/)

Elements | September 2024

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for precious metals and green tech elements. These observations are presented with images and charts laid out efficiently and concisely.

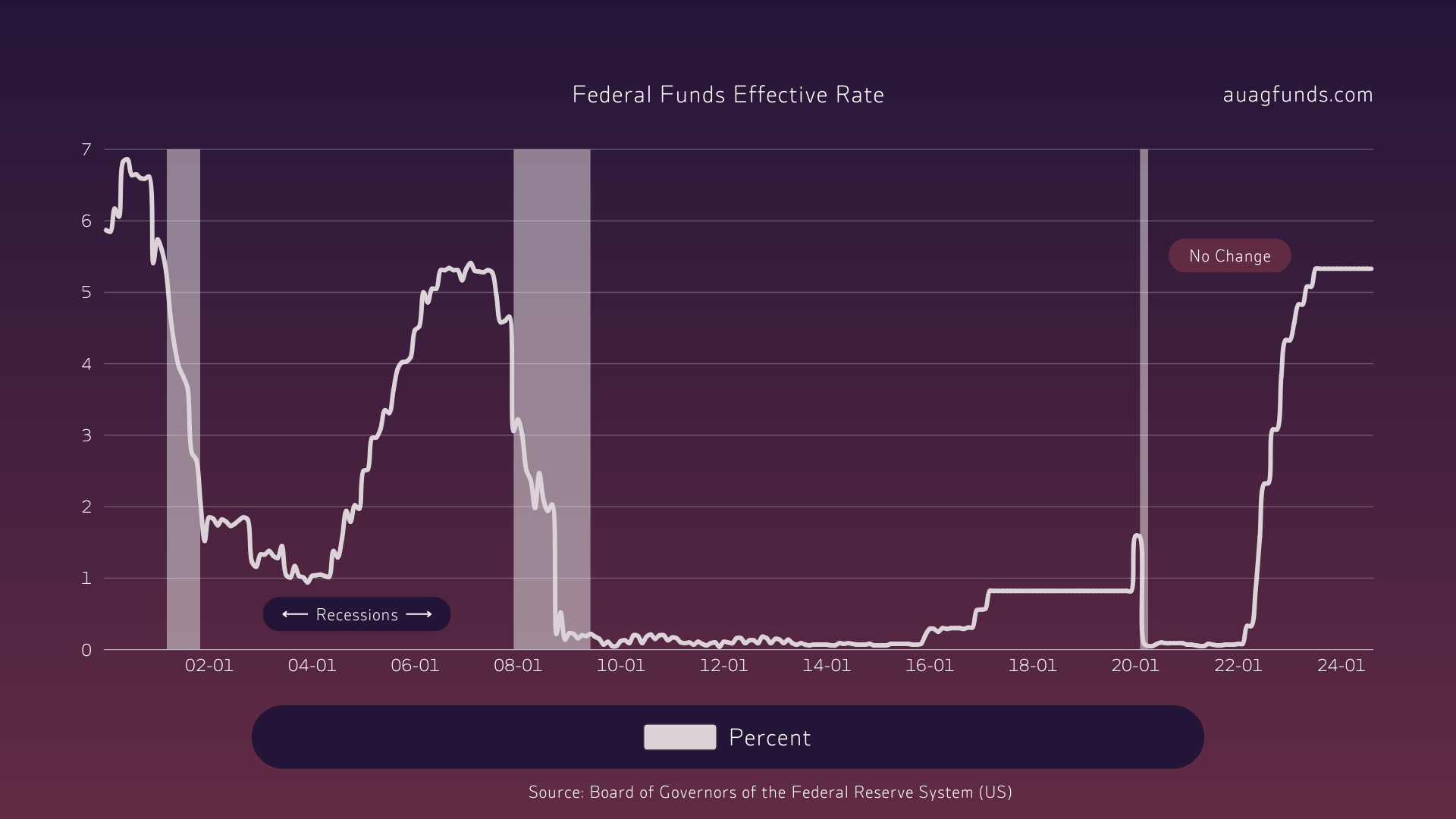

Interest rates heading towards zero

In August, the annual meeting of central bank leaders was held in Jackson Hole and it ended, as usual, with a speech by US Federal Reserve Chairman Jerome Powell. The Fed chairman made it clear for the first time that the US is entering a new phase of the interest rate cycle and that the next step will be one of several interest rate cuts. The first cut is expected in September, although ongoing reports on the inflation rate may cause the Fed to hold back.

