/)

Elements | April 2024

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for precious metals and green tech elements. These observations are presented with images and charts laid out efficiently and concisely.

Ride the Gold Bull!

In last month's letter, we wrote about the market phenomenon of "Boom and Bust". Of course, it's possible that a "bust" and a major stock market downturn could be delayed. However, we note that the stock market rally is limited to just a few companies. Some of the big companies known as the "Magnificent 7" have not been doing so well lately. This might make more investors want to sell their shares to take a profit before things possibly get worse (“sell high”). At the same time, we wrote about the opportunities to buy cheap, "buy low," referring to gold mining companies. That rise may now have begun, as the index for gold mining companies increased by more than 20 percent in March (some funds much more).

Has the train left the station? We believe it has, but with a potential of over 1000% (10-20x), there's still much return left over the coming years. It is now that the long, mature "bull market" has begun. Many trend-following investors will only enter once the market has started to move significantly. The rapid pace of market movements was evident this month, mirroring the "baby bull of 2016," a period during which companies saw their value increase by over +100 percent within a span of just eight months.

Gold's price went up by 13.2% in 2023 and has already increased by over 11% this year. We are now seeing gold consistently reach new all-time highs, having broken out of a more extended consolidation phase. As a result, all those who are invested in gold have made a profit, fostering a favourable investment atmosphere and setting the stage for new record highs in the future.

Gold's price went up by 13.2% in 2023 and has already increased by over 11% this year. We are now seeing gold consistently reach new all-time highs, having broken out of a more extended consolidation phase. As a result, all those who are invested in gold have made a profit, fostering a favourable investment atmosphere and setting the stage for new record highs in the future.

Our aggressive target in our "Gold Outlook 2024" of 2,475 USD per troy ounce now seems almost conservative. Even JPMorgan issued a price target for gold at 2,500 USD during the month. When major banks like JPMorgan and Goldman Sachs become positive on commodities, it usually results in increased allocation from all banks and their clients worldwide. This leads to a gradual investor rotation and, thus, strong capital flows into the sector, which will be a positive factor moving forward.

What is happening?

What is happening?

