/)

Elements | August 2024

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for precious metals and green tech elements. These observations are presented with images and charts laid out efficiently and concisely.

Gold with new all-time high in July

The Olympics are in full swing as athletes compete and sweat to win gold. Humanity and gold have a long history, with victory and success often symbolised by gold (sometimes silver). The price of gold has also been on a roll this month, with gold reaching USD 2,481 per troy ounce and a new all-time high on the 17th of July. Silver peaked at 31.69 in July and has since corrected slightly, but still looks strong on the way to its next target of USD 35 per troy ounce.

What is happening in the market?

If July ended on a high note, August has started on a much lower note, especially for the stock market. Precious metals such as gold and silver have shown stability, while equities in the sector have corrected slightly. This is due to the fact that they have been dragged along by the large movements of several overbought technology stocks. However, given the upcoming interest rate cuts in the US, we are seeing a rotation of investments, which should favour interest rate sensitive sectors and smaller companies.

The mini crash immediately after the end of July was triggered by the fact that Japan has finally started to raise interest rates from zero, while the US is approaching a rate-cutting cycle. This shift changes a lot in the financial world. All investors who were short YEN and long USD (the "yen-carry-trade") have now quickly started to change their footing. This is having a major impact and causing sharp swings in the market, with both the dollar and the stock market falling at the same time.

In our Outlook for 2024, we see a gold price at USD 2 475 in the end of the year, which represents a +20 per cent increase. Now we have already passed this target in July and most major banks, with JPMorgan in the lead, now have prices such as USD 2,500 and 2,600 as targets for the year. It seems a bit odd that we would have a lower target than the major commercial banks, so perhaps we should consider raising the target.

