/)

Who will pay for the party?

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for gold, silver and other essential metals. These observations are presented with images and charts laid out efficiently and concisely.

Intro

The first month of 2025 is now behind us, and we can look back on an eventful start to the new year. In this monthly letter, we discuss the strong performance of gold and silver prices and how you can take advantage of the momentum despite the recent surge.

We also dive into two phenomena from the past month, both of them related to the recent US presidential election, and how they impact the amount of money being printed in the financial system. As always, don't hesitate to ask us questions or continue the discussion in our Discord!

Gold

Gold had a strong start to the year, rising +6.6% in USD (+6.9% in SEK) in January. This brought gold to a new all-time high of USD 2816 per troy ounce and continues to show its strength, despite a strong dollar.

Silver

Silver started the year even stronger than gold, rising 8.2% in USD (8.5% in SEK) during January. On the last day of the month, silver surpassed USD 31 per troy ounce, reaching an important level that we explore further in our recently published "Silver and Silver Miners Outlook 2025". There are strong indications that 2025 could be the year when silver beats gold.

Mining Companies

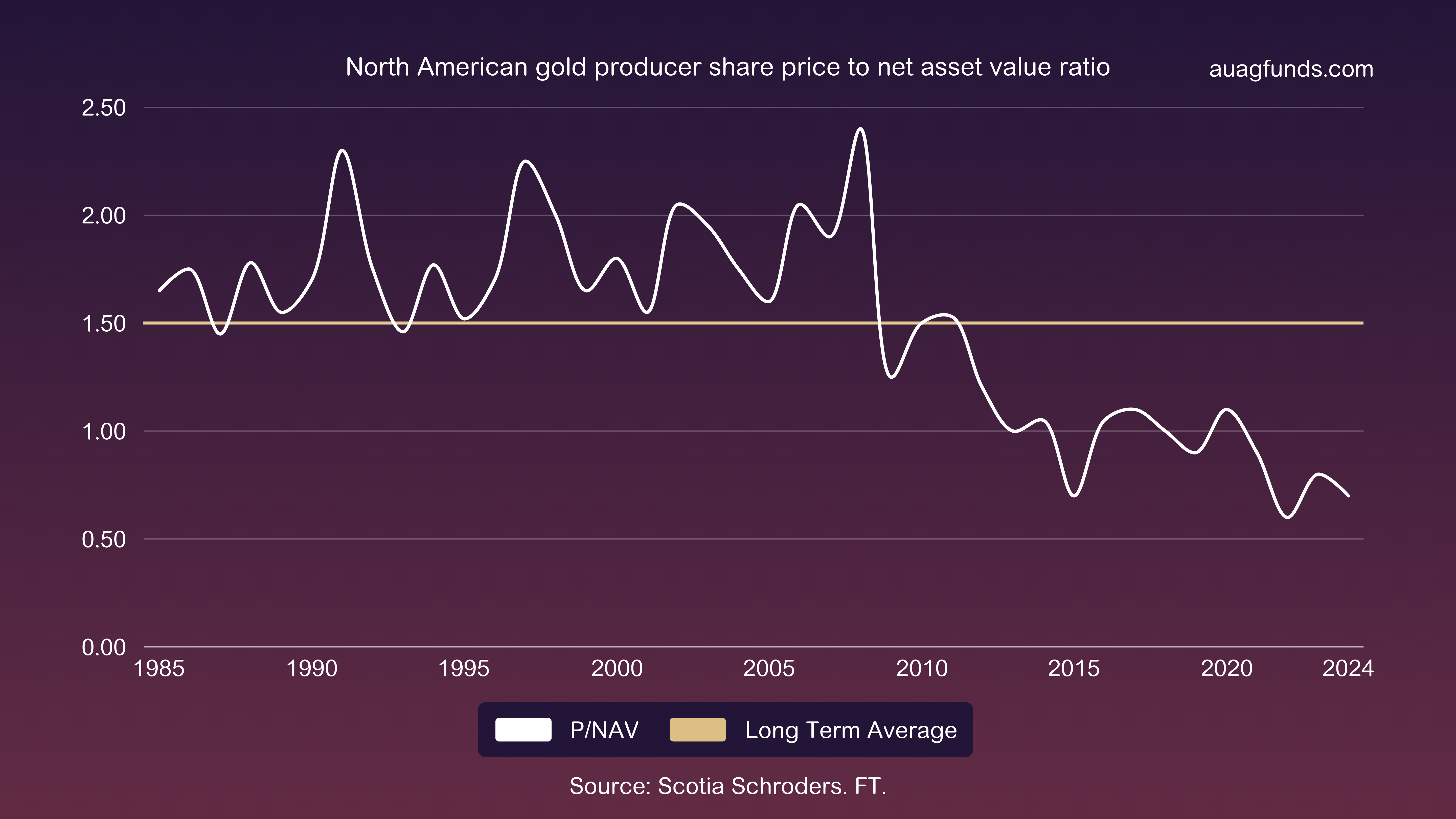

If you don’t want to miss out on the strong trend in the gold price, there is a second chance to get in by investing in gold mining companies. Historically, gold mining companies haven't been valued this low in the past 40 years (as you can see in the chart below), suggesting that the price increases over the past year may only be the beginning of a much longer upward trend.

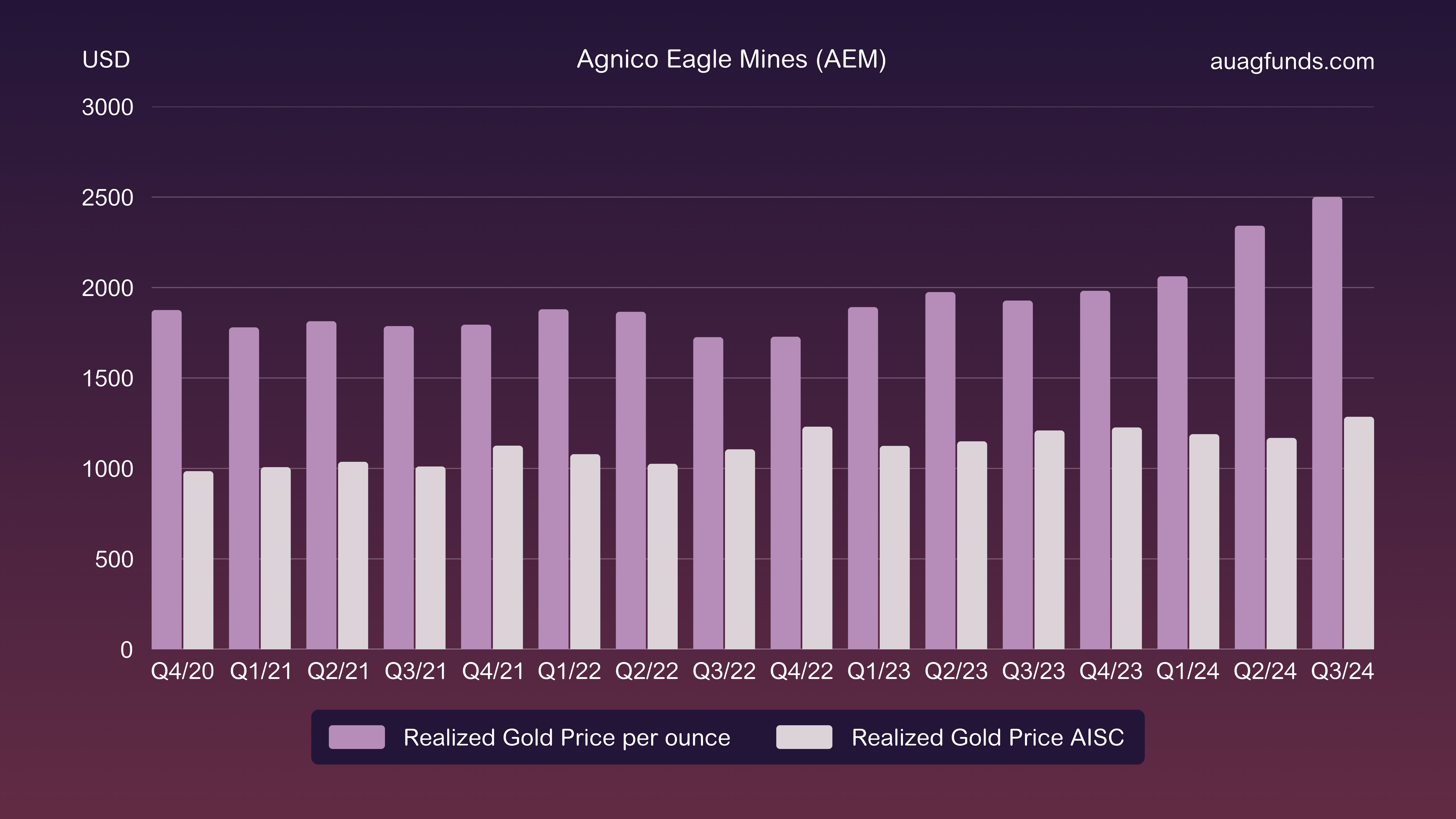

We now await the financial results set to be reported in February. Companies like Agnico Eagle Mines have been showing strong cash flows, and we’re eager to see if their results, along with the entire sector’s earnings, will attract larger institutional investors back to the mining sector. When that happens, it could drive stock prices in a way we haven’t seen in a long time.

