/)

Elements | October 2024

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for precious metals and green tech elements. These observations are presented with images and charts laid out efficiently and concisely.

Gold and Silver

As we wrote in September's monthly letter, we were expecting a major interest rate cut by the US Federal Reserve. A 50 basis point cut is a strong beginning to the rate-cutting cycle. Although the Fed is trying to calm market expectations of more big rate cuts, it is likely that this is just the beginning of a new trend.

Gold continues to hit new all-time highs as stimulus measures gain momentum again. On 26 September, the gold price reached a record high of USD 2,685 per troy ounce. By the end of the month, gold had settled at USD 2,634, while silver closed at USD 31.17, resulting in a Gold-Silver Ratio (GSR) of just over 84:1. With gold prices already up more than 27% this year and most major commercial banks significantly increasing their targets, we have now set a new target of USD 2,750. This compares to our previous outlook for 2024, in which we had set a target of USD 2,475. In the same outlook, we forecasted the silver price to reach USD 35 per troy ounce by year-end. Our silver price outlook is based on an expected decline in the Gold-Silver Ratio (GSR), which we still anticipate will drop to 70:1 in the near future. With the new gold target and the same GSR target, the projected benchmark for silver is now just above USD 39. A lot can happen in the final months of the year!

For gold and silver mining companies, it is margin expansion - i.e., the relative increase in profits - that leads us to expect significant growth in share prices going forward. This improvement in margins comes as we transition from a period of high commodity prices and rising production costs to a phase where commodity prices are even higher, but production costs are declining. This shift is due to the stabilization of inflation and the decrease in energy prices.

Chinese stimulus

Central banks around the world are note the only ones who have shifted their approach by trying to stimulate the economy again, but China has also chosen to do more stimulus. China, which has been in a prolonged economic downturn, experienced a sharp and extended correction in its stock market. During this period, China's economic weakness raised concerns and uncertainty about future demand for commodities and industrial metals.

As a result of the stimulus, the Chinese stock market, which has been heavily depressed in the past, has now risen sharply. As China is the world's largest construction and manufacturing nation, this has also given a major boost to industrial metals and the related mining companies.

As a result of the stimulus, the Chinese stock market, which has been heavily depressed in the past, has now risen sharply. As China is the world's largest construction and manufacturing nation, this has also given a major boost to industrial metals and the related mining companies.

At the same time as these incentives were introduced, China celebrated its 75th anniversary with a light show of more than 10 000 drones - an unprecedented display. This is yet another sign that China will not slow down its economic activity, and we can therefore expect more of the same massive fireworks (stimulus) in the future.

