/)

The Impact of the Presidential Election on Gold and Silver

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for precious metals and green tech elements. These observations are presented with images and charts laid out efficiently and concisely.

Gold, Silver, and Presidents

Gold continued its upward trend with new all-time highs in October, reaching it’s top of 2,790 USD per troy ounce on October 30th. The month ended around 2,750 USD (2,475), which also sets our new target price for the year. Perhaps it’s time to consider raising the target price again?

The U.S. election causes significant short-term movements across many markets, including gold and silver. In the longer term, however, the money supply, measured as M2, has increased at the same rate since the 1980s, regardless of whether the president has been a Democrat or a Republican. The same applies to U.S. debt levels and the average inflation rate. Even budget deficits have shown similar averages (-3.86% vs. -3.72%). This suggests that initial reactions are likely driven by algorithmic trading rather than fundamental changes over the coming years.

We’ve noted that the U.S. dollar has been strong recently, rising 3.5% against the EUR in October. Therefore, October's increase in gold prices is particularly remarkable, with gold measured in USD up 4.2% and even more in other currencies.

Silver reached its highest point in mid-month, almost touching 35 USD per troy ounce. Given our benchmark for the GSR (Gold-Silver Ratio), set at 70:1 for the year, there is still substantial potential to reach our updated silver target of 39 USD.

Silver mining companies continued to perform well throughout the month and have had a strong year since the reversal that began on February 29th, 2024. This is just the beginning of a long-term, mature bull market for precious metals and their associated mining companies, which remain undervalued and often overlooked by many investors.

Times of Devaluation

The extreme tariffs that the U.S. plans to impose will likely lead to some form of trade war with the rest of the world. As we see it, this will very likely be followed by devaluations in several countries. China and other major exporting countries, such as Germany, are among those most affected by these tariffs, and it could be China that initiates the next round of devaluations. This will ultimately increase demand for currencies that hold their value, such as gold and silver. The dollar may also strengthen as the world’s reserve currency within the fiat system, which could temporarily have a negative impact on gold and silver prices in USD. However, we believe that global purchasing power will have a positive price-driving effect, resulting in higher overall prices for gold and silver.

Devaluations have taken various forms throughout the years. In Sweden, the krona was devalued several times during the 1970s and 1980s, by 6, 10, and even 16 percent at a time. When the exchange rate eventually became floating, the krona continued to lose value. This trend has persisted, with the U.S. dollar becoming 45% more expensive, and gold, measured in Swedish kronor, rising by 227% over the past ten years.

Thus, devaluations and “more or less intentional” currency depreciations are nothing new. One should be prepared for new devaluations and their effects as we move into a world filled with tariffs and trade restrictions.

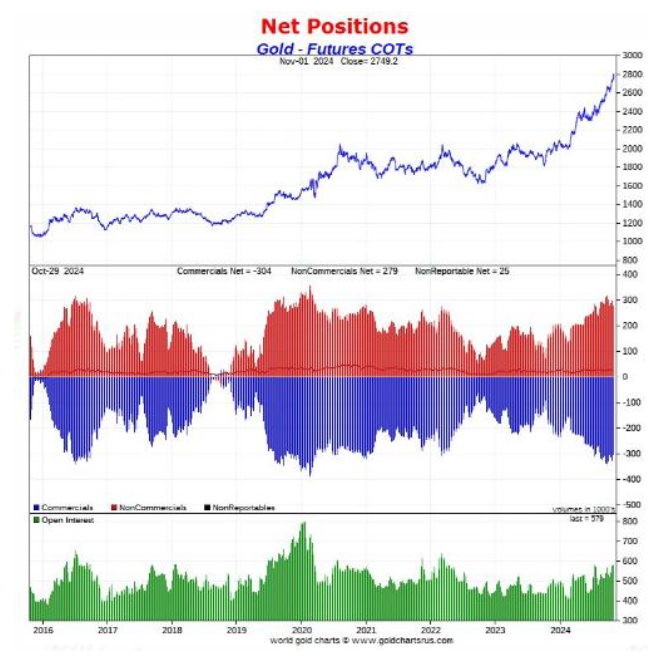

COMEX

Virtually all global factors indicate a significantly higher gold price in the future. However, what has often temporarily slowed this long-term trend are extreme positions on the U.S. commodity exchange, COMEX. The short positions held by so-called “Commercials” have grown during the latest price upswing for gold and silver.

When these positions are substantial, there’s an increased risk that these Commercials will try to push prices down to reduce their short positions. We are approaching a “breaking point,” with their unrealised losses currently estimated at around 30 billion USD.

At the same time, this situation presents an enormous opportunity. A significant upswing is in the cards if they are forced to give up and buy back their short positions, which could lead to rapid price increases. It then becomes crucial to act quickly, as those trapped in these short positions risk chasing rising prices and realising even larger losses.

This time, we also note that the Commercials have behaved differently, unable to bring prices down as effectively as in the past. We also see that they have slightly reduced their positions over the past week, even as gold prices have risen. Very exciting!

Explore the funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

Morningstar - Best and worst performing funds in October

Morningstar writes about the best performing funds in October 2024 where Silver Bullet is in top.

/)

How to protect your savings - with gold

In an interview with Mikaela Somnell at Aftonbladet Eric Strand talks about how investing in gold can be a protection in your savings and the huge demand for precious metals that will only grow bigger

/)

Stocks to Watch - Why Invest in Precious Metals Now | Nordic Funds & Mines 2024

/)

Morningstar - Best and worst performing funds in October

Morningstar writes about the best performing funds in October 2024 where Silver Bullet is in top.

/)

How to protect your savings - with gold

In an interview with Mikaela Somnell at Aftonbladet Eric Strand talks about how investing in gold can be a protection in your savings and the huge demand for precious metals that will only grow bigger

/)

/)

/)