Many central banks around the world have already begun to cut their interest rates and, the US (which is usually the first to both raise and cut rates) is late this time, which means that the Fed risks falling behind the curve. This could later lead to both larger cuts and at a faster pace.

High interest rates have hit consumers, small businesses, capital-intensive sectors and commercial property hard. Once the trend towards lower interest rates takes hold, these are sectors that can recover quickly.

High interest rates have hit consumers, small businesses, capital-intensive sectors and commercial property hard. Once the trend towards lower interest rates takes hold, these are sectors that can recover quickly.

The Fed wants to portray this shift as a soft landing and show that inflation is slowing. But as long as inflation remains above 0%, prices, as measured by the consumer price index (CPI), will continue to rise - and from already high levels.

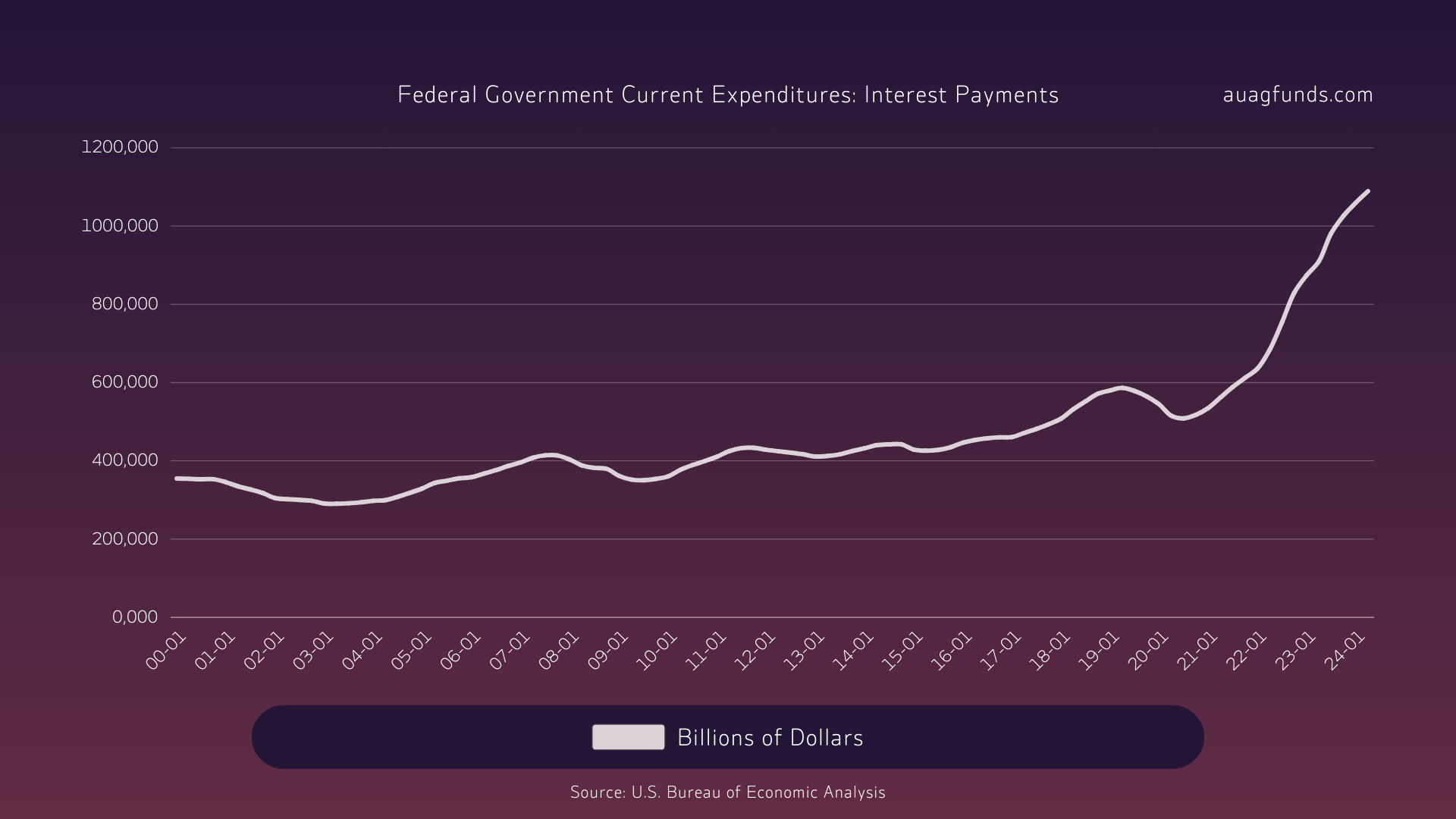

In recent years, the Fed has tightened by raising interest rates and reducing its bloated balance sheet, but this has been matched by fiscal stimulus. The US now has huge budget deficits of 6-8% as a consequence. This has caused the country's national debt to grow to an incredible USD 35 trillion. The high interest rate on this enormous debt has now made interest costs the largest of the major expenditures. This is, of course, unsustainable, and it is now necessary for the Fed to start stimulating the economy again. The interest rate cuts are coming.

It is also likely that the Fed will do everything possible to keep the economy running smoothly all the way to the US presidential election. This also talks in favour for interest rate cuts.

Gold and precious metals

Gold has been strong since the link between the US dollar and gold was broken on 15 August 1971. This is because politicians have been able to print money since then and are doing so at an increasingly rapid pace. Many had expected gold to lose some of its lustre in the interest rate hike cycle that we now seem to be seeing the end of. However, this has not been the case, as gold has increased 30 percent since March 2022. Gold continued to shine in August, reaching a new all-time high of USD 2,531 per troy ounce. Now, we are facing a rate-cut phase, which could send the gold price flying. A target of USD 3,000 within the next year seems realistic.

