/)

Gold and Gold Miners Outlook 2025

A brief summary of the most important trends and themes for gold and gold miners in 2025.

Inflationary Boom in 2025 – Gold Could Reach 3,300 USD

The significant increase in the price of gold during this millennium has reflected the massive amounts of debt and credit created. The printing presses have really been running at full speed, and in the first 24 years of the millennium, gold has risen by 802% in USD (1,082% in SEK). This corresponds to an average annual return of +9.6% in USD (+10.8% in SEK).

2024 was a strong year for gold, with a +27% increase, or if you prefer, a weak year for the financial system as central banks reversed course and resumed stimulation with interest rate cuts. This occurred at the same time as the world’s largest economy, the U.S., continued to power ahead with massive budget deficits.

Our forecast for 2025 suggests another strong year for gold. We predict that gold will break the 3,000 USD level during the year and potentially finish even higher, with a realistic target of 3,300 USD (+26%).

Underlying Factors for a Higher Gold Price

It appears that 2025 will “trump” 2024 in terms of stimulation. Continued interest rate cuts and further deficits in the U.S. are expected. While Trump may try to reduce government expenses, the new policies will also result in lower tax revenues and higher unemployment.

Both Donald Trump and Elon Musk have built their empires on loans, lots of loans, while driving full steam ahead. This will likely be the scenario for the coming four years. Avoiding a “bust” at all costs to create a positive “boom”. The price for this will be monetary inflation. An inflation boom creates a financial environment where commodity prices, including gold, rise significantly.

It’s important to note that it’s not only in the U.S. that debt is skyrocketing. The entire world is setting new record debt levels. The amount of money in the system is increasing without much real growth being created, which naturally means that each monetary unit becomes less valuable.

We’ve seen the beginning of de-globalization, which seems to be intensifying, especially now as the U.S. seeks to impose conditions that favour itself. “America First” policies and high tariffs may provide certain advantages for the U.S., but they also damage trust in a country that should instead be leading by example when it comes to free market economies.

This new phenomenon will likely drive inflationary pressures and potentially create a wave of devaluations in other countries to compensate for the tariffs.

A peace agreement between Russia and Ukraine in 2025 would lead to higher metal prices. The war, which has now lasted several years, has forced Russia to sell its large production supply at discounted prices.

The world cannot function without metals from Russia, but the West has done everything to reduce Russia’s income from essential metals. An end of the war would eliminate this price pressure, which has influenced global commodity prices for all producers will lead to an upward price adjustment.

What Favors Mining Companies – Margin Improvements!

Gold mining companies naturally benefit from rising gold prices. All else being equal, the percentage increase in company profits tends to outpace the change in the commodity price. In 2024, companies started performing well, but before that, they were hit by rising production costs. Margins did not increase as hoped.

With gold prices, which generate revenue in USD, continuing to rise and costs stabilizing, we see significant margin improvements for these companies. This percentage change could make the sector one of the big winners in the stock market in 2025.

Several factors already favour the sector. Gold mining companies are historically undervalued relative to the gold price, and they have reduced their debt levels while being cautious with new expensive projects for several years now.

Companies have also engaged in relatively large share buybacks, which is positive when done at low valuations and without relying on debt financing. Additionally, a strong trend of increasing dividends and high M&A activity makes the sector more attractive.

As institutional investors are forced to seek alternative investment options, gold mining companies become appealing due to their historically low valuations and low correlation (0.3) with the broader stock market. A capital rotation into the sector could lead to strong gains over an extended period.

