/)

Elements | March 2024

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for precious metals and green tech elements. These observations are presented with images and charts laid out efficiently and concisely.

Boom and Bust – Is it time again?

We are now facing a situation in the stock market where the five largest companies on the US stock exchange (S&P 500) together account for more than 25% of the market. When the IT bubble burst, the five largest companies were up to 18%.

Another indicator shows that the largest companies, measured as the top 10% of all American stocks, are valued at over 75% of the market value of the entire exchange. This is something we have not experienced since 1929.

Common to "boom & bust periods" such as the banking, finance, and real estate crisis in the early 90s, the IT bubble in 2000, and the financial and debt crisis in 2007/2008 was that they caused significant, almost parabolic, increases before the bubble burst. As we have written in previous letters, the excessive amounts of stimulus and money printing contribute to large bubbles.

For investors, the art is to secure and realize profits gradually. This is especially important when more and more signals become visible that individual segments are in bubble valuations. The risk and most common scenario is that investors see large unrealized gains on their investments – but do nothing, only to see the same "perceived gains" melt away during subsequent corrections and downward trends.

If "sell high" is part of the success in creating real "relative" wealth, then "buy low" is what has really made a difference between those who have succeeded in investments and those who have not.

The question is whether tech stocks have reached an overvaluation relative to the rest of the stock market (S&P 500), just like during the IT bubble in 2000. Prices can always continue upward, but it requires more and more capital to push the stocks up another percentage point. Perhaps it is a good opportunity to secure parts of the profits - and stay partly invested if it still feels like some momentum is left in the upward movement.

![]() Other sectors than tech, such as commodities, can, on the other hand, be seen as low-valued relative to the market. The picture below shows gold mining companies in relation to the US stock market (S&P 500). It was really good to buy the S&P 500 during the 90s, then it was better with gold mining companies from 2000-2010, and then better with the S&P 500. A horizontal line in the picture means the relationship is static, while downward and upward movements give a greater relative difference. A movement up towards the average and then a bubble top up towards 15 in the chart for the gold mining companies shows a huge opportunity (the last upward journey for the companies gave 10-20x).

Other sectors than tech, such as commodities, can, on the other hand, be seen as low-valued relative to the market. The picture below shows gold mining companies in relation to the US stock market (S&P 500). It was really good to buy the S&P 500 during the 90s, then it was better with gold mining companies from 2000-2010, and then better with the S&P 500. A horizontal line in the picture means the relationship is static, while downward and upward movements give a greater relative difference. A movement up towards the average and then a bubble top up towards 15 in the chart for the gold mining companies shows a huge opportunity (the last upward journey for the companies gave 10-20x).

If you have been in the industry for a long time, you know that all great fortunes have been created by those who bought really, really cheaply. Those who, for example, became billionaires in real estate bought a lot when the real estate crisis was at its ultimate low and no one wanted to buy. Right now, there are great opportunities to buy cheaply, for example, in the commodity sector.

In this month's letter, we wish to focus on the intriguing uranium market. Nuclear power is now considered a green alternative, at least until the world produces enough wind, solar, and hydro energy. This, combined with the efficiency of new nuclear power plants, has led to the construction of new plants in many countries. Consequently, demand has increased, and the uranium price has risen sharply. Previous factors that pressured uranium prices, such as the dismantling of nuclear weapons, which provided "extra" uranium to the market, are now gone.

In this month's letter, we wish to focus on the intriguing uranium market. Nuclear power is now considered a green alternative, at least until the world produces enough wind, solar, and hydro energy. This, combined with the efficiency of new nuclear power plants, has led to the construction of new plants in many countries. Consequently, demand has increased, and the uranium price has risen sharply. Previous factors that pressured uranium prices, such as the dismantling of nuclear weapons, which provided "extra" uranium to the market, are now gone.