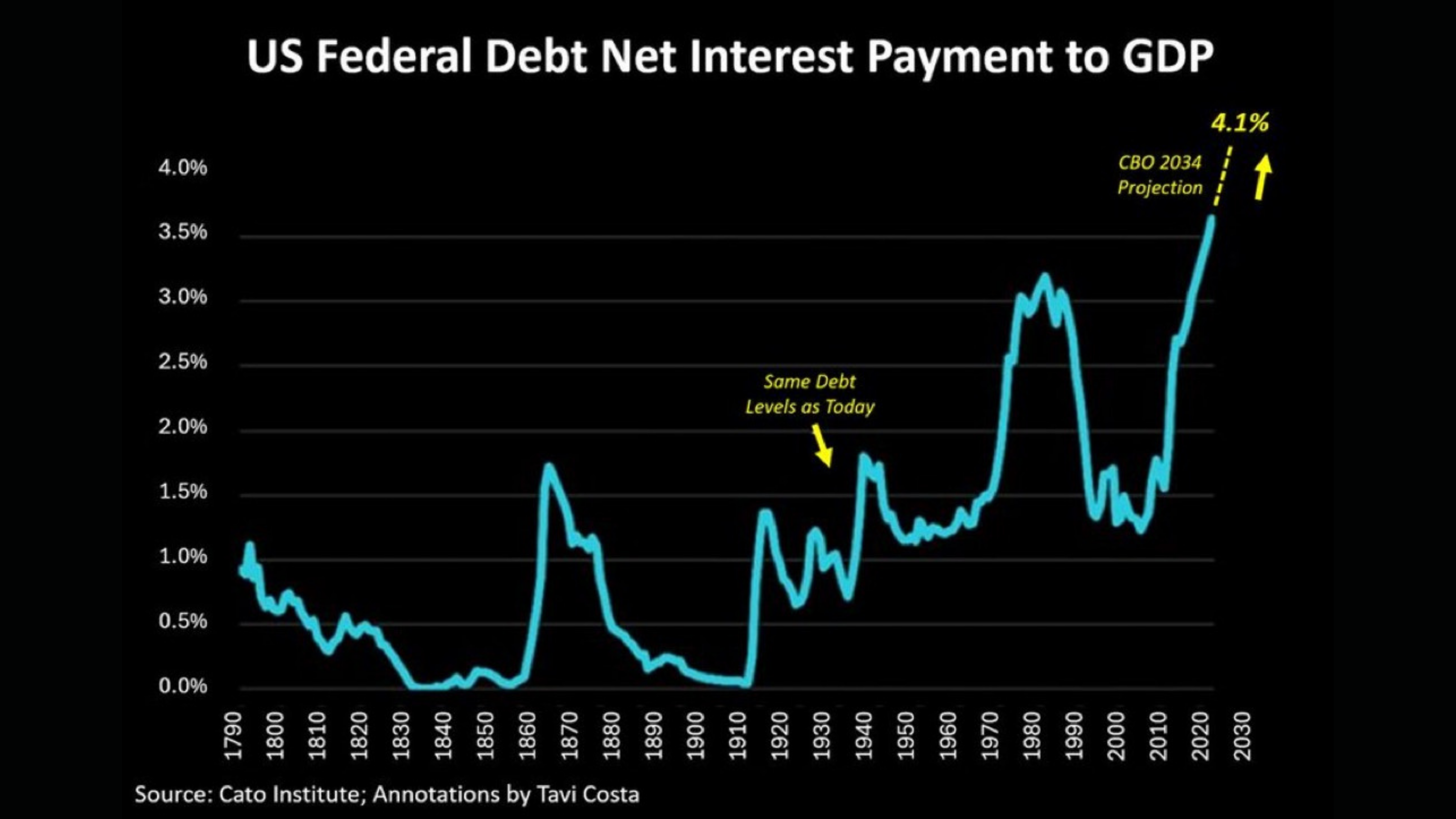

One reason to raise the target is that the US budget deficit and debt are increasing faster than we could have predicted. The US is printing money at an increasing rate to finance its deficits.

Although central banks always "cut for too long and raise for too long", the coming cuts are inevitable. This will be another stimulative change for the economy and something that will drive gold and silver prices up sharply going forward. In addition, we are fast approaching the US presidential election and there is thus a lot of political pressure on the Fed to facilitate the election campaign (read interest rate cuts/other stimulus) for the incumbent president/vice president.

