/)

Game theory with irrational decision makers

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for gold, silver and other essential metals. These observations are presented with images and charts laid out efficiently and concisely.

Intro

Another month has gone by in what has truly been a remarkable year for us investors. In this month’s letter, we write about the “game” being played between the world’s leaders. The stakes are high, and we have now seen how the essential metals we have been talking about for a long time have become an important piece in this game.

Gold

Gold closed the month at 2,856 USD, rising 2.1% in February. The gold price also set a new all-time high of 2,955 USD per troy ounce.

Silver

The silver price, which was over 33.3 USD mid-month, ended February at 31.1 USD, a slight decline of 0.5%. During the month, the silver price stabilised at the level of 31-33 USD per troy ounce and we see this as an important step for our Silver and Silver Miners Outlook to be realised.

In our Silver Outlook we wrote, among other things: "We see silver breaking through several significant levels, such as 31, 35, and 40 USD in 2025. All to break through its former all-time high from 2011, which is just below 50 USD per troy ounce (which corresponds to as much as +73%). The first major target will be to surpass 2024's peak of 35 USD (+21% from the end of 2024/25)."

Mining Companies

While the gold mining funds have been on top of the rankings in 2025, the mining companies (as we have written about before) are still extremely cheap. Their strong cash flows are not yet reflected in their share prices. Silver miners are also improving their results.