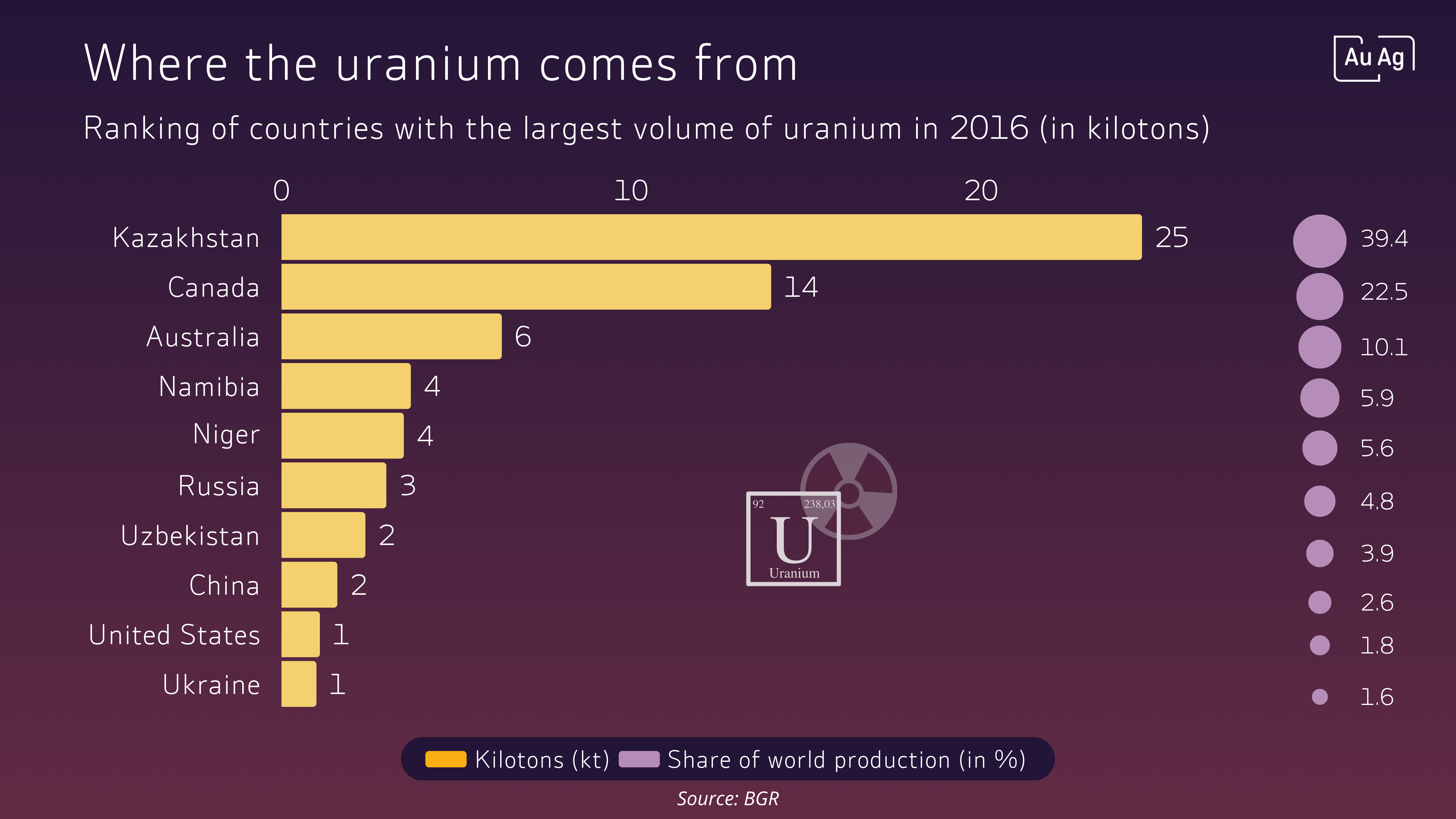

Canada is the most significant uranium producer in the West, but Kazakhstan has total dominance globally. In the US, several companies aim to make the US a major producer, and in Europe, the hope lies on a few countries. De-globalization and a stronger desire not to depend on individual countries are driving this process.

