/)

Investing in Silver and Silver Mining Funds

Key takeaways:

- Silver has both industrial and monetary attributes and is indispensable for new technology.

- Silver is a great portfolio diversifier because of its low correlation with the broad stock market.

- Similar to gold, silver is considered a safe haven investment in uncertain times acting as a hedge against inflation.

- Investing in silver mining companies provides exposure to both the price of silver and the specific mining company. The share price of mining companies often fluctuates more than the price of silver, resulting in a leveraged effect relative to the price of silver.

- The supply and demand for silver are both increasing rapidly.

Invest in silver today with AuAg

ETCs, physical silver, silver funds (& ETFs), derivatives (paper silver), and shares - there are multiple ways to go about investing in silver. However, there is a great disparity between physical and paper silver where the paper silver market is several hundred times bigger than the physical silver market; this is, however, of course, subject to change. Very few choose to invest in physical silver, for example, bars and coins, due to its lack of liquidity and logistical challenges (storing and transporting). The easier, cheaper, and safer option is silver investment funds.

Explore our sector fund ─ AuAg Silver Bullet ─ with an emphasis on investing in silver mining companies; a great option for someone looking to add silver investments to the portfolio. AuAg Silver Bullet consists of some of the most sustainable silver mining companies in the industry chosen based on their ESG risk rating from Sustainalytics.

/)

The advantages of investing in commodities

Commodities have always been considered a great way to diversify your portfolio. This is due to the fact that it is an asset class with a low correlation with the broad stock market. Investing in commodities such as silver, gold, or any other precious metal provides several advantages to an investor’s portfolio:

- Risk-adjusted return: An investment portfolio with several uncorrelated assets typically offers a higher risk-adjusted return.

- Protection against inflation: Investing in commodities can be a good protection against inflation as commodity prices have historically increased during periods of high inflation.

Investing in physical commodities, however, is not suitable for everyone. Shares in the companies that produce commodities have both advantages and disadvantages. Ultimately, a company can expand and increase its profits, which can lead to a rising share price. In comparison, a commodity does not generate any cash flow; instead, its price is governed by supply and demand in the global market.

About silver

By investing in silver, the investor gains exposure to a metal with both industrial and monetary properties. Silver [Ag] is a precious metal with high resistance to corrosion and oxidation and has the best thermal and electrical conductivity of all metals, which makes it indispensable in our high-tech and green world. It also has antibacterial properties that make it useful in medicine, water purification and other consumer products. It is a unique metal as it is important for both industry and used as money. There are no spare stocks of silver today, which can result in a physical shortage and price increase. Silver is often just a by-product for the largest mining companies (only about 27% come from primary silver mines), which can provide the conditions for a perfect location for focused silver mining companies.

The price of silver tends to rise in times of inflation and a weaker US dollar and has a low correlation with the stock market. Thus, silver contributes to risk diversification in a traditional equities and fixed-income asset portfolio. The price of silver also tends to rise in times of market turmoil, similar to gold, when risk aversion in the market is high. Silver investments have historically proven efficient in protecting a traditional portfolio of stocks and bonds.

For a high risk-adjusted return, it may be a good idea for long-term investors to set up a plan to invest in silver. Investing in silver in 2024 represents an opportunity to gain exposure to two global trends: "the creation of debt and credit" and "the transition to a greener world".

How and where is silver used?

Silver is most commonly associated with luxury goods such as jewellery, tableware, and fine art. However, a majority (~55%) of silver today is used as an industrial commodity. It is used extensively in a wide variety of fast-growing electronics segments such as solar panels, LED lighting, flexible displays, touch screens, cellular technology, and water purification.

/)

Is silver a good investment?

Silver is a good investment for many of the same reasons why gold and other precious metals are liked by investors:

- Returns: The price of silver tends to follow the price of gold but with greater volatility. Thus, the metal has significant potential for returns.

- A store of value: Similarly to gold, silver is a good store of value.

- Diversification: Silver is a good risk diversifier since it has a low correlation with the broad stock market.

When to invest in silver

The price of silver is volatile because the market is relatively small. The timing of when you should invest in silver depends on the market environment and your investment goals. Therefore, it may be wise to set up a monthly recurring investment with a fixed amount.

