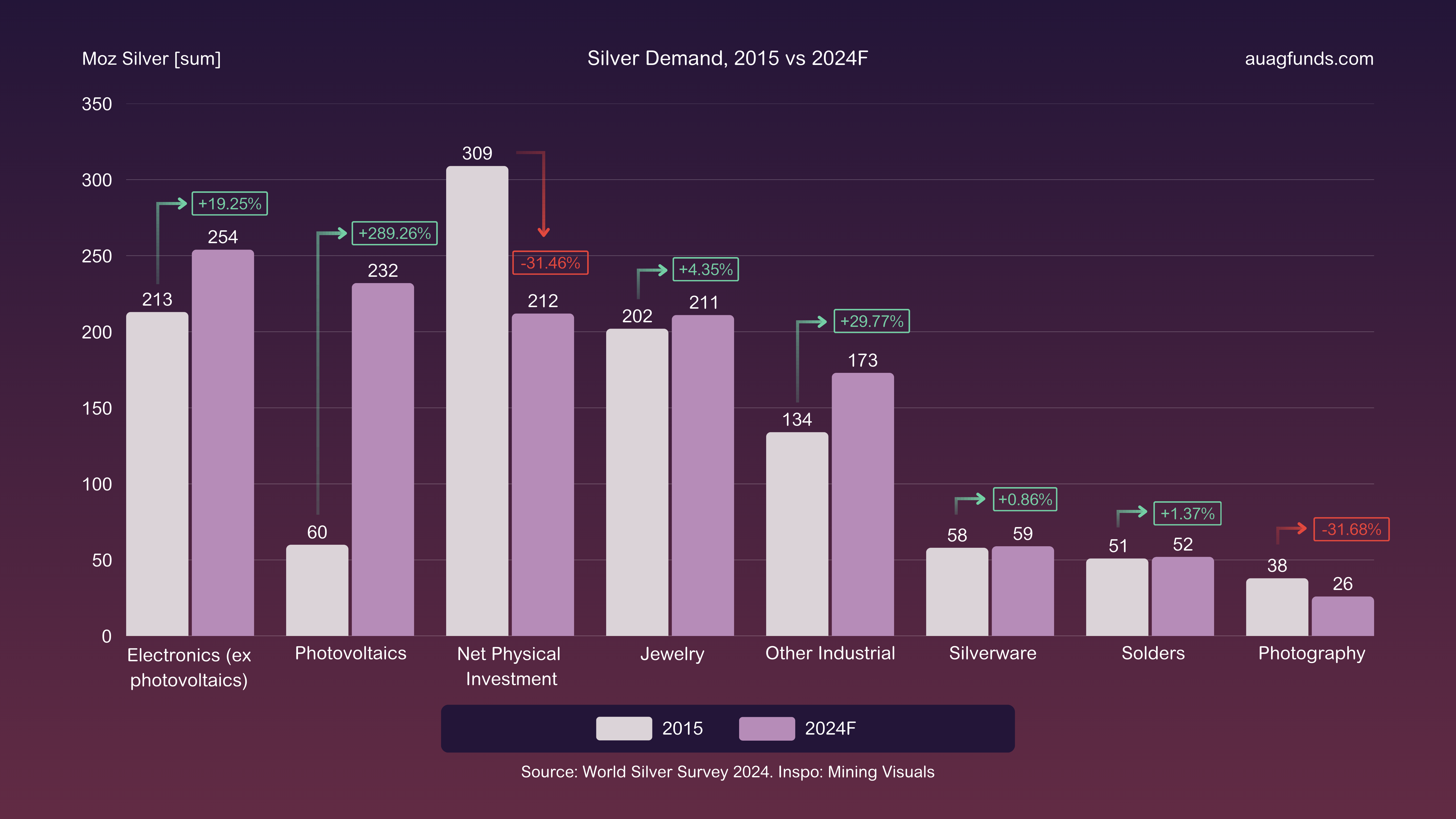

Today, industrial use accounts for 55% of total silver demand, driven by rising silver usage in the latest generation solar panels. When Elon Musk predicts that 90% of global energy will come from solar power, it is clear to see how dramatically silver demand could surge.

