/)

Invest in Uranium Mining Companies - Best Uranium Mining Stocks

Key takeaways:

- Uranium mining involves extracting uranium ore to supply nuclear reactors.

- The demand for uranium is driven by the expansion of nuclear power facilities and the continuous need for energy.

- Investing in uranium mining offers potential high returns and diversification.

- The future of uranium demand is linked to the growth of nuclear power plants and geopolitical agreements.

Understanding Uranium Mining and Nuclear Energy

Uranium mining involves extracting uranium ore from the ground to supply nuclear reactors, which use the metal to generate electricity. As a significant component of the global energy mix, nuclear energy provides about 11% of the world’s electricity, touted for its reliability and cleanliness.

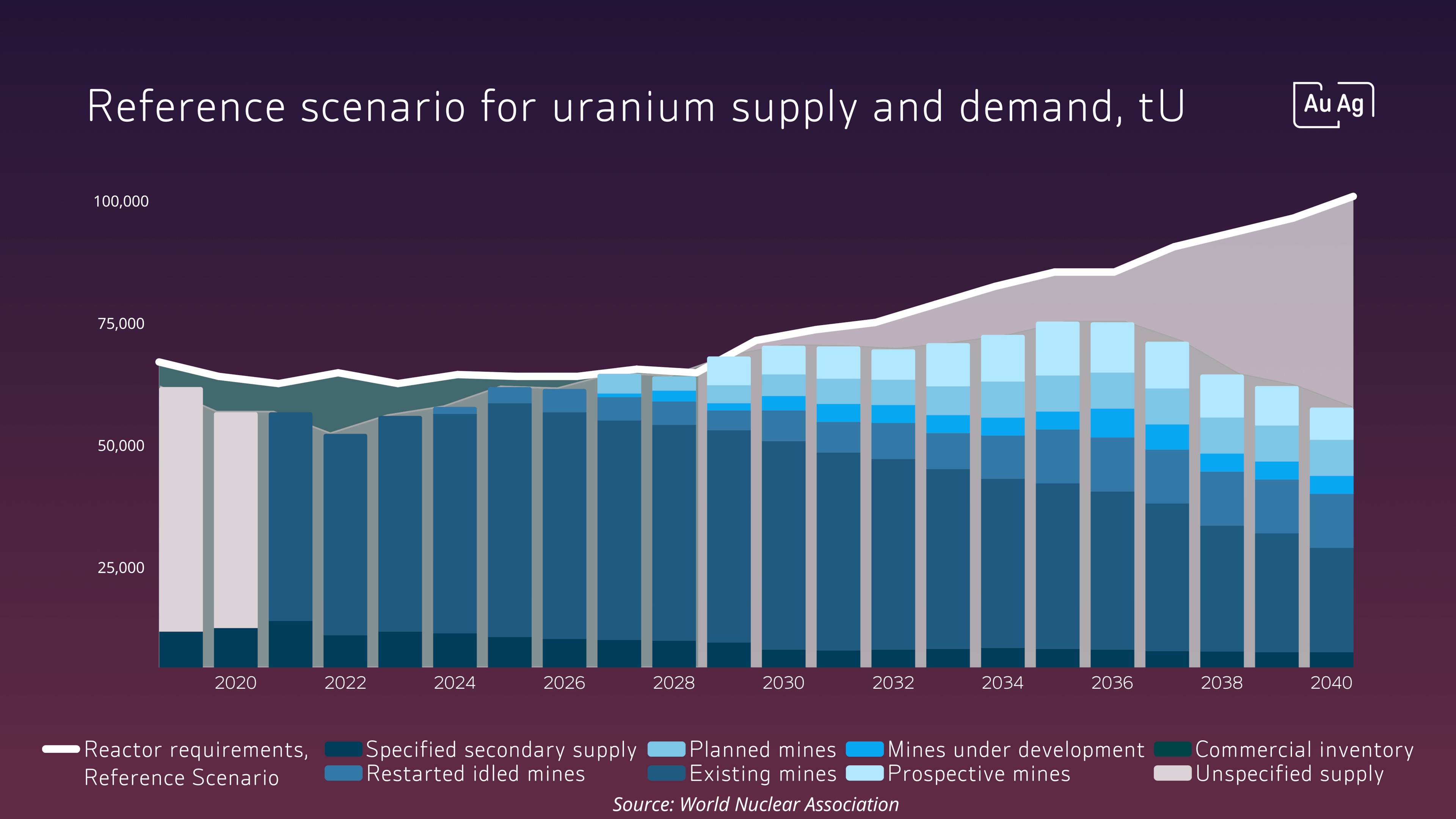

The demand for uranium is primarily driven by the expansion of nuclear power facilities and the continuous need for energy. However, uranium market dynamics are also shaped by supply constraints and geopolitical factors, which can significantly affect uranium prices.