History and background of central banks

Before the Fed was formed in 1913, many US presidents opposed a central bank system. But after a lot of “behind-the-scenes power play” and a weak president, proponents pushed the model through, which has given this “structure” (the Federal Reserve) a lot of power.

We note that the world's oldest central bank is the Swedish Riksbank. You could say that the Riksbank was created in the aftermath of the failure of the Stockholm Banco. The famous scam was unravelled when it fell for the temptation of issuing more credit notes than it could cover.

Augusti 15, 1971

This date is significant in modern financial history. On that day, Nixon shocked the world by breaking the link between the dollar and gold. 11 August 1971 was the turning point when the UK demanded to be paid USD 3 billion in gold. This was a consequence of the US printing too much money, leading other countries to favour gold over the US dollar, which was in line with the international agreement. Half of the US gold reserve had been depleted within a few years.

QE & Forward guidance

Before the Great Financial Crisis of 2008, central banks were silent, and new interest rate decisions were only communicated in the form of the newly decided policy rate. Nowadays, central banks influence not only short-term interest rates but also long-term interest rates. In the past, it was the free market that set interest rates. However, because the cost of interest on market rates had become too high for the financial system, quantitative easing (QE) was introduced to push down long-term interest rates. The medicine has worked in a way, but at the same time, the side effects can end up being more harmful than the disease itself.

Continually trying to reassure the market by communicating that everything is under control with phrases like “do whatever it takes” and “do whatever is necessary” can ultimately lead to a loss of confidence. Central banks and the financial system are built on trust, as banks do not have access to all the money we see in our accounts. Therefore, this is a risky game to play.