Based on our experience, we believe investors should consider investing in silver in the following scenarios:

- you need a reliable hedge against monetary inflation,

- you want to diversify your portfolio with commodities, or

- you want exposure to a commodity that is indispensable in the transformation to a green world.

Investing in silver mining funds

There isn’t necessarily a “best way” to invest in silver. This all depends on the current market, your own financial situation, and what you want to achieve with your investment. There are pro’s and con’s with investing in physical silver. An investor completely removes the counterparty risk by holding physical metal, but at the same time you have to sort out storage and safekeeping yourself. However, if you seek an easy and instant investment of silver, silver mining funds are usually your best option.

Because of their unique makeup, silver funds focused on mining companies are viable investments for pretty much everyone, delivering several benefits to all types of investors including:

- Portfolio diversification: Silver mining companies' low long-term correlation with the broad stock market contributes to a higher risk-adjusted return in a portfolio that largely consists of equities and interest rates. This makes them a valuable source of diversification in your portfolio.

- Commodity exposure through equity: Silver mining companies (equity) are strongly correlated to the spot price of silver. This gives investors exposure towards the commodity itself without having to buy physical metals, or a paper derivative. .

- Protection against inflation: The price of silver has, similarly to gold, an inverse relationship to the amount of money that is created.This will over time provide an investor with a protection against inflation.

- Financial growth: Investors can gain exposure to commodities such as gold and silver by investing in silver mining companies. This offers several advantages, including receiving dividends paid by the mining companies. Investors also gain exposure to the individual mining company's operations and growth from activities such as the development of mines.

- Leveraged effect on silver prices: Investing in silver mining companies gives investors a leveraged effect on the price of silver - which you don’t get if you buy the metal itself. The share price of silver mining companies tends to increase more than the price of silver when the silver price is on the rise, and vice versa.

Comparison between silver and gold

Silver is sometimes referred to as the “poor man’s gold”, however, it is anything but a cheap gold proxy. It is a more volatile precious metal than gold because the silver market is smaller and that it can be used as both an investment and an industrial metal.

Like gold, investing in silver is considered a safe-haven investment since it is both a hard asset and a store of value. Similarly, it is viewed as a hedge against inflation, though often overshadowed by gold as an investment choice. However, silver investment funds focusing on silver mining companies may offer opportunities for significant outperformance, partly due to its volatility. When considering investing in silver or gold, it's important to keep in mind several key differences: the larger industrial use of silver, their relative market sizes, and their correlation with other asset classes.

Like gold, investing in silver is considered a safe-haven investment since it is both a hard asset and a store of value. Similarly, it is viewed as a hedge against inflation, though often overshadowed by gold as an investment choice. However, silver investment funds focusing on silver mining companies may offer opportunities for significant outperformance, partly due to its volatility. When considering investing in silver or gold, it's important to keep in mind several key differences: the larger industrial use of silver, their relative market sizes, and their correlation with other asset classes.

-

Industrial usage of silver accounts for ~55% of its annual demand. In comparison, gold only has ~8-9% of its demand driven by industrial use; the rest is used for jewellery and gold bars. Gold is in other words regarded as a more purely precious metal, whereas the price for silver is impacted by both the demand for it as a precious metal and its industrial demand.

-

The global gold market is the biggest precious metal market by a large margin. It is around three times as large as the global silver market.

