/)

US hits the debt ceiling - again

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for gold, silver and other essential metals. These observations are presented with images and charts laid out efficiently and concisely.

Gold

Gold had an exceptional year in 2024, with the trend of reaching new all-time highs remaining strong. This occurred during a period when the US dollar was strong relative to other fiat currencies, such as the euro and the Swedish krona.

In our Outlook 2024, We set a target price of $2,475 per troy ounce and projected a +20% increase in USD. The outcome exceeded expectations, with gold ending the year at $2,624, a rise of +27.2%. In EUR and SEK, the increase was an impressive +35.6% and +39.5%, respectively.

In our Outlook 2025, we foresee a significantly higher gold price throughout the year, ranging from $3,000 to $3,300. Several major banks have begun releasing their Outlooks for 2025, predicting a gold price around $3,000 (+14.3%), and as mentioned, we wouldn’t be surprised if it reached as high as $3,300 (+25.7%).

Silver

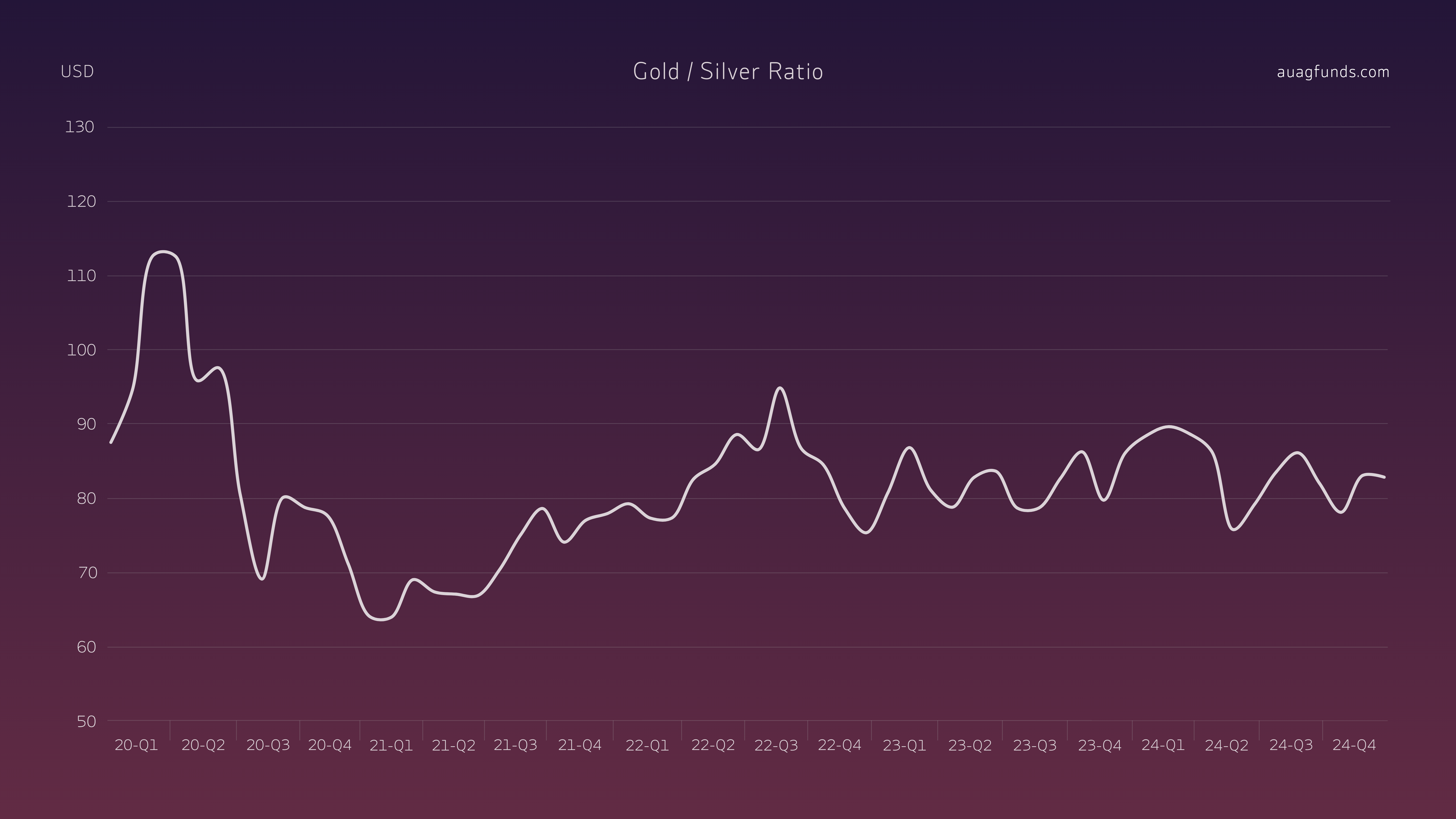

Silver had a particularly strong first half of the year. During that time, the GSR (Gold-Silver Ratio) dropped below 74:1. In our Outlook for 2024, we had expected this strength to persist throughout the year, but we saw a peak at the end of October at $34.8. The subsequent correction brought silver to $28.9 by year-end, a +21.4% increase. In EUR and SEK, the gains were slightly higher, at +29.5% and +33.3%, respectively.