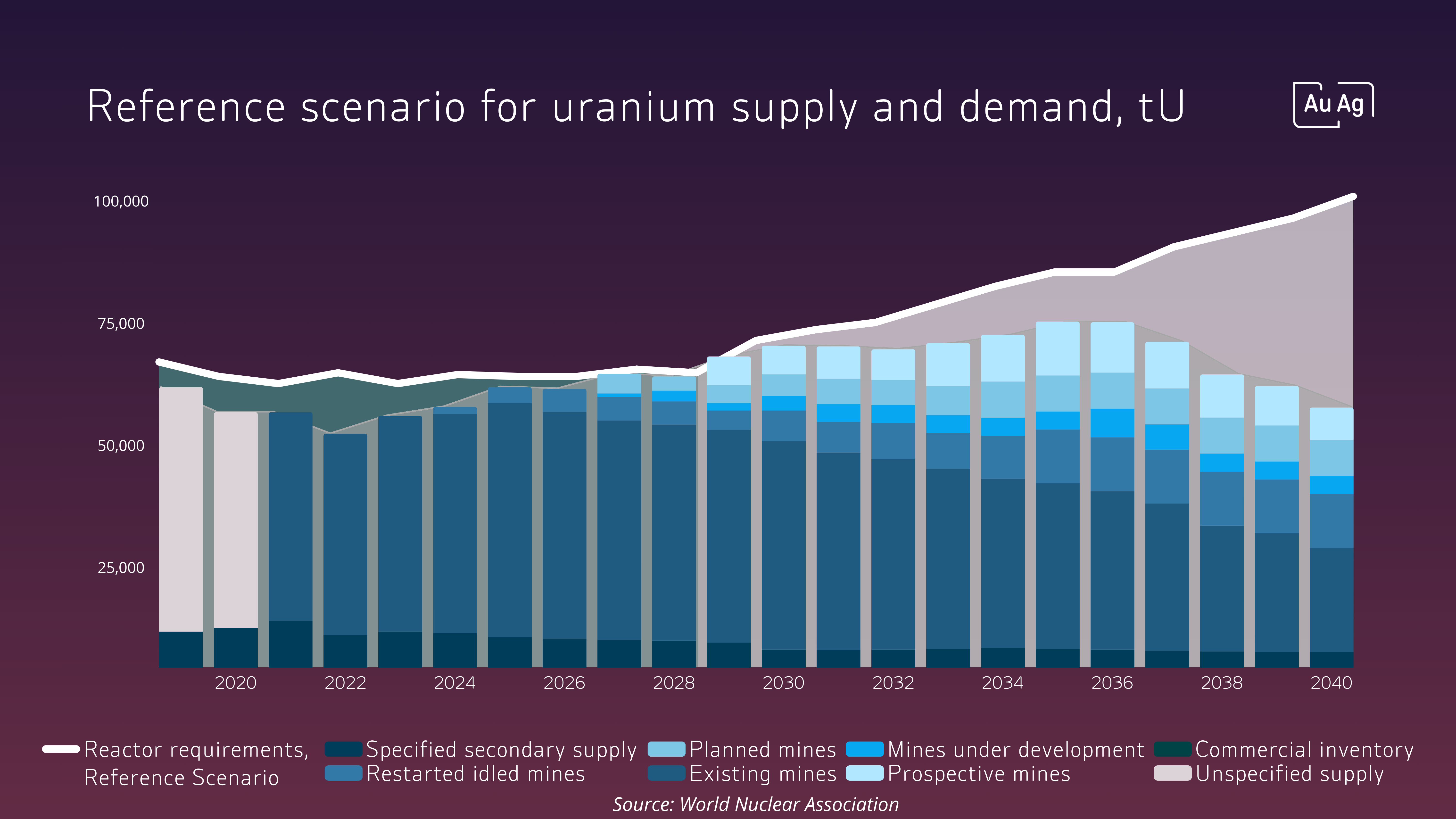

Of course, there are various scenarios regarding the demand and supply situation. Even a moderate scenario indicates that there could be a significant future deficit. A physical shortage of a commodity is truly "rocket fuel" for its price.