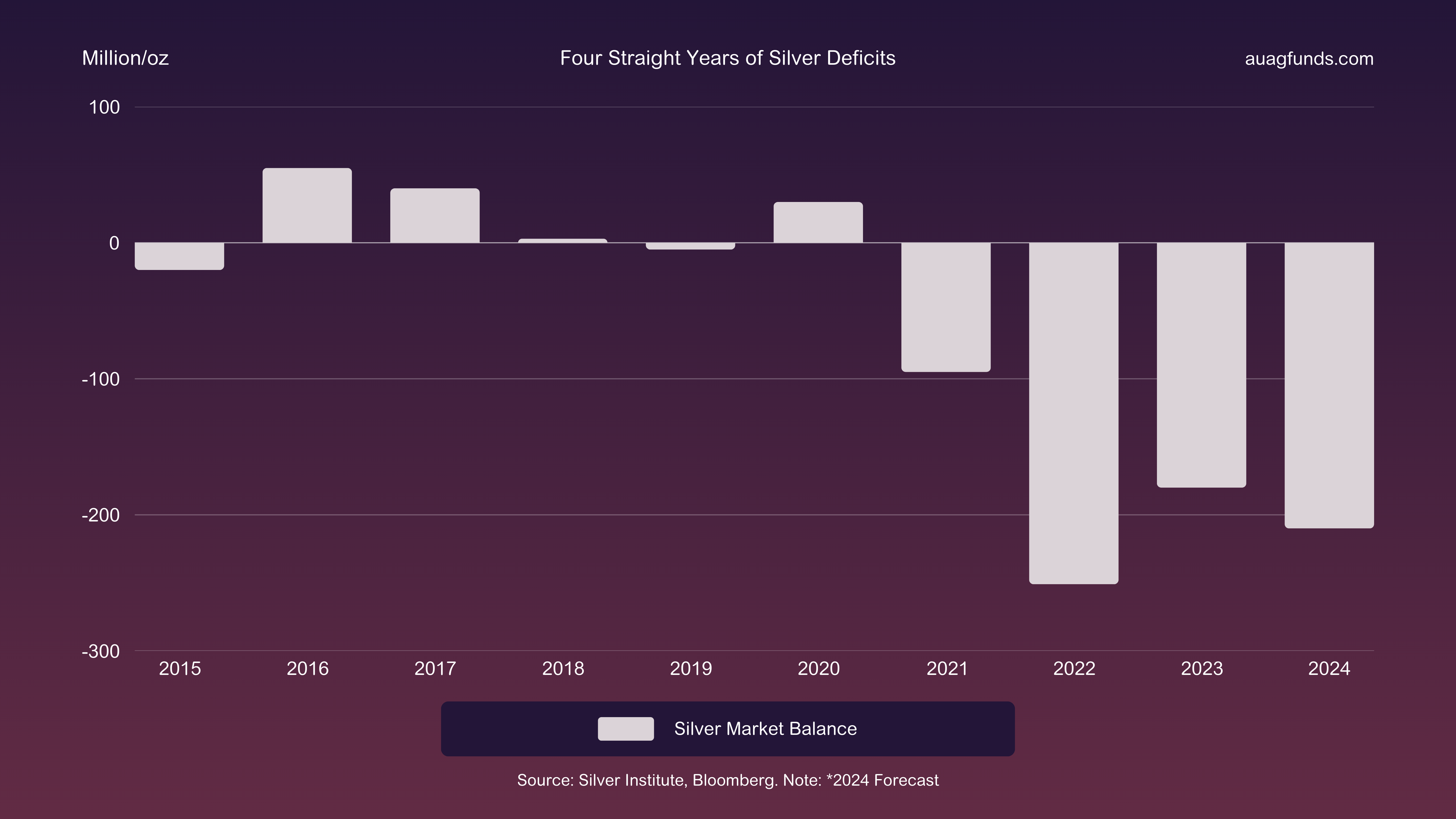

Another key factor about silver is that there are no longer any stockpiles available for purchase. After several years of deficit in supply relative to demand, we are facing a situation that will have a major impact on the price of silver. A physical shortage could trigger a price surge, potentially doubling silver’s value in a short period. In addition, demand is inelastic, as we will not consume less silver regardless of price increases. This is due to silver’s irreplaceable properties and the fact that the amount of silver used per product is relatively small, meaning price surges rarely impact the final product's cost significantly.