Exposure to Gold – AuAg Gold Rush

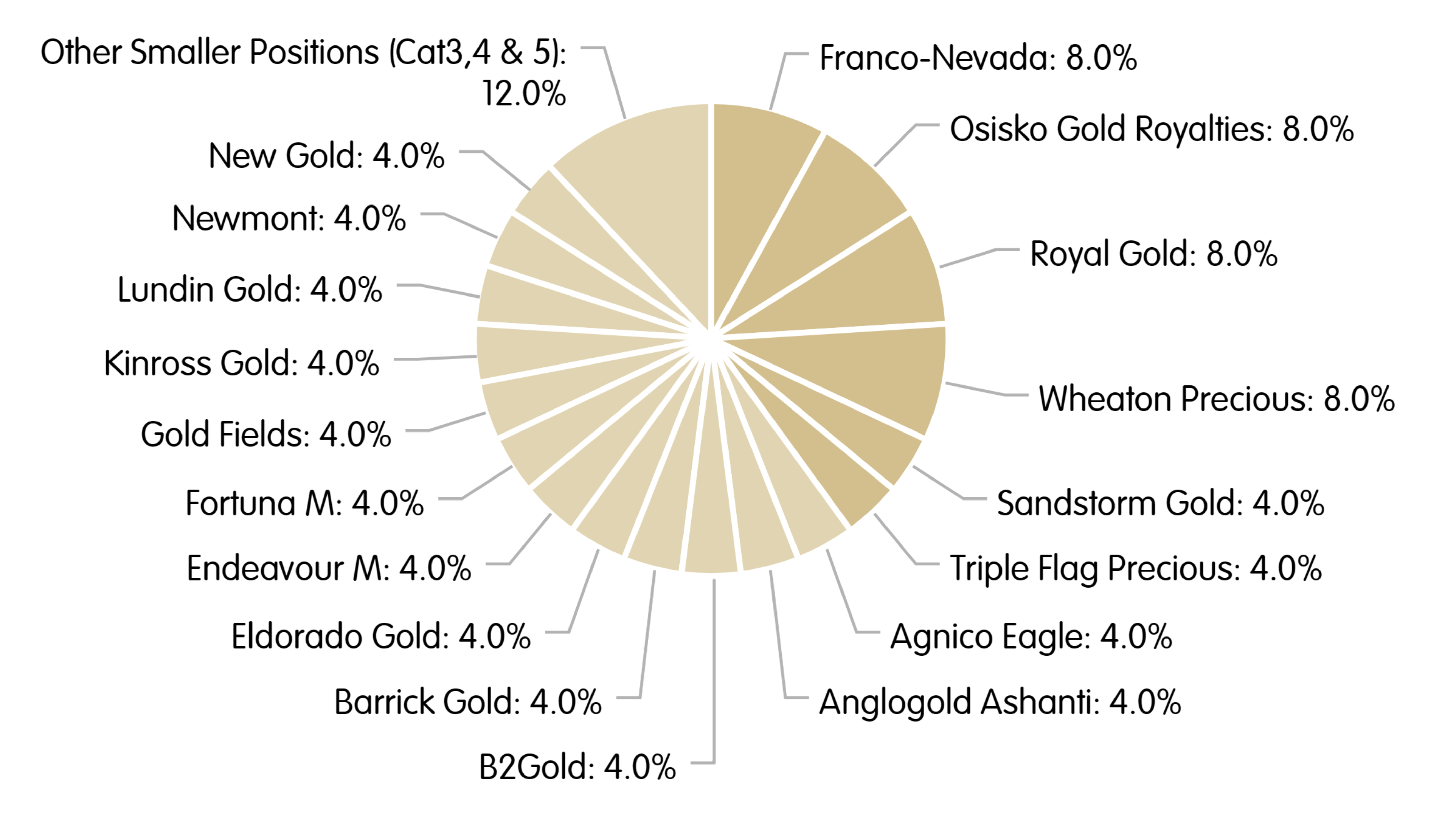

AuAg Gold Rush is a fund created to offer investors a portfolio of 24–27 carefully selected companies.

With a unique 40% exposure to Royalty/Streaming companies, the fund aims to have strong defensive qualities. The underexposure to the sector’s three mega-companies also allows for higher exposure to large-cap and mid-cap companies, creating a strong portfolio poised to capture the upside in a bull market for gold and gold mining companies.

By increasing your exposure to gold mining companies, you can improve the return potential of your overall portfolio. In our 2025 Outlook, which points to continued growth in the sector, the AuAg Gold Rush fund is an excellent choice for those looking to diversify their portfolio.

Disclaimer: The performance represented is historical; past performance is not a reliable indicator of future results, and investors may not recover the full amount invested.

/)

The Downside of the Index Market – The Big Get Bigger

AuAg's monthly letter highlighting macroeconomic observations from the previous month.

/)

AuAg Silver Bullet

Portfolio updates from the fund managers for AuAg Silver Bullet.

/)

Reasons to invest in gold, silver, and mining companies in 2024

A brief summary of the most important trends and themes for gold, silver and mining companies in 2024.

/)