In our Outlook for 2025, we anticipate silver gaining momentum once again, with the GSR moving from today’s level of 90:1 to below 70:1. This could lead to a remarkable year for silver, with prices exceeding $40 and potentially reaching up to $50 per troy ounce.

Mining Companies

Mining companies have been volatile as algorithmic trading targeted the sector for both short and long positions, driven by employment, inflation reports, and interest rate announcements. Sentiment is currently low, creating a favorable starting position as capital inflows into the sector are expected to grow both larger and more stable.

Cost increases for the companies have slowed, which, combined with relatively low energy prices, benefits their results. At the same time, the companies are enjoying strong cash flows, low valuation multiples, and significantly increased margins. Furthermore, commodity prices are now significantly higher than in recent years and remain at a relatively stable level. In our Outlook for 2025, we will provide further insights into the mining sector.

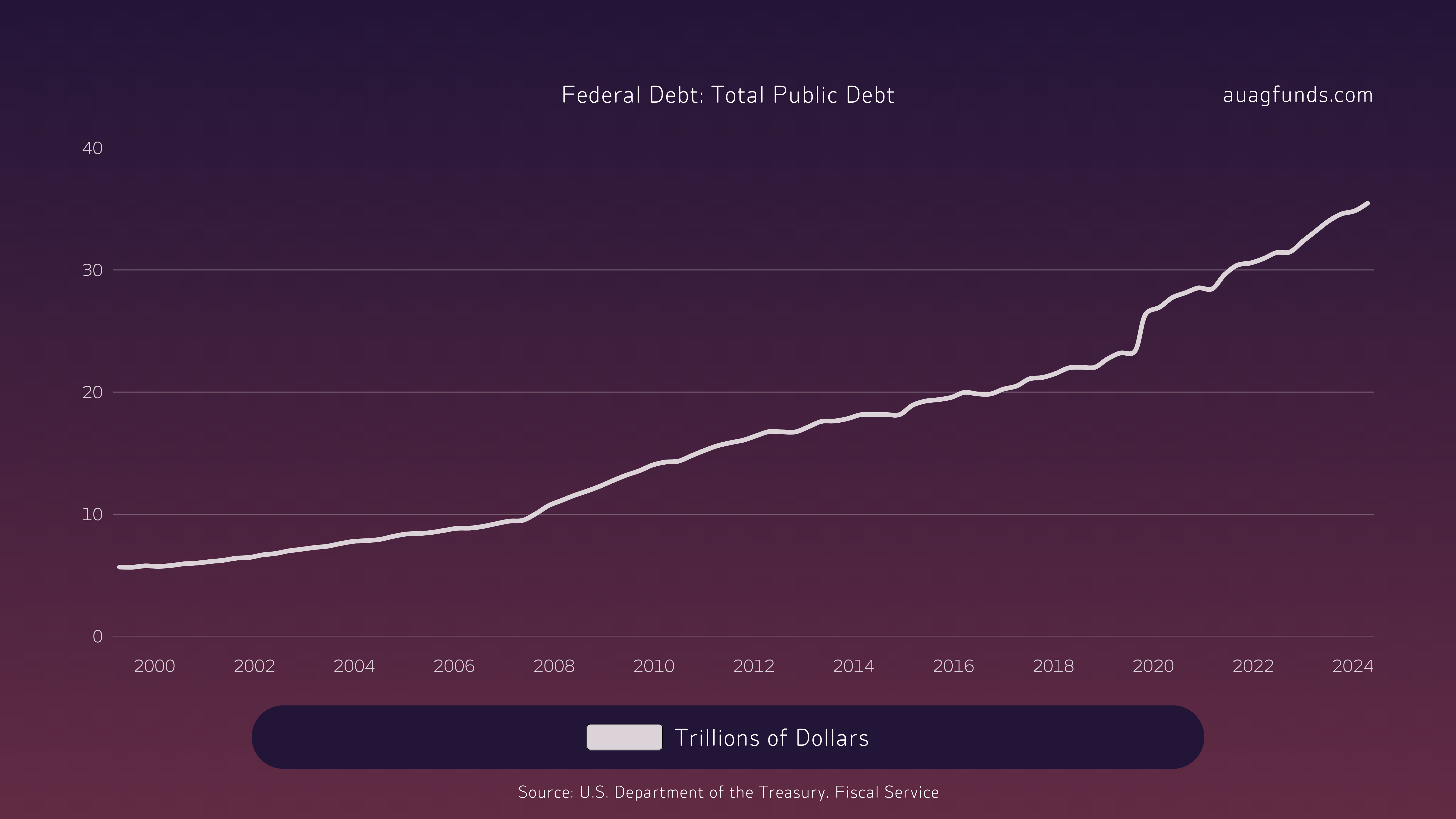

AuAg Macro - Monetary Inflation

The U.S. has once again reached its so-called debt ceiling, which could lead to partial government shutdowns due to the lack of funding. As usual, after some political wrangling, a higher debt ceiling will likely be approved, creating room to borrow more to finance the ongoing deficit. The money printers will thus be back in action as soon as the ceiling is raised.