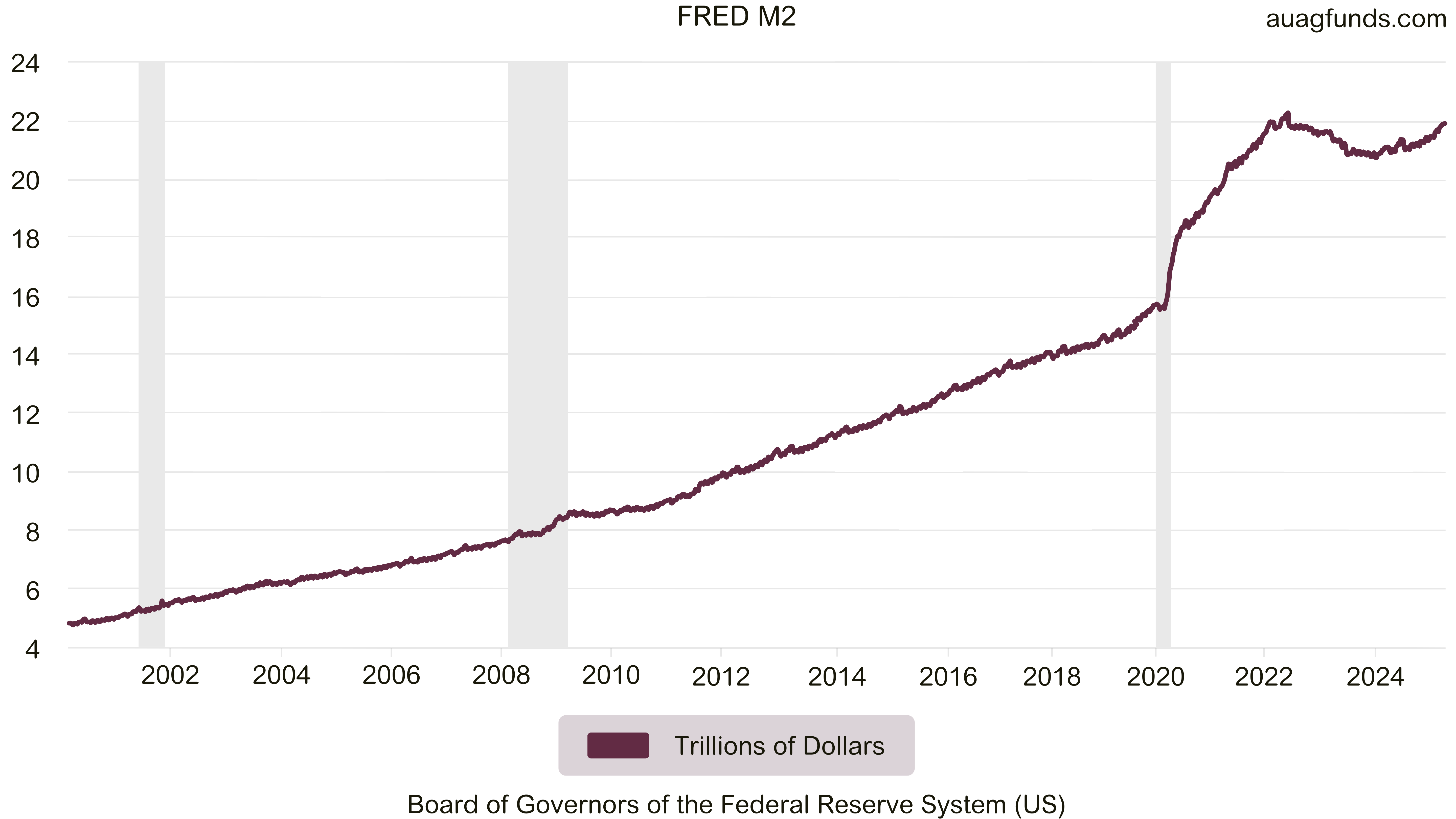

AuAg Macro - Monetary Inflation

The next phase of money creation in the financial system has begun. The most common metric used to measure the amount of money is ‘M2’, Money Supply (see the chart below). Normally, the money supply is increased to keep the financial system afloat and to avoid deep recessions so that the "wheels keep turning". A rising M2 curve is an indicator that the printing presses have come to life and monetary inflation is picking up again.