Of course, there are various scenarios regarding the demand and supply situation. Even a moderate scenario indicates that there could be a significant future deficit. A physical shortage of a commodity is truly "rocket fuel" for its price.

A higher price will be needed to make new extraction profitable. This will benefit mining companies that have or will have good margins, but also those with smaller margins, as the percentage difference on the "bottom line" becomes greater for these companies.

Should Sweden be part of the solution? The Swedish government has acted and appointed a rapid investigation to be completed by May 15 to explore the possibilities of allowing uranium mining in Sweden again.

Should Sweden be part of the solution? The Swedish government has acted and appointed a rapid investigation to be completed by May 15 to explore the possibilities of allowing uranium mining in Sweden again.

The oldest uranium deposits in the Swedish bedrock are more than 1.9 billion years old. Many of them are located in the northern parts of Sweden. These deposits have a higher uranium content, but their size is limited. In southern Sweden there is more uranium, but the crucial concentration, is much lower.

The future profitability of a project is often a function of how easy/difficult it is to extract metals in relation to the concentration of metal in the ground. Of the world's total uranium resources, about 0.2 per cent are expected to be in Sweden. However, Sweden's uranium resources constitute almost 30 per cent of Europe's total volume.

Sweden is also reinstating the concept of "mineral hunting," which can further indicate that the extraction of minerals/metals is slowly but surely becoming something significant.

Uranium is not traded on an open market like other commodities. Instead, buyers and sellers negotiate contracts directly with each other. An option to follow the market price/value of uranium is via an ETF (Sprott Physical Uranium). Since the summer of 2023, the price rose by +100% in a short time. After this year's peak, the uranium price has corrected by -20% (this depends a bit on which pricing one follows). Sharp increases can become overbought after a time, leading to a correction, as we reasoned above at the beginning of the letter.

Uranium is not traded on an open market like other commodities. Instead, buyers and sellers negotiate contracts directly with each other. An option to follow the market price/value of uranium is via an ETF (Sprott Physical Uranium). Since the summer of 2023, the price rose by +100% in a short time. After this year's peak, the uranium price has corrected by -20% (this depends a bit on which pricing one follows). Sharp increases can become overbought after a time, leading to a correction, as we reasoned above at the beginning of the letter.

Today, we own two companies involved in the extraction of uranium. In the AuAg Essential Metals fund, we have Cameco, which has been with us since the start, and now also NexGen. Cameco, which operates in Canada, is the only producing company in the Western world that has sufficient liquidity on the stock market for us. American NexGen, which is also large enough on the stock market, has fine deposits and could become one of the world's largest producers.

Today, we own two companies involved in the extraction of uranium. In the AuAg Essential Metals fund, we have Cameco, which has been with us since the start, and now also NexGen. Cameco, which operates in Canada, is the only producing company in the Western world that has sufficient liquidity on the stock market for us. American NexGen, which is also large enough on the stock market, has fine deposits and could become one of the world's largest producers.

Cameco returned about +88% in 2023 and is at -2.5% this year. This is a slightly smaller movement than for the commodity itself. This is partly because the contracts are long and do not follow the rapid price movements of the commodity up and down in the same way. NexGen, which was added to the fund this year, is up approximately 10%.

Perhaps one day, we could own a company that extracts uranium in Sweden!

If you want to add uranium exposure to your portfolio, check out our funds AuAg Essential Metals.

The funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

When the gold price takes off

Gold and Copper at Dagens Industri

/)

Realtid - The Financial Supervisory Authority Can Increase the Return of Actively Managed Funds

An article where Eric Strand discusses how a change in the rules for third-party remunerations could be beneficial for investors.

/)

Reasons to invest in gold, silver, and mining companies in 2024

A brief summary of the most important trends and themes for gold, silver and mining companies in 2024.

/)

/)

/)