As we wrote in our Gold Outlook, the US, led by Trump, wants to avoid a ‘bust’ at all costs to create a positive ‘boom’ sentiment. The price to be paid for continuing stimulating the economy is monetary inflation.

An inflationary boom creates an environment where commodity prices, including silver, surge. And it’s not just the U.S., global debt levels are reaching new record highs. The money supply in the system is growing rapidly without any substantial growth being created, resulting in each monetary unit losing value, driving up the price of monetary metals like silver.

We also see an approaching end to the long-standing price manipulation that has occurred via trading on the COMEX exchange. Authorities have already issued billion-dollar fines, but have not put a complete stop to this behaviour, which has created artificially low prices, in particular for silver. However, the upside of this situation is that once they are forced to repurchase their ridiculous short positions, the price of silver will spike rapidly. Until that happens, there is a huge one-time discount to be seized.

Since we don't expect the authorities to solve this, we see this happening when either investors start buying in bulk or industrial users secure reserves ahead of a supply shortage to avoid production shutdowns. The ‘mother of all short squeezes’ then becomes a fact as those holding short positions will be forced to buy back at increasingly higher prices to avoid a financial catastrophe for their business.

Historically, you can tell whether silver is cheap or expensive by comparing the ratio between the prices of gold and silver. The Gold-Silver Ratio (GSR) usually reaches 30:1 when a bull market in precious metals begins to peak. So the ratio drops gradually during the bull market as silver has the tendency to outperform gold in long-term uptrends (and vice versa in a bear market).

Currently, the GSR stands at a high 90:1, making silver particularly attractive as an investment. Our short-term target for 2025 is for GSR to go towards 70:1, then gradually to 50:1, and then over several years, to 30:1. A GSR of 70:1, combined with a gold price of 3,000 – 3,300 USD, would give a silver price of 42 – 47 USD per troy ounce, which would be equivalent to an annual return of +45% and +62% respectively.

The case for mining companies – silver focus!

Silver miners naturally benefit from rising silver prices. All else being equal, the percentage increase in corporate earnings tends to outperform the change in the price of the commodity. While silver miners started to perform well in 2024, they had previously been hit by increased production costs. Margins did not increase as hoped. However, now that the silver price, which generates revenue in USD, has continued to rise and costs have stabilised, we expect strong improvements in the companies' margins. Potentially making the sector one of the stock market’s biggest winners in 2025.

One aspect that makes silver mining particularly interesting is that the majority of silver is produced as a byproduct from gold and copper mining operations. This means there are very few "primary silver miners" — companies specifically focused on silver extraction. Only these companies have the incentive to ramp up extraction in case of supply shortages. As a result revenues would therefore increase significantly for these silverfocused miners.

There have long been a strong case for the sector. Silver is undervalued relative to gold, which also makes silver miners undervalued relative to gold miners. Furthermore, gold miners have historically been undervalued relative to companies in the S&P 500.

As institutional investors are forced to look for alternative investment alternatives, silver miners are of interest with their historically low valuation and correlation (0.3) with the broad stock market. A capital rotation into the sector could drive substantial rallies for silver miners for a long time ahead.