AuAg Macro - Monetary Inflation

During the month, we witnessed a quite remarkable phenomenon. The, at the time, recently launched "TrumpCoin" (and also "MelaniaCoin") skyrocketed to imaginary valuations over a single weekend. This made Donald Trump one of the richest people in the world, at least on paper, or perhaps more accurately, on screen. Now, the price has dropped by 75%, but the fact that these coins can create virtual value remains concerning. As long as they are considered to have value, they increase the amount of money in the system. It's like an additional printing press on top of the central banks.

Who will pay for the party in the future? That’s the big question. We already have plenty of taxes: income tax, employer contributions/tax, sales tax, property tax, capital gains tax, interest tax, import tariffs, corporate tax, inflation as a hidden tax, and many more. The most populist approach is to shift the tax burden onto “others” rather than the voters, so it’s no surprise that tariffs (import taxes) are emerging as a future option. If you looked at the world as a single country, you would soon realize that any populist solution relying on someone else to cover the costs of poor financial management is a dangerous path. That said, we see this as a strong trend and one that also makes it easier, at least on paper, for countries to accelerate with more stimulus.

Now, even countries with large national debts are launching "sovereign wealth funds. It makes sense for nations with a debt below 30% of GDP, but when countries like the United States, with over 120% debt, launch such a fund, one has to wonder, what kind of money will actually go into the fund? New printing, perhaps?

AuAg Macro - Electrification

At the recent COP climate summit, organised by the United Nations, more than 25 of the world's most influential countries signed an agreement to triple global nuclear power capacity within the next 20 to 30 years. This effort aims to reduce dependence on fossil fuels.

With global demand for more electricity, driven by technological developments and electrification, nuclear power seems to be enjoying a renaissance. One thing is clear - nuclear power is returning as a central part of global energy supply.

Fund of the Month

AuAg Silver Bullet had yet another strong month and made it into the top 10 of all funds in Sweden for the month. During January, we added 4 smaller companies that we hope will be able to grow over time. Their weight in the fund is currently low and totals only 2% of the fund.

The reason why we are now adding these minor companies and also increasing the exposure to physical silver (the commodity) from 1-2% to 4-5% is because there are several acquisitions in the sector. First Majestic recently bought Gatos (2%) and soon SilverCrest (4%) will also disappear where Coeur is the buyer. We need to gradually add new holdings and change some target weights in the fund as we cannot simply increase the weight in the buying company. First Majestic would otherwise weigh 8% + 2% = 10% and we do not want a higher target weight than 8% for any holding in the portfolio. Likewise, Coeur after the purchase of SilverCrest would weigh 8% and in that case we would hold too many companies weighing over 5%.

All this is done to comply with our own target weights for the portfolio, but also to comply with the rules that apply to UCITS funds. UCITS funds are the safest form of fund construction for investors and also have the toughest rules to follow for managers and fund companies. You can see all the holdings in the fund and their target weight under ‘Holdings’ on our website.

Macro Observation of the Month

Another notable phenomenon was the large amount of gold and silver shipped from London to the United States before the introduction of the tariffs (taxes). This created a lot of speculation about how it would affect the market. We shared our views on X (Twitter) but most importantly in the AuAg Club which is now approaching 350 members. More information about the club and how you can join can be found here.

Tariffs or not, the demand and supply of copper, silver and other industrial metals is not decreasing.

While tariffs do not increase costs for mining companies, they do raise costs for U.S. importers who are in need of industrial metals. All else being equal, industries outside the U.S. that use large amounts of metals may gain a competitive advantage, as they will not have to import the metals into the US with tariff taxes as US industries have to do.