We look forward to following fiat currency developments in the upcoming currency wars, which could become a major event in 2025. Has the dollar peaked? Will BRICS nations dare to challenge Trump's threats against those using alternatives to the dollar in global trade? Or will the dollar strengthen as other nations devalue their currencies?

AuAg Macro - Electrification

Elon Musk predicts that 90% of all future energy will come from solar power. Say what you want about Elon Musk, but he has a vision and significant influence worldwide. He is currently the richest man on earth and has a unique relationship with the incoming U.S. president.

Although the green transition and, for example, electric vehicle sales have recently slowed down, the electrification of our world remains an unstoppable megatrend. Solar farms, upgraded and improved power grids, and new energy-intensive AI data centers will demand significantly more essential metals, such as copper and silver.

According to the IMF, copper demand is expected to rise sharply over the next 20 years. At the same time, the trend over the past two decades of finding new high-quality copper deposits has nearly ground to a halt. Most copper today is mined in Chile and Peru. The Escondida mine, the largest copper mine globally, accounts for 4–5% of the world’s copper production. To meet future demand, we would need to discover and develop at least 15 new mega-deposits of this scale.

Silver demand for solar panels alone has increased by 100% over the past two years. Usage has grown from 118 to 232 million ounces (+115), in a market that produces approximately 1,000 million ounces annually.

Fund of the Month

Each month, we highlight a fund, either because it has performed well or because something stands out on the downside. Sometimes, we’ll also feature interesting portfolio changes.

This month, we focus on AuAg Gold Rush, which got its new name on December 3 and became actively managed on December 4. The fund has a defensive character due to an unusually high 40% allocation to royalty/streaming companies. At the same time, it has a lower allocation to the three mega-companies in the gold sector, with 12% compared to the typical 30% in standard indexes.

This allows for a higher allocation to large-cap and mid-cap companies, adding an offensive edge to capitalize on the major upward phases that gold has ahead. With AuAg Silver Bullet and now the actively managed AuAg Gold Rush, we offer both the most high-octane fund and the most stable precious metals equity fund in the market.

Fund of the Year

As we enter a new year, we also introduce a segment on the "Fund of the Year", or more accurately, the previous year!

For 2024, AuAg Silver Bullet was in the spotlight. The fund topped the Swedish rankings for several individual months and, as recently as October, was ranked first for year-to-date performance in 2024. However, a correction in November and December, combined with a surge in tech stocks and tech funds, resulted in a place within the top 2% for annual returns. As the saying goes, "It’s a fast-paced game." A 30.8% gain for 2024 is, of course, not bad, but we see even better years ahead. Perhaps 2025, with a strong start to the year, will be our time to shine.

It’s worth noting that performance periods, such as months or years, can be misleading, as they often depend on short-term events or prior trends (e.g., the first NAV day for 2025 saw a +8.44% increase, illustrating how quickly things can shift). For us as fund managers, month- or year-end boundaries are not particularly significant. Our advice to investors is consistent: sell a small portion (5–10%) after a sustained rally and add to your positions after periods of sharp corrections.

Macro Observation of the Month

Compared to other strong economies, the U.S. runs its economy with very large budget deficits. As we’ve written in previous monthly letters, Trump and Musk are likely to reduce U.S. government spending. However, it’s also probable that revenue will decrease due to lower tax income and other factors, leaving the deficit as large as (or even larger than) before, now exceeding 6%.

Trump and Elon Musk are not afraid of debt, as both have built their business through leverage. President Trump is likely to clash with Fed Chair Powell, who doesn’t want to adjust decisions on rate cuts based on the “debt problem and enormous interest cost.” We’ll see who wins that battle. For now, the market seems to believe in both simultaneously - which we don’t.

Similarly, Trump is pushing for a raised (or even abolished) debt ceiling before stepping in as US next president on January 20, avoiding an unpopular negotiation during his term.

Fears of tariffs and currency wars have once again strengthened the dollar. Combined with market belief that the Fed won’t need to cut rates, this has put the gold and silver bull market on pause. We believe this is temporary, creating another favorable entry point for investments in our sector as the mature bull market progresses.

Explore the funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

/)

/)

/)

/)

/)