AuAg Macro - Electrification

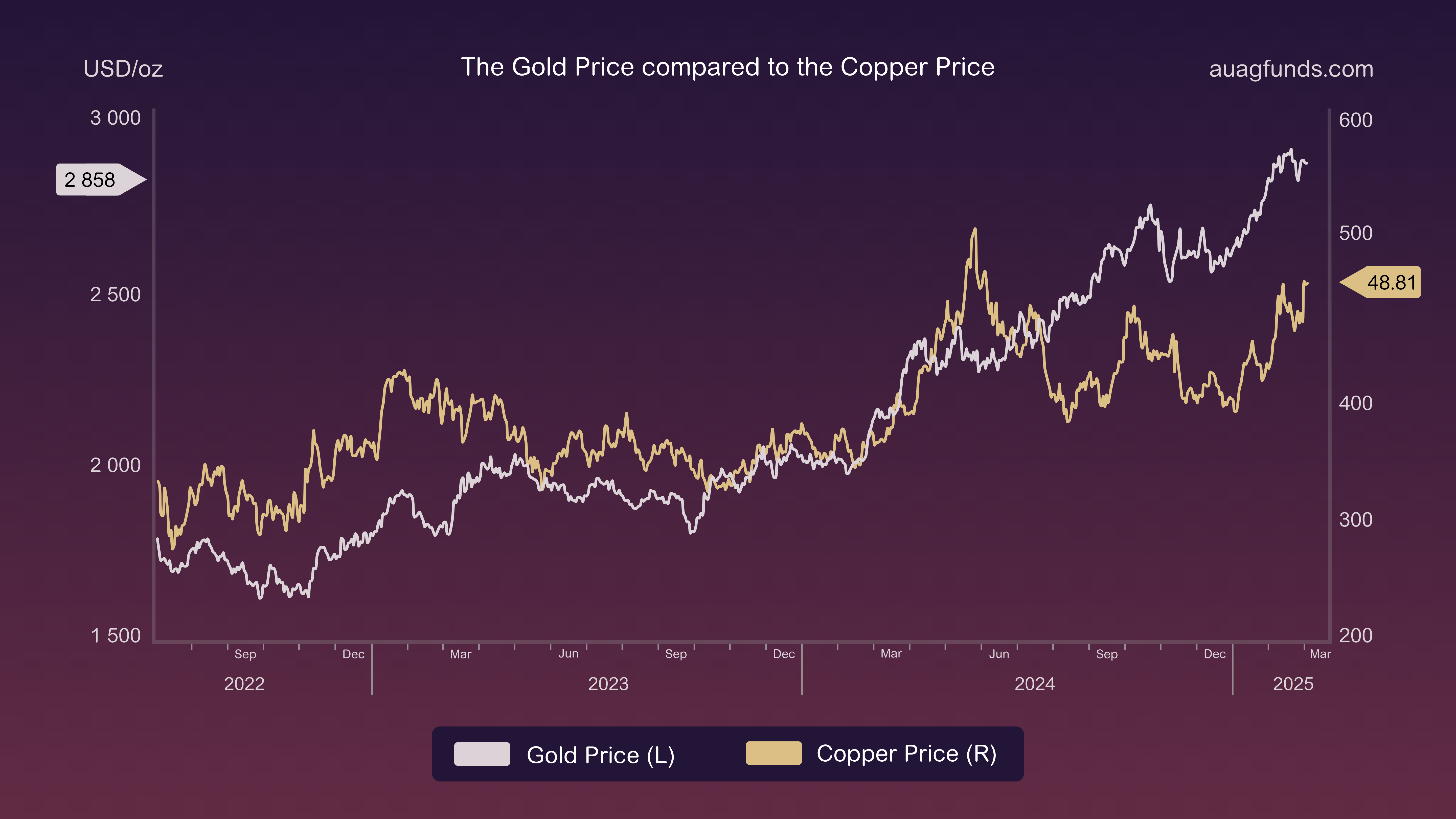

The electrification of the world is advancing rapidly, yet we are still only at the beginning of this megatrend. This transformation is driven by our ability to generate increasing amounts of electricity at lower costs, alongside ongoing innovation and the growing need for efficient electricity transmission. In this regard, copper plays a crucial role, and significantly more copper will be required over the next 5, 10, and 20 years.

Copper demand is now rising at a pace that supply cannot keep up with, suggesting a higher copper price in the future. Limited supply, combined with strong demand, is driving prices upward. While the copper price has begun to increase, it still has significant room to "catch up," as it is not rising as quickly as, for example, the gold price. When copper prices truly take off, it will strongly benefit the miners extracting copper, particularly those whose primary focus is copper production, as they stand to be the biggest winners.

Copper demand is now rising at a pace that supply cannot keep up with, suggesting a higher copper price in the future. Limited supply, combined with strong demand, is driving prices upward. While the copper price has begun to increase, it still has significant room to "catch up," as it is not rising as quickly as, for example, the gold price. When copper prices truly take off, it will strongly benefit the miners extracting copper, particularly those whose primary focus is copper production, as they stand to be the biggest winners.

Fund of the Month

AuAg Essential Metals, also known as “Doctor Copper,” is a broader metals fund. Unlike AuAg Silver Bullet and AuAg Gold Rush, which primarily provide exposure to silver and gold, respectively, AuAg Essential Metals offers exposure to industrial and new-technology metals. Some examples of metals mined by the fund’s companies include rare earth elements, copper, and uranium.

Right now, it is remarkable how little capital is being allocated to buying shares and owning companies that extract metals like copper. Surely, no one has missed that the U.S. president, Donald Trump, has shown interest in Mexico, Canada, and Greenland—but why? What is it they are after? These three countries all have significant reserves of essential metals that are crucial for their future and the future of our world.

Although the meeting between the United States and Ukraine was a disaster (for everyone), the idea and the greatest desire for the US was to take advantage of Ukraine's mineral reserves. The entire US peace plan and the communicated ‘payback model’ is based on obtaining more metals.

AuAg Essential Metals should be a favourite fund among professional investors who want commodity exposure but do not want to invest in oil/coal and livestock/food. Moreover, the timing is great given that the companies are still undervalued in a sector that looks like it could get really hot once everyone realises what world leaders are really after.

Macro Observation of the Month

Trump tariffs, the rising threat of a recession in the U.S., NATO in disarray, "counter-tariffs" announced by several countries, and Tesla’s tailwind turning into a headwind… Yes, it’s starting to get difficult to keep up with all the twists and turns. We continue to face chaos and uncertainty ahead, and we truly hope this doesn’t lead to everyone eventually stopping to care about where the world is headed. Much is at stake now.