-

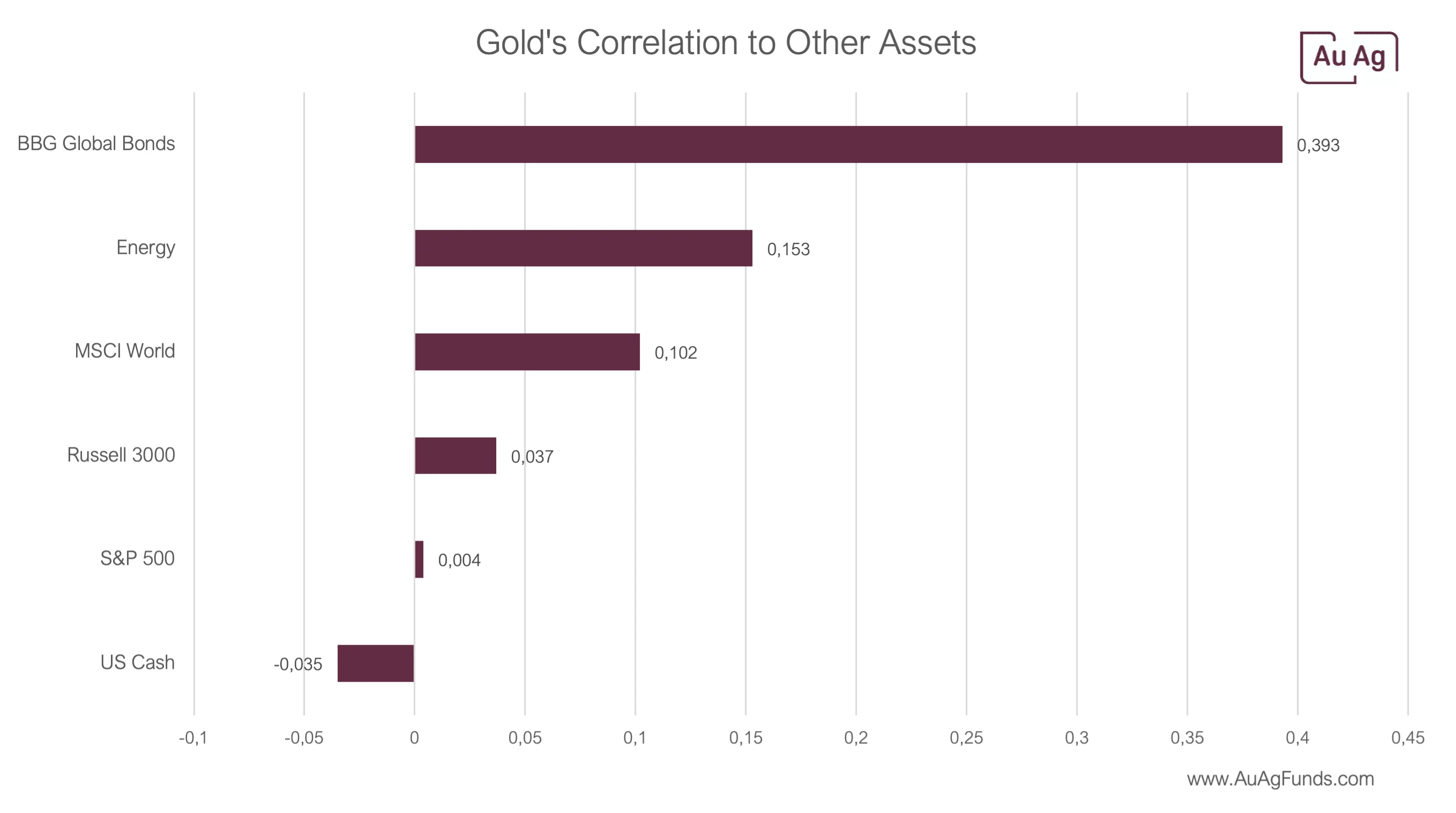

Gold and silver also have a low correlation with other asset classes. Gold and silver are strongly correlated with each other (0.76), as shown in the chart below. Silver also has a higher correlation with the S&P 500 compared to gold, mainly due to its more extensive industrial use.

How to invest in silver – silver funds, shares, ETCs

Physical silver

You can buy the physical metal and store it at home, or in another safe place. ETCs for those who want to supplement their portfolio with a straight 1:1 exposure to silver, it is the cheapest/easiest to use the ETPs [ETCs] available to buy at most platforms where you can buy stocks and funds. Make sure the products have allocated physical gold and no counterparty risk. An ETC is also constructed via an SPV whose assets are entirely separate from the issuer's assets.

ETCs (Exchange Traded Commodities)

By buying an ETC, you own physical silver, but you do not have to take care of the storage yourself.

Derivatives

Investment products that follow the price of silver, but where you have a counterparty risk against the issuer of the product.

