/)

Elements | February 2024

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for precious metals and green tech elements. These observations are presented with images and charts laid out efficiently and concisely.

Is copper the new oil?

So far, the beginning of 2024 feels like a continuation of what we have seen throughout 2023. Central banks are talking about a soft landing, and the market is expecting swift interest rate cuts now that the pace of price increases has slowed to around two per cent per year. Meanwhile, central banks are trying through continued "forward guidance" to communicate that rates will not be lowered as early and quickly as the market expects. Globally, China's problems within the real estate sector have flared up again, and the turmoil from the terrible wars in Ukraine and the Middle East continues without any clear resolution in sight.

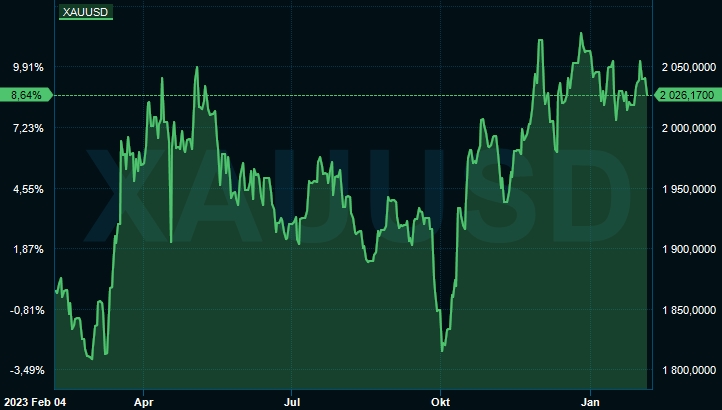

Nowadays, the market reacts strongly to statements from the Fed, which also affects movements in the price of gold. It is observed that the price of gold often gives back part of its earlier gains on these occasions. However, the price remains stable at over 2,000 USD per troy ounce and has, after all, increased by +8.6% in USD over the past year.

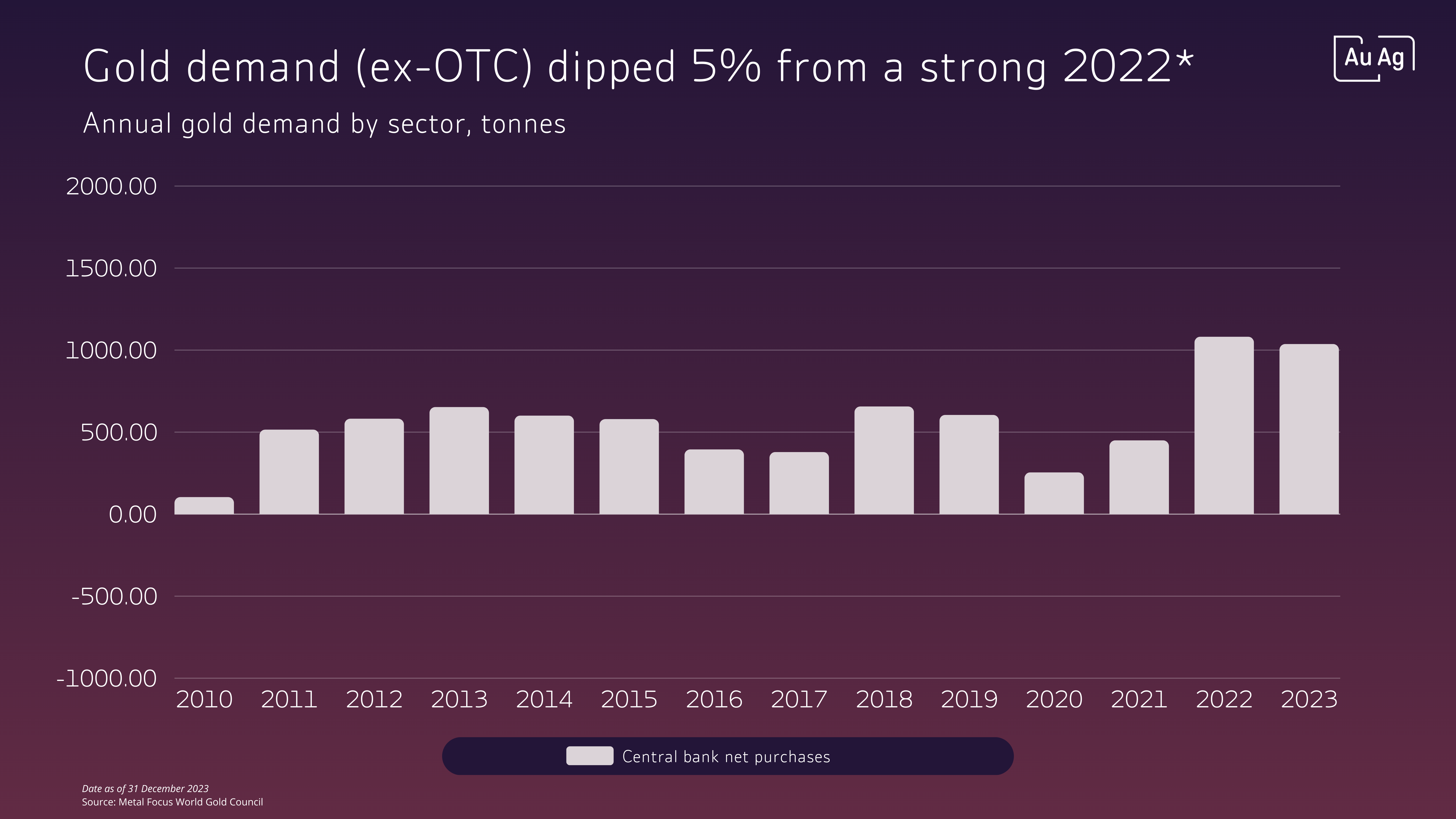

Central banks also set several new records for gold purchases in 2023. The purchases for the entire year of 2023 were almost as large as the record year of 2022. Since the financial crisis, central banks have been trying to strengthen their financial positions by accumulating more and more gold in anticipation of potential future turmoil or disruptions in the financial system.