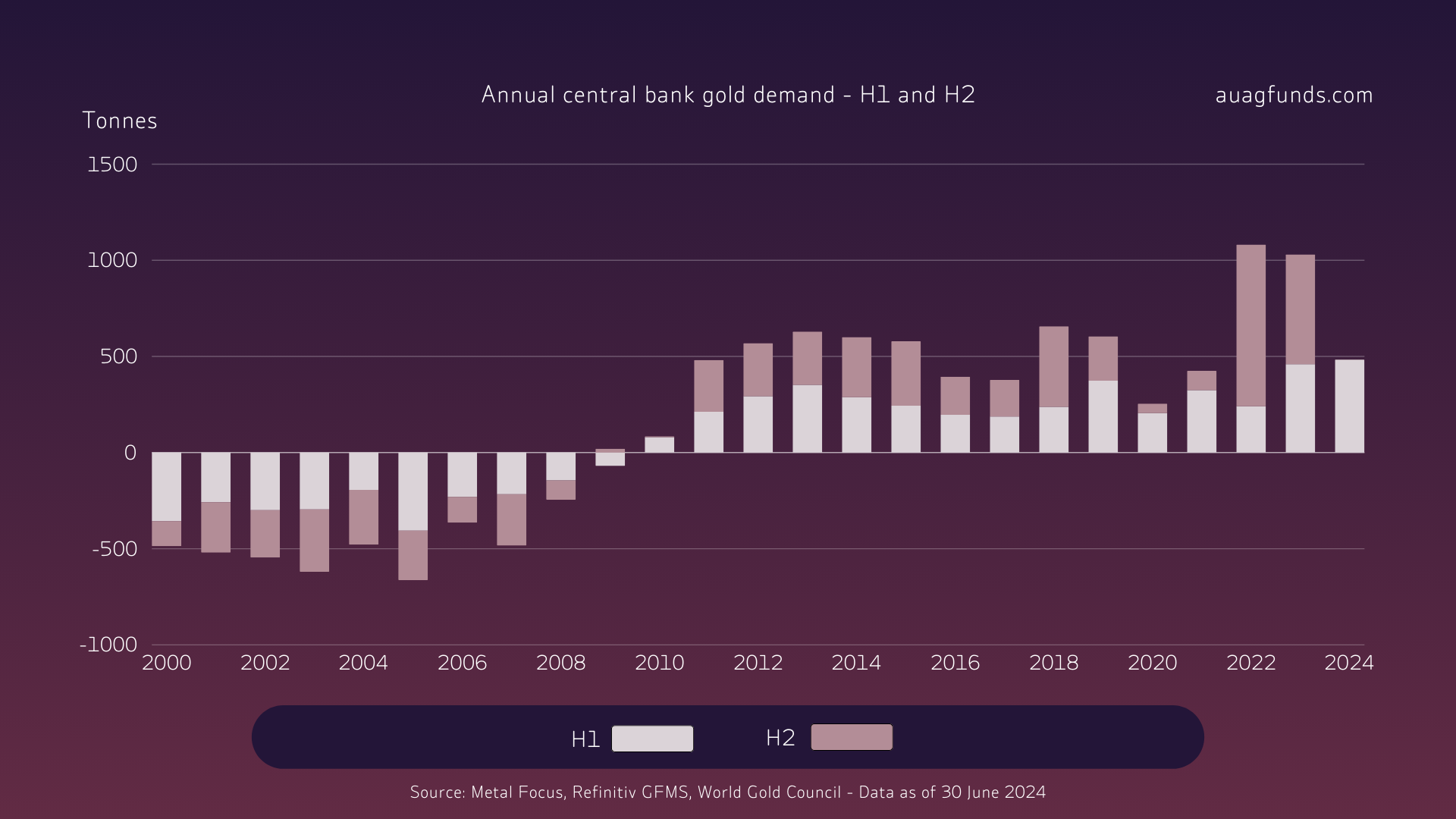

Central banks make record gold purchases in 2024

Central banks continue to show a strong interest in gold. After record years in 2022 and 2023, central banks have made the largest purchases in the first half of the year ever.