Shares

The share price of the mining companies that extract silver is strongly linked to the spot price for silver. Mining company shares often move more than the price of the underlying asset because you also add a company risk. This means that the share goes up more when the silver price goes up, and vice versa.

It is also important to understand that a silver mining company is primarily mining silver, but they also mine other metals they find. Around 60-70% of a focused silver mining company’s mined volume is silver, the rest is often gold, copper, or other metals. This means that as an investor, you also get exposure to the price of other metals by investing in a silver mining company. This has the benefit of diversifying the risk.

Commodity Funds

There are different types of silver investment funds. When you invest in a fund, you pay a fee for an expert (fund manager) to select the underlying assets that provide exposure to silver. A fund may include any of the options listed above. There are two types of funds:

- Daily traded fund: Often actively managed, which means that an expert reviews the holdings and rebalances at regular intervals.

- Exchange Traded Fund (ETF): A basket of securities that follows an index and is traded as a stock.

The price of silver

Silver is priced in USD as a standard. This makes it important for an investor to understand the price movement of USD in relation to the currency the investor is trading in. If you for example live in Europe and invest using the euro (€), the euro’s relative price in relation to the USD will affect your trade. A strong USD in relation to other currencies makes it more expensive for the holder of the weaker currency to buy silver. This effect results in that the spot price of silver measured in USD can decline in one currency, but appreciate in another currency. Follow this link to see a live chart of the silver price.

Investing in silver and the future

Data from The Silver Institute indicates that the demand for silver is rising. This is partly due to increased demand from the industry linked to the green transition. But also due to monetary inflation - the creation of debts and credits in the financial system.

The green transformation

Silver plays a central role in the development and production of green technology. Many components in electric vehicles use silver, including cables, safety switches, fuses, power switches, and relays. Silver's superior electrical properties make it a difficult metal to substitute with other materials. Silver is equally important in producing solar panels, batteries, and other technologies.

Monetary inflation

Over the past few years, we have seen a record increase in the balance sheets of the world's central banks. This began during the last financial crisis in 2008 and has continued to rise since then. The COVID-19 pandemic led to further escalation, especially when the US Federal Reserve created one-fifth of all dollars ever made in 2021.

The economic damages from the war in Ukraine are expected to contribute to a significant slowdown in global growth in 2022 and increase inflation. Both fuel and food prices have risen rapidly. According to the IMF, global growth is expected to slow down from 6.1% in 2021 to 3.6% during 2022 and 2023. Silver, gold, and other precious metals are relatively resistant to inflation due to their intrinsic value. However, due to silver's demand from both industry and investors, and the fact that the silver market is smaller, the price of silver typically fluctuates more than gold.

/)

Conclusion

Silver possesses both monetary and industrial properties, making it an indispensable metal for our high-tech and upcoming green world. Similarly to gold, it is also a reliable way to safeguard wealth against inflation. For investors looking to enter the silver market, it is worth considering investing in the silver mining companies rather than the metal itself.

A business may expand due to operational excellence and grow its profits, leading investors to push the stock higher. In contrast, a physical commodity does not generate cash flow; the only reason for its price to change is because someone wants to pay more or less for it.

Due to silver’s volatility and dependence on different industries, it is close to impossible to predict what the silver market will look like in the future. Therefore, investing a recurring flat-amount of money every month is advised. Invest in the world’s best silver mining companies through AuAg to the benefit of your portfolio, the silver mining industry, and the world.

Why invest in silver mining companies with AuAg Funds?

AuAg Funds offers funds that focus on providing exposure to precious metals and elements in green technology. They have in common that these assets provide protection against monetary inflation and are necessary in the transition to a green world – highly topical trends today.

AuAg Funds offers exposure to silver both via daily traded funds and an ETF. The fund, AuAg Silver Bullet, invests in silver mining companies, whereas the AuAg Gold Rush fund invests in gold mining companies. By investing in gold and silver mines, the funds provide a leveraged exposure towards the price of gold and silver. The funds find gold and silver mining companies to invest in through a rigorous investment process that also considers sustainability aspects.

/)