Uranium itself is a dense, silvery-white metal essential for producing nuclear energy. It is critical in maintaining a steady supply of low-carbon electricity, making it a vital resource in today’s energy landscape.

Benefits and Risks of Investing in Uranium Mining

Benefits

Investing in uranium mining can be appealing due to the long-term demand for uranium, potential for high returns, and the opportunity to diversify an investment portfolio. As the nuclear sector grows, so does the potential for lucrative returns from uranium mining ventures.

Risks

However, the sector is not without its challenges. The volatility of uranium prices can pose a significant risk. Environmental and social concerns, along with regulatory risks, also play a crucial role in the investment decision-making process. These factors can affect the stability and profitability of uranium mining operations.

Investment Options

• Uranium Stocks: Companies like Cameco, Kazatomprom, and Energy Fuels offer direct exposure to uranium mining.

• Uranium ETFs: ETFs like the Global X Uranium ETF and the Sprott Uranium Miners ETF allow investors to gain diversified exposure to the uranium sector.

• Physical Uranium: Investments in physical uranium, such as through the Sprott Physical Uranium Trust, provide a tangible asset that reflects the uranium market’s dynamics.

• Uranium Futures: Futures contracts provide a financial strategy for speculating on the future price of uranium, though this market can suffer from low liquidity and complexity.

Evaluating Uranium Mining Stocks

When considering investments in uranium mining stocks, investors need to consider a variety of factors that can affect the profitability and stability of the companies. One of the primary considerations is the production costs and the quality of uranium reserves a company has. These factors are critical in determining how profitably a company can operate. Companies with access to high-grade uranium at lower extraction costs are typically more profitable.

Another vital aspect to consider is the company's financial health and management expertise. A strong balance sheet and experienced leadership are essential for sustaining operations and driving growth, especially in the volatile uranium mining market.

Additionally, market exposure and the regulatory environment are significant influencers on operational risks and compliance costs. Companies operating in countries with stable regulatory frameworks may face fewer operational hurdles and lower compliance costs, which can enhance profitability.

Lastly, environmental and social performance are increasingly important in the mining sector. A company’s reputation for environmental stewardship and social responsibility can heavily influence its ability to secure operational approvals and maintain good relationships with local communities and governments. This, in turn, can affect long-term sustainability and profitability.

These factors are necessary to analyse in order to ensure good conditions for your investment. If you find it difficult to analyse these factors, we recommend that you invest in a fund to gain exposure to uranium. Through a fund, you leave the responsibility to the fund manager to ensure that the holdings in the portfolio are rebalanced and that all holdings are well thought out.

AuAg Essential Metals, one of our own funds, is an industry fund specialising in uranium mining and companies and other essential metals miners.

Explore the Uranium Fund

AuAg Funds provides investors with a fund designed to give exposure towards uranium and other metals that are important for our world. Our portfolio includes investments in uranium mining companies, offering an excellent addition to a traditional asset portfolio.

The Future of Nuclear Energy and Uranium Demand

The role of nuclear energy in the transition to a low-carbon economy is increasingly recognized, with uranium demand expected to rise alongside the growth of nuclear power plants. Key geopolitical agreements, such as U.S.-Russia uranium purchase agreements, also play a role in shaping market dynamics. The sector’s future will likely be heavily influenced by governmental policies aimed at promoting clean energy.

The Regulatory Environment

Regulations governing nuclear energy and uranium mining can significantly influence market operations and company profitability. Changes in policy can affect production costs, environmental standards, and the overall demand for uranium. Therefore, understanding the regulatory landscape is essential for investors in the uranium sector.

Market Trends and Timing Your Investment

Uranium prices have historically been volatile, with recent trends seeing prices reach over $80 per pound for the first time since 2008. Due to the cyclical nature of the market, investors need to stay informed about these trends and consider a long-term perspective when investing in uranium.

Next Steps for Investors

Conduct thorough research and due diligence on potential uranium mining stocks and ETFs.

Consult with financial advisors to tailor an investment strategy that fits risk tolerance and investment goals.

Diversify investments to mitigate risks associated with the volatility of the uranium market.

Stay updated on industry trends and regulatory changes that could impact the uranium mining sector.

By following these guidelines, investors can navigate the complexities of uranium mining and nuclear energy investments, potentially reaping the benefits of this critical and growing sector.

FAQ – Invest in uranium mining companies

Uranium mining can be a good investment due to the rising demand for nuclear energy as a low-carbon energy source. However, it carries risks associated with fluctuating uranium prices, regulatory challenges, and geopolitical issues. The profitability of uranium mining also depends on technological advancements in extraction and processing methods.

/)

/)

/)