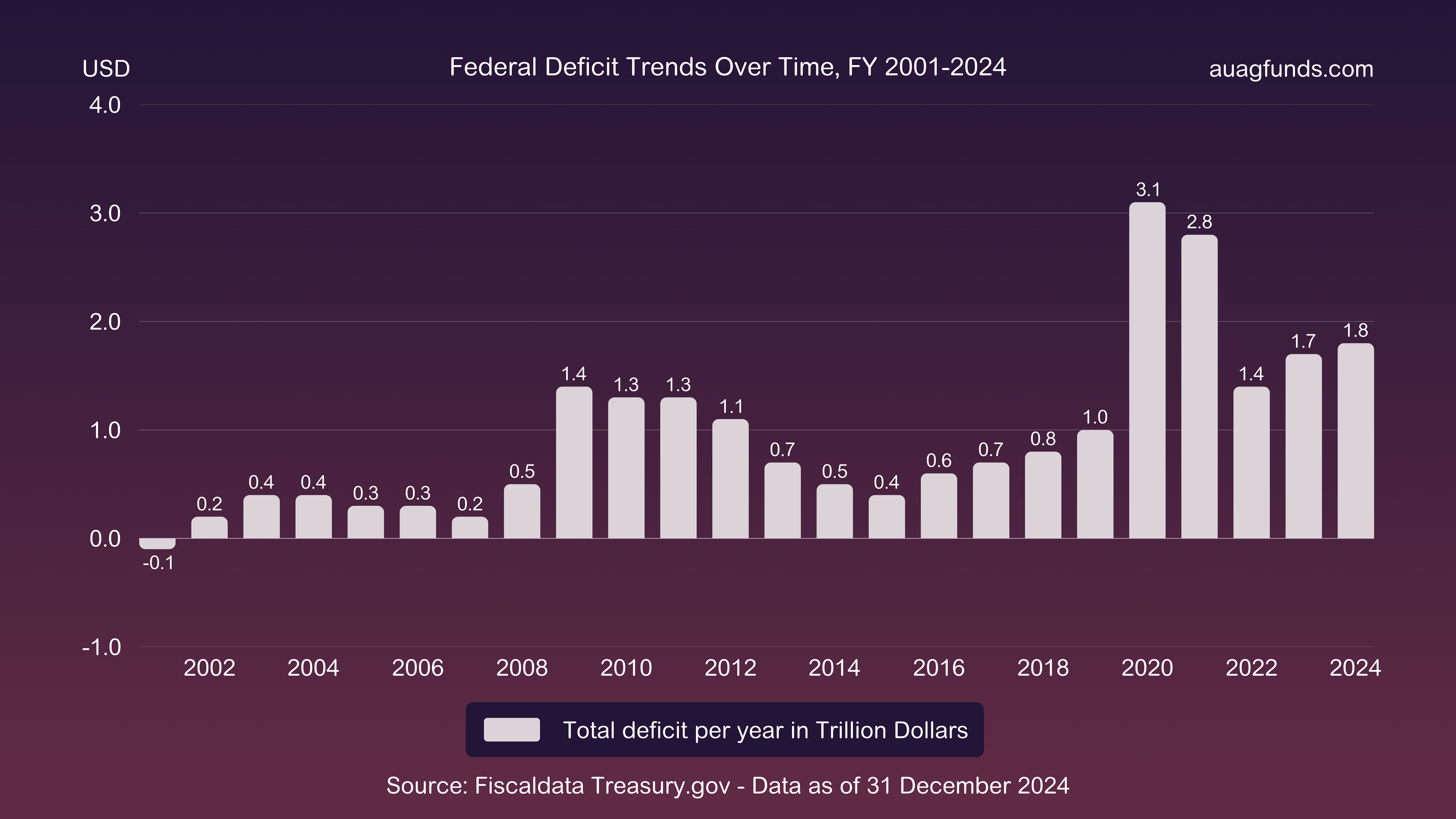

We are currently experiencing increased volatility in the market, with significant losses in the stock market for several highly valued companies. More turbulence is likely to come, but we still don't foresee a true long-term recession on the horizon. When one does occur and begins to take hold, the U.S. Federal Reserve will likely respond by cutting interest rates rapidly and implementing some form of quantitative easing (QE).

The expectation of reduced budget deficits in the U.S. does not seem to be materialising. While the team around Donald Trump (DOGE) plans to significantly reduce the number of government employees, this is more likely to result in higher unemployment than in significantly lower costs. Perhaps the president actually welcomes higher unemployment, as it would increase pressure on the Fed to cut interest rates more quickly. The U.S. president wants low interest rates and an economy running at full speed.

Meanwhile, proposals are emerging that Europe should take on a massive loan to fund the rearmament of its military capacity. Instead of burdening taxpayers, they would rather create money by incurring new debt. Additionally, China has started to announce strong measures to stimulate its own economy.

It's all part of a larger game now, and one might need to study game theory to understand who will come out as the winner from this spectacle. But one thing is certain: This marks the beginning of another phase of monetary inflation.

Note: "Game theory includes theories aimed at describing, with the help of mathematical models, strategic interactions between rational decision-makers. It is an interdisciplinary field of research and is mainly used in economics, biology and computer science, but also increasingly in political science." Read more about mathematical game theory.

We conclude by thanking all of you, our monthly newsletter subscribers, club members, and AuAg investors. With the world as it is, marked by loose monetary policy and the ever growing demand for metals, we truly believe that our funds play a valuable role in every investor's portfolio.

With your support, our community keeps growing. Thank you for being our greatest ambassadors.

Explore the funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

/)

/)

/)

/)