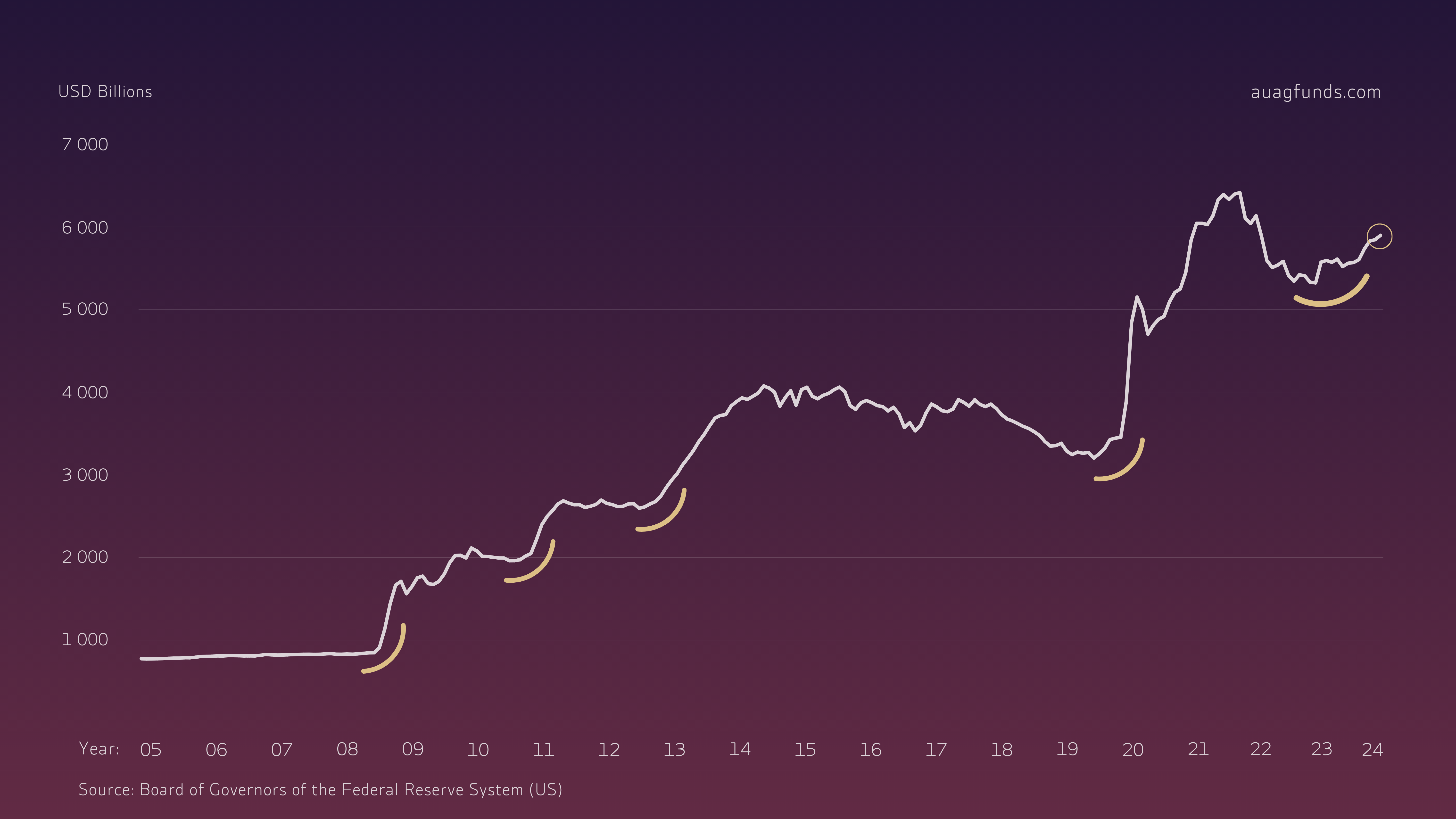

Expected cuts in interest rates often lead to an increase in the price of gold. Such a cycle of rate reductions tends to weaken the dollar, which benefits gold as it increases demand from buyers in Europe and Asia. The Federal Reserve is holding off on rate cuts for as long as it can, but it has already begun injecting stimulus into the economy through what is known as "backdoor quantitative easing," evident in the growing monetary base (see the chart above). It's also important not to overlook the substantial and questionable fiscal stimulus in the USA, which has led to a budget deficit of 6-8 percent, all in the pursuit of reaching an increase in economic growth.

Central banks remain major purchasers of gold, aiming to reinforce the credibility of their economies. China, in particular, seems to be aggressively buying up the market, and they are likely to continue doing so.

There are always risks after quick and large price increases. Yet, this particular rise in value hasn't been widely noticed, and until March, the sentiment among precious metals investors was very low. Historically, such conditions are considered an ideal time to start investing or to add to existing investments. Naturally, we can expect some price drops along the way before prices start climbing again.

There are always risks after quick and large price increases. Yet, this particular rise in value hasn't been widely noticed, and until March, the sentiment among precious metals investors was very low. Historically, such conditions are considered an ideal time to start investing or to add to existing investments. Naturally, we can expect some price drops along the way before prices start climbing again.