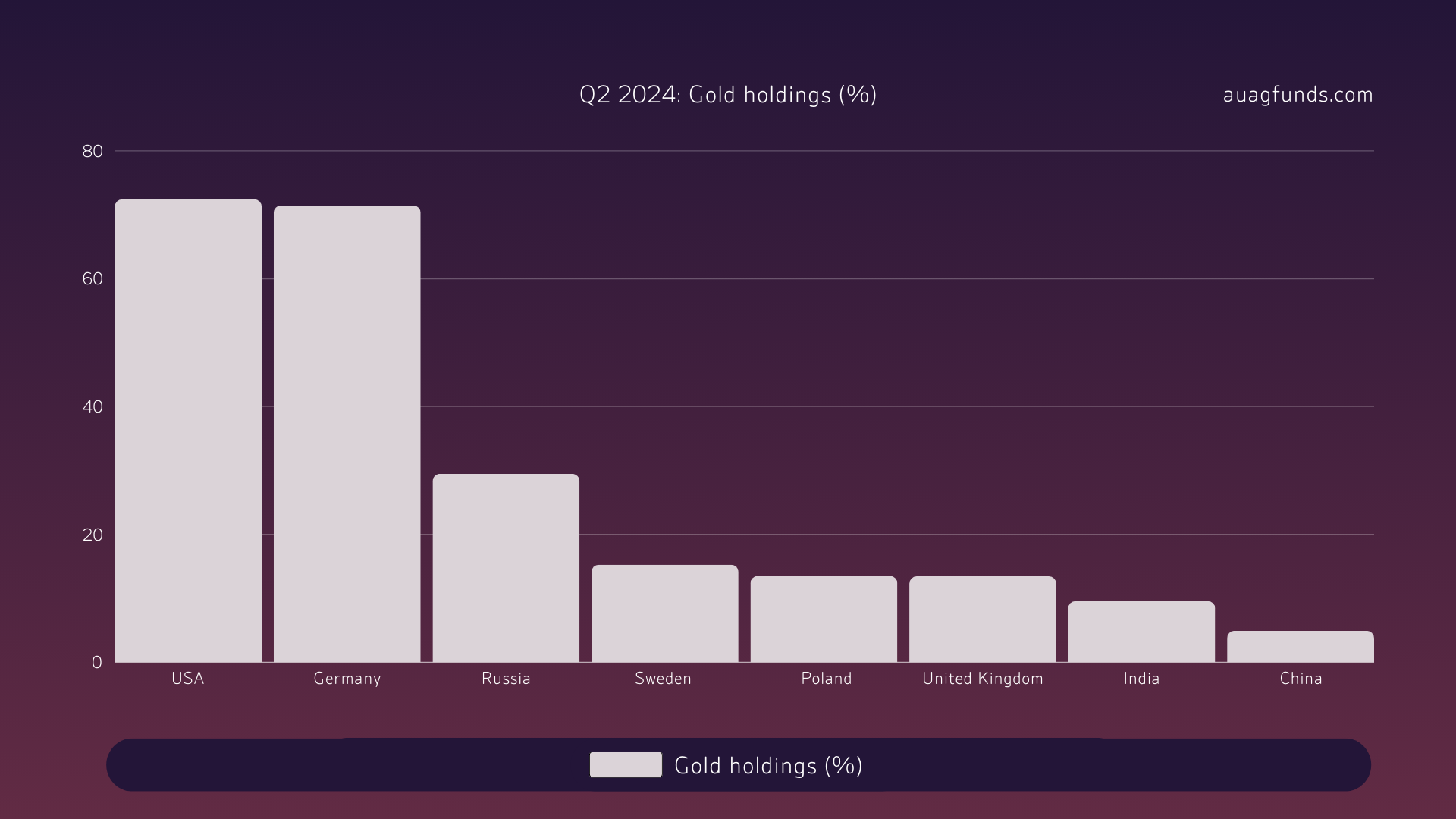

What is unique now is that several European central banks, which have not been buying for a long time, have also started buying. In the second quarter of 2024, three of the five largest buyers were Turkey, Poland and the Czech Republic. This is an exciting development.

What is unique now is that several European central banks, which have not been buying for a long time, have also started buying. In the second quarter of 2024, three of the five largest buyers were Turkey, Poland and the Czech Republic. This is an exciting development.

Returning to the Swedish Riksbank, the share of gold in its reserves has now increased to just over 15%. However, this is not due to new purchases but to the selling of other currencies, such as USD, and buying SEK to strengthen the weak Swedish krona. Gold reserves remain at 125 tonnes despite being sold almost every month between 2005 and September 2009. Especially in 2008 and 2009, funds were needed to rescue and support the Swedish banking system.

Explore the funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

/)

/)

/)

/)

/)

/)