The gold market

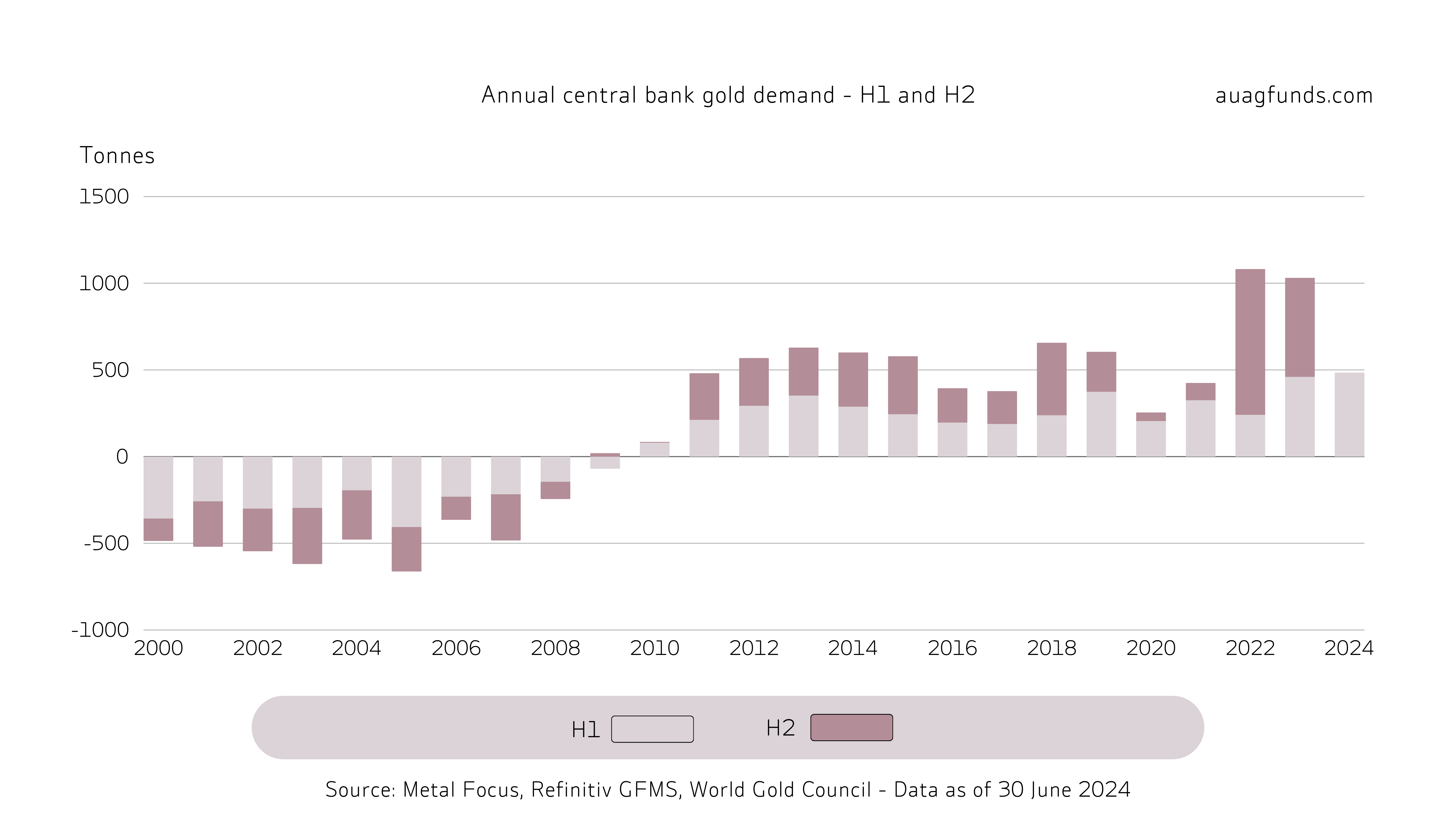

On the positive side for the gold market, mainstream investors in the west have returned to the market as buyers. Combined with the continued strong buying pressure from investors in China and India, this looks good. In addition, central banks have continued to buy. They have now been large net buyers for 14 years, with a record year in 2022 and almost as much in 2023. Now they set a new record again. 483 tonnes in the first six months of the year are the largest purchases ever for a 'first half' (H1).