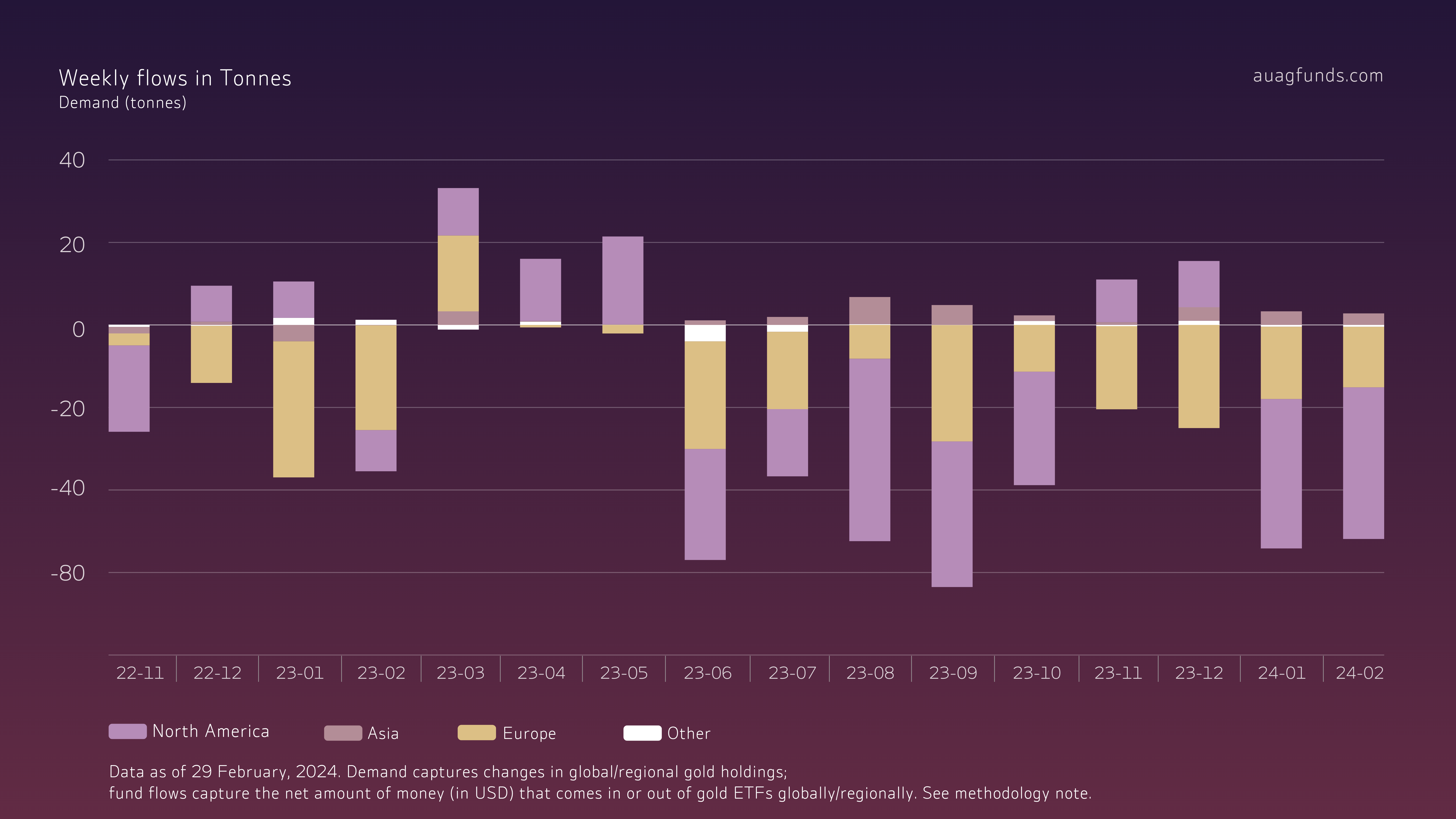

One concern is the current overbought status of COMEX due to retail investors, which usually isn't a positive indicator. Meanwhile, there's significant potential buying of ETFs/ETCs, which have been oversold for a long time period.

Yet, the greatest potential for returns may not be in gold but rather in silver, and the companies mining precious metals, as we have seen during March. The rise in the cost of extraction has curbed these companies' results and returns during the rise in commodity prices over the last 6 to 12 months. Now, with costs levelling off and the prices of gold and silver remaining strong, these companies are beginning a phase of increased profitability and robust free cash flows. This situation creates a significant leverage effect, where the increase in profit margins could be dramatic in the future.

The year 2024 is an Olympic year, making it a time when gold will be in the spotlight, not just as a valuable commodity but also as a symbol of triumph in the form of medals. A fun fact is that Olympic years coincide with leap years, and interestingly, February 29 was the day when the precious metals market began to accelerate. So, indeed, gold will be in the centre stage throughout the year.

The year 2024 is an Olympic year, making it a time when gold will be in the spotlight, not just as a valuable commodity but also as a symbol of triumph in the form of medals. A fun fact is that Olympic years coincide with leap years, and interestingly, February 29 was the day when the precious metals market began to accelerate. So, indeed, gold will be in the centre stage throughout the year.

The first modern Olympic Games took place in Athens in 1896, with only nine sports on the program: cycling, fencing, gymnastics, weightlifting, shooting, athletics, swimming, and wrestling. Paris was the venue for the Olympics in 1900 and again in 1924. Now, a century later, Paris is set to host its third Summer Olympics. In the initial Games up to the 1912 Stockholm Olympics, gold medals were made of pure gold. Today, they are predominantly made of silver (sterling silver with a 92.5% silver purity) with just around 6 grams of gold. Further information about the distinctive medal designs for the Paris Olympics can be found here.

The funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

AuAg Live - #1 Live on Instagram with Eric Strand

/)

Realtid - The Financial Supervisory Authority Can Increase the Return of Actively Managed Funds

An article where Eric Strand discusses how a change in the rules for third-party remunerations could be beneficial for investors.

/)

Reasons to invest in gold, silver, and mining companies in 2024

A brief summary of the most important trends and themes for gold, silver and mining companies in 2024.

/)

/)

/)