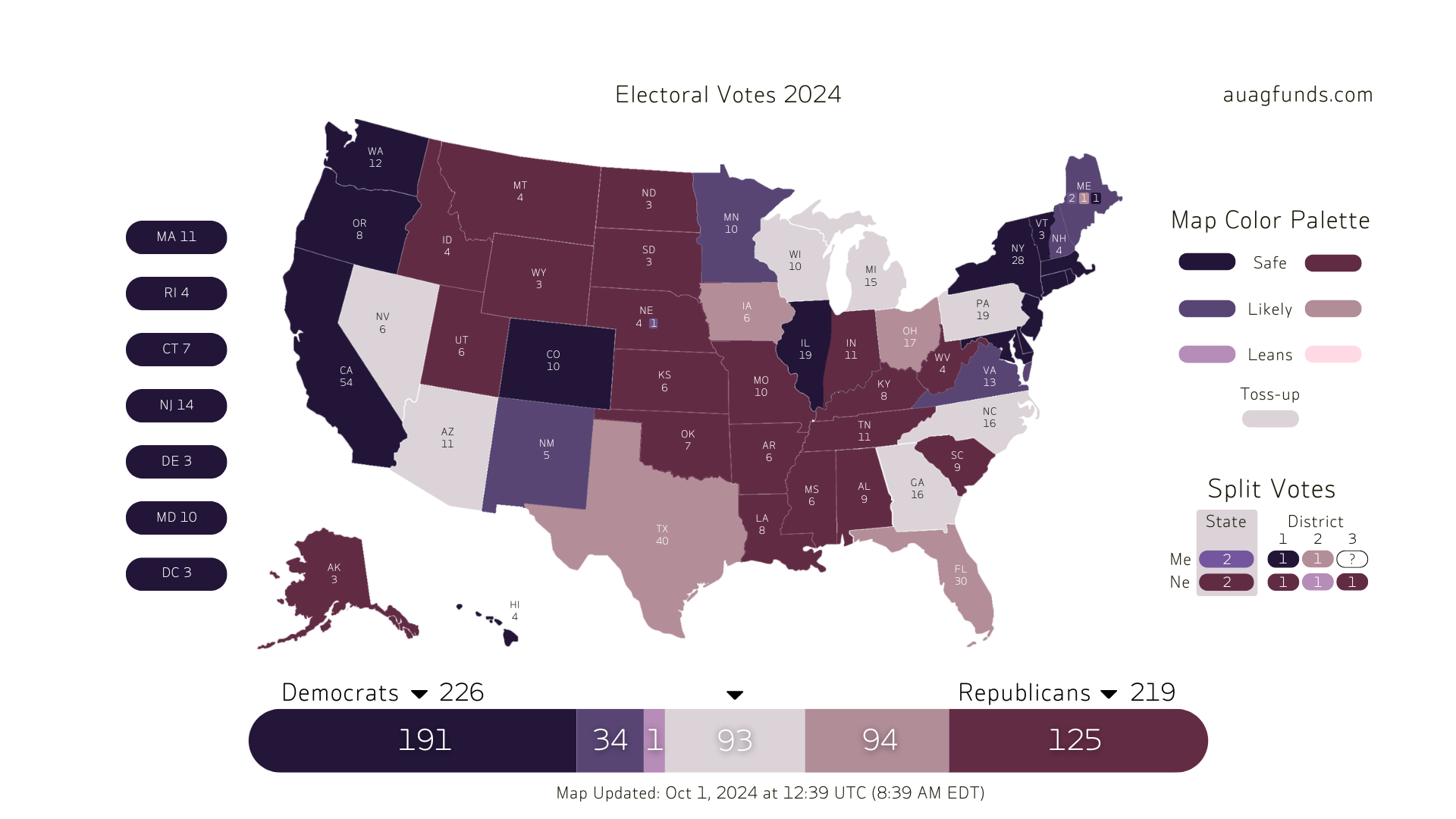

U.S. presidential election

With one month remaining until the U.S. presidential election, market turbulence is likely on the horizon. The election appears to be a close race, and as an outside observer, it's surprising to see the generally low level of discourse among global politics and politicians.

We expect continued turbulence until November 5th. One issue we've focused on is retaliatory tariffs, which Trump has especially advocated. He has not only pushed for general increases in such tariffs but has also specifically targeted Chinese goods, as well as threatening to penalize U.S. companies that plan to move production to countries like Mexico. Additionally, he has stated that any countries conducting trade without using the U.S. dollar as the currency of exchange must stop or face 100% retaliatory tariffs on their trade with the U.S.

The U.S. wields considerable global influence, given that the dollar has long been the dominant currency in international trade. However, in recent years, more countries - led by the BRICS - have sought to reduce their reliance on the U.S. and its currency. Is Trump's threat an attempt to halt the gradual decline of the dollar’s dominance? It could also be perceived that this threat may backfire, prompting even more countries to avoid giving the U.S. such an advantage.

It’s also worth noting that, despite disagreeing with Trump on virtually every other issue, the Democrats have maintained the retaliatory tariffs Trump imposed during his previous term. In addition to the tragic wars we’re witnessing today, we seem to be moving closer to a trade- and currency war as well.

The only clear winner in this scenario seems to be gold. Gold is the only currency without counterparty risk. Central bank gold purchases over the past 15 years, and especially the record amounts purchased in the last three years, highlight gold's enduring value. Trade barriers and policies aimed at protecting domestic workforces are all part of the de-globalization trend we are witnessing today.

USA built on ideals - birth, growth, development, and preservation

We conclude with a reflection on the founding of the United States and the strong ideals of freedom on which it was built. The formation of the United States and the early presidents' visions for the future of humanity are both inspiring and thought-provoking, especially in contrast to today’s political leaders. Let’s hope that no future president will symbolize a fifth step - destruction.

Thomas Jefferson, the third President of the United States and one of the principal authors of the Declaration of Independence, famously said:

“We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.”

“I predict future happiness for Americans, if they can prevent the government from wasting the labors of the people under the pretense of taking care of them.”

“Honesty is the first chapter of the book wisdom.”

“I sincerely believe that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.”

Read more inspiring quotes from different US presidents throughout history here:

Explore the funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

EFN Commodities: Bargain mode after the market slaughter of the green transition

/)

AuAg portfolio manager Eric Strand on gold, silver and copper

Eric Strand is a guest at Trading Direkt to talk about gold, silver, and copper.

/)

Here are the top funds of the month - manager: ‘A lot of potential left’

Here are the top funds of the month - manager: ‘A lot of potential left’

/)

/)

/)

/)