Commodity exchange, COMEX

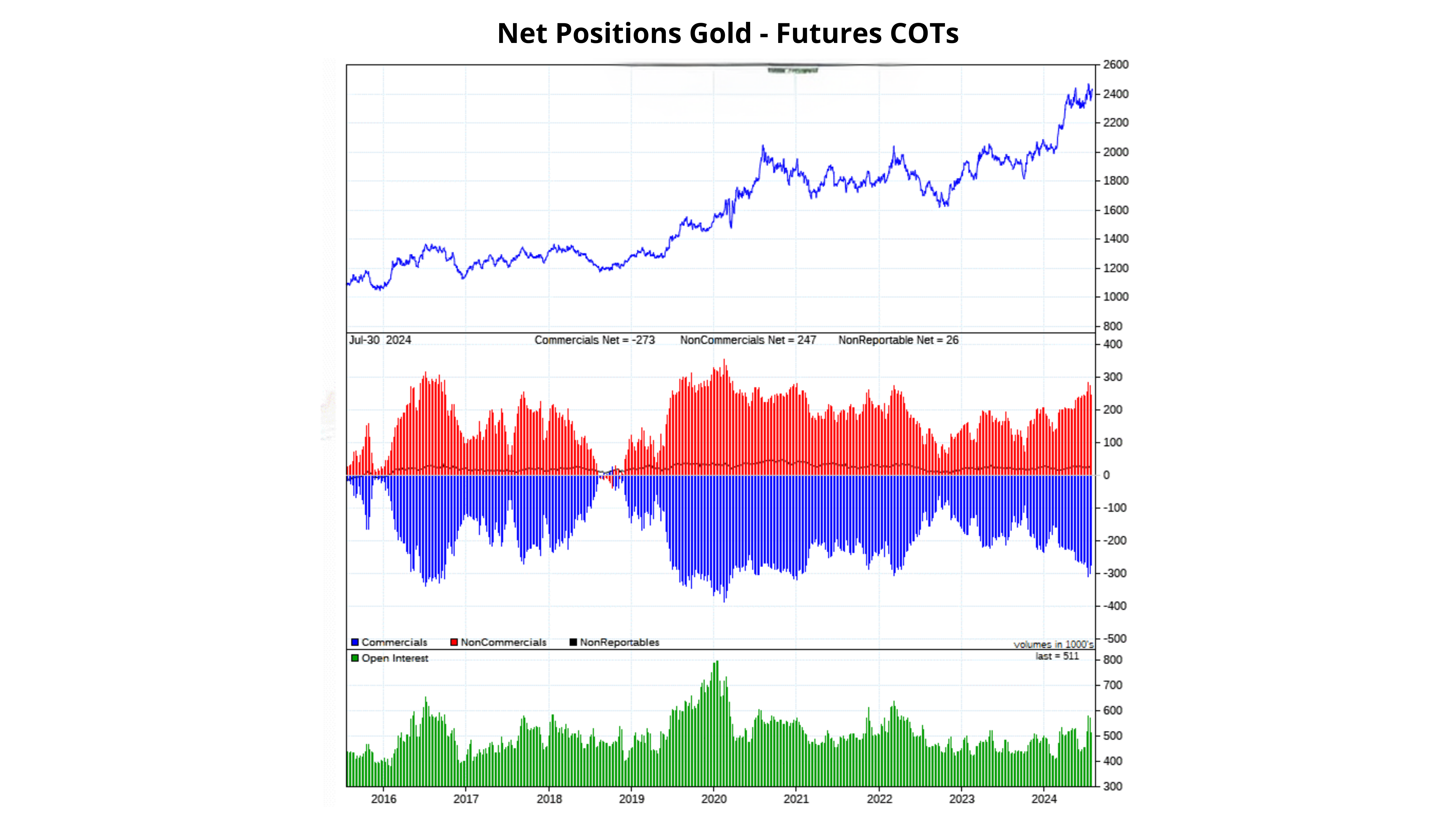

The US commodity exchange, COMEX, has always been a concern. At times, "paper positions" have been able to drive the market, disrupting the fundamentals that normally drive the price of gold and silver.

When the major commercial banks have large short positions (blue bars) and a desire to "bring down" prices, this is always a temporary risk. However, it can also be a great opportunity, if banks are forced to buy back their short positions at higher prices. This would be to avoid the bank's unrealised losses turning into large realised losses. Exciting to say the least.

Silver

In our Outlook for 2024, we have a gold price ending at USD 2,475, which represents a +20 per cent increase. At the same time, we saw the gold-to-silver ratio going down towards 70:1 during the year. This would give a silver price of USD 35 per troy ounce and a +48 per cent rise in 2024.

Silver has been going strong but there is still room for a lot of upside left in 2024. A strong case in favour of silver is that the G:S ratio normally moves towards 30:1 during a mature bull market for precious metals. In the coming cycle, we believe that the ratio may even go towards the natural occurrence of 16:1 or even lower as silver is both a monetary metal along with gold and a technology metal, necessary in the electrification of our world.

The companies

Many mining companies in the sector are showing improving results, with a combination of higher commodity prices, lower energy costs and lower interest rates giving this underbought sector great potential. In particular, the change in the last two factors creates a strong "margin expansion" in relation to past performance.

It should be noted that the sector often moves in steps and that historically, on the way to a new step, they have often gone up +100 per cent in just 6-9 months. Such a movement is again in the cards now that the companies' share price have been lagging in relation to the commodity price.

In conclusion, the gold rush continues

The Olympics are coming to an end but will be followed by the Paralympics, and so the gold rush continues. Nor do we see any signs that the demand for gold investments with the stable purchases in India and China would slow down. Central banks also seem insatiable as they look to strengthen their balance sheets for a possible future financial crisis. Once Western buyers really get going and start chasing the price, that's likely to be what makes the journey really take off.

In 2024, we have really hit the mark with our presentation "Going for Gold". We have been invited to speak at major foreign sector fairs in Frankfurt and Zurich, among others. Now we have been invited to take centre stage at Sweden's first event for mining companies in September. We hope to see you there and that you will take the opportunity to talk to us - so that we can continue to build a community for metal investors together.

Explore the funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

/)

/)

/)

/)

/)

/)