Gaining Exposure to Silver – AuAg Silver Bullet

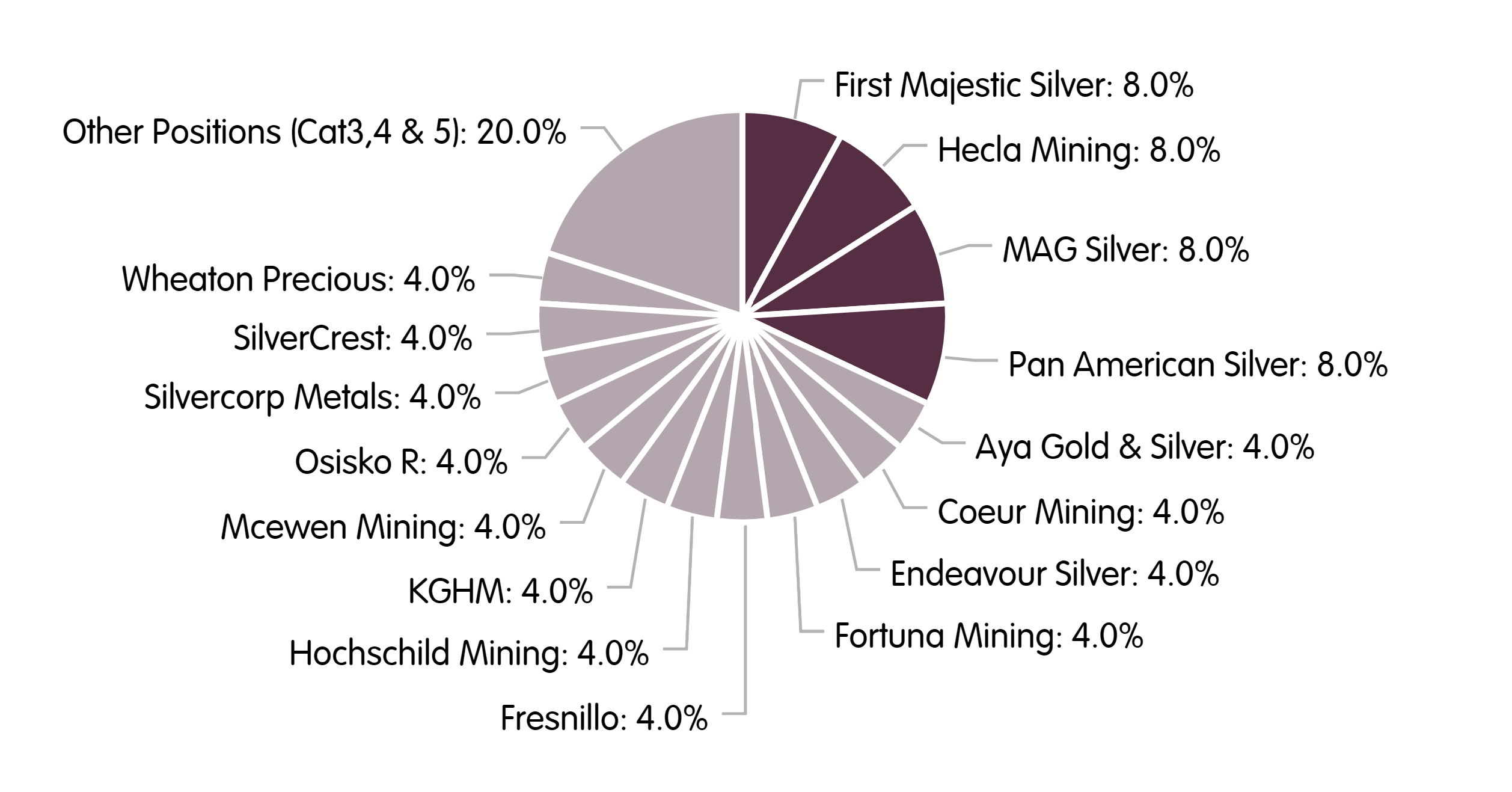

AuAg Silver Bullet is a fund created to provide you as an investor a portfolio of 25-30 focused silver mining companies.

With a focus on the portfolio companies' liquidity on the stock exchange, exposure to silver, extraction jurisdiction and the company's management, the base for AuAg Silver Bullet is set. Through a smart allocation of weights, a better portfolio is created than, for example, the index that the world's largest silver mining company ETF tracks. These factors provide a strong portfolio to catch the upside in a bull market for silver and silver miners.

With a focus on the portfolio companies' liquidity on the stock exchange, exposure to silver, extraction jurisdiction and the company's management, the base for AuAg Silver Bullet is set. Through a smart allocation of weights, a better portfolio is created than, for example, the index that the world's largest silver mining company ETF tracks. These factors provide a strong portfolio to catch the upside in a bull market for silver and silver miners.

By increasing your exposure to silver miners, you can improve your overall portfolio's return potential. With our 2025 outlook pointing to continued growth in the sector, the AuAg Silver Bullet fund is ideal for those looking to diversify their portfolio.

Disclaimer: The performance represented is historical; past performance is not a reliable indicator of future results, and investors may not recover the full amount invested.

/)

Gold and Gold Miners Outlook 2025

A brief summary of the most important trends and themes for gold and gold miners in 2025.

/)

US hits the debt ceiling - again

AuAg's monthly letter highlighting macroeconomic observations from the previous month.

/)

Reasons to invest in gold, silver, and mining companies in 2024

A brief summary of the most important trends and themes for gold, silver and mining companies in 2024.

/)