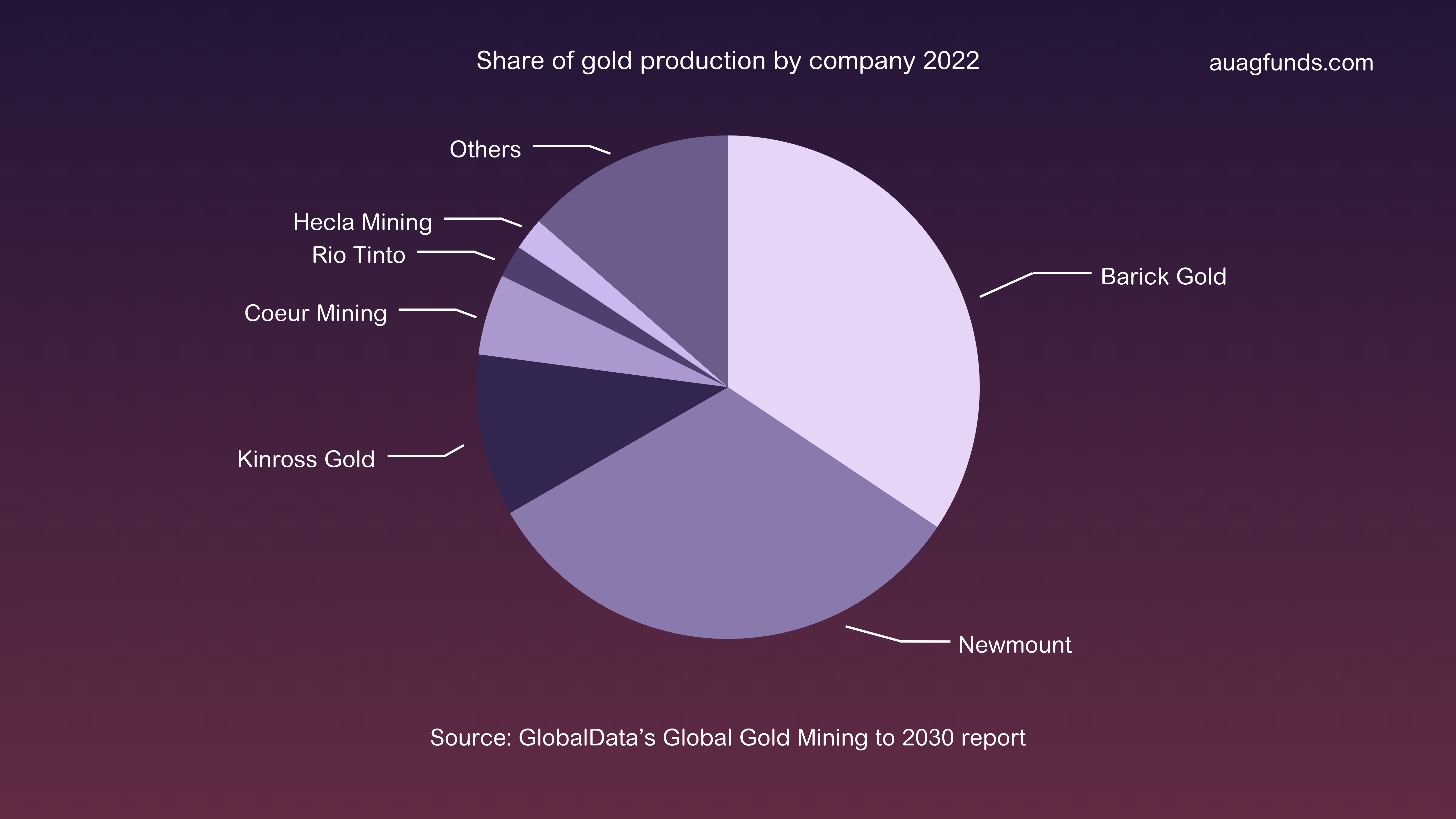

Speculators identified a "trade" to move as much metal as possible into the U.S. before the tariffs took effect, all in order to make an arbitrage. Mining companies with significant mine operations in the U.S., such as Hecla, may gain a small amount. For these companies it is not a matter of imports for the US industry when mining and sales stay within the US.

Holders of physical gold and physically backed ETCs, have no issues regarding the movement of gold and silver from the rest of the world into the U.S. However, and this is a good thing, speculators who use various derivatives, shorts, or have leased out their gold may find themselves in a squeeze or trouble depending on how much and what counterparty risk they have taken. If this non-physical game takes a hit, it could lead to rising prices, a scenario we view as very positive.

Explore the funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

/)

/)

/)

/)

/)