Central banks also set several new records for gold purchases in 2023. The purchases for the entire year of 2023 were almost as large as the record year of 2022. Since the financial crisis, central banks have been trying to strengthen their financial positions by accumulating more and more gold in anticipation of potential future turmoil or disruptions in the financial system.

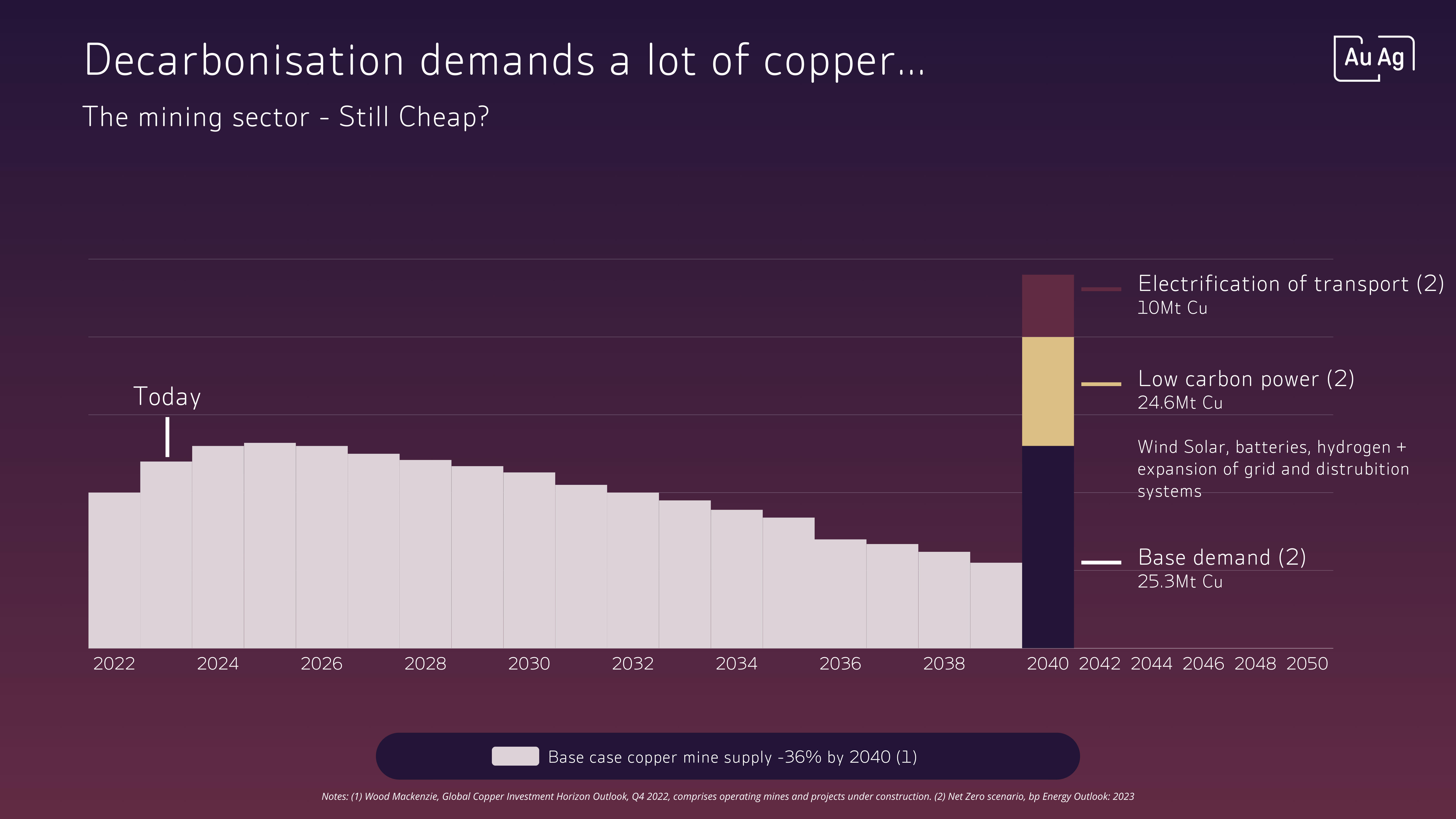

In this month's letter, we want to highlight the fascinating copper market. Besides all the copper needed in industry and the real estate sector, we see how the electrification of our era and the green transition are increasing the demand for copper. Research indicates that by 2040, we will need to extract 2-3 times as much copper as today. In contrast to this demand, the supply is estimated to decrease by 36% during the same period. This equation can only be solved with much higher metal prices, serving as an incentive for mining companies to try to extract more copper. This is a situation that could benefit and significantly increase the profitability of mining companies.

In this month's letter, we want to highlight the fascinating copper market. Besides all the copper needed in industry and the real estate sector, we see how the electrification of our era and the green transition are increasing the demand for copper. Research indicates that by 2040, we will need to extract 2-3 times as much copper as today. In contrast to this demand, the supply is estimated to decrease by 36% during the same period. This equation can only be solved with much higher metal prices, serving as an incentive for mining companies to try to extract more copper. This is a situation that could benefit and significantly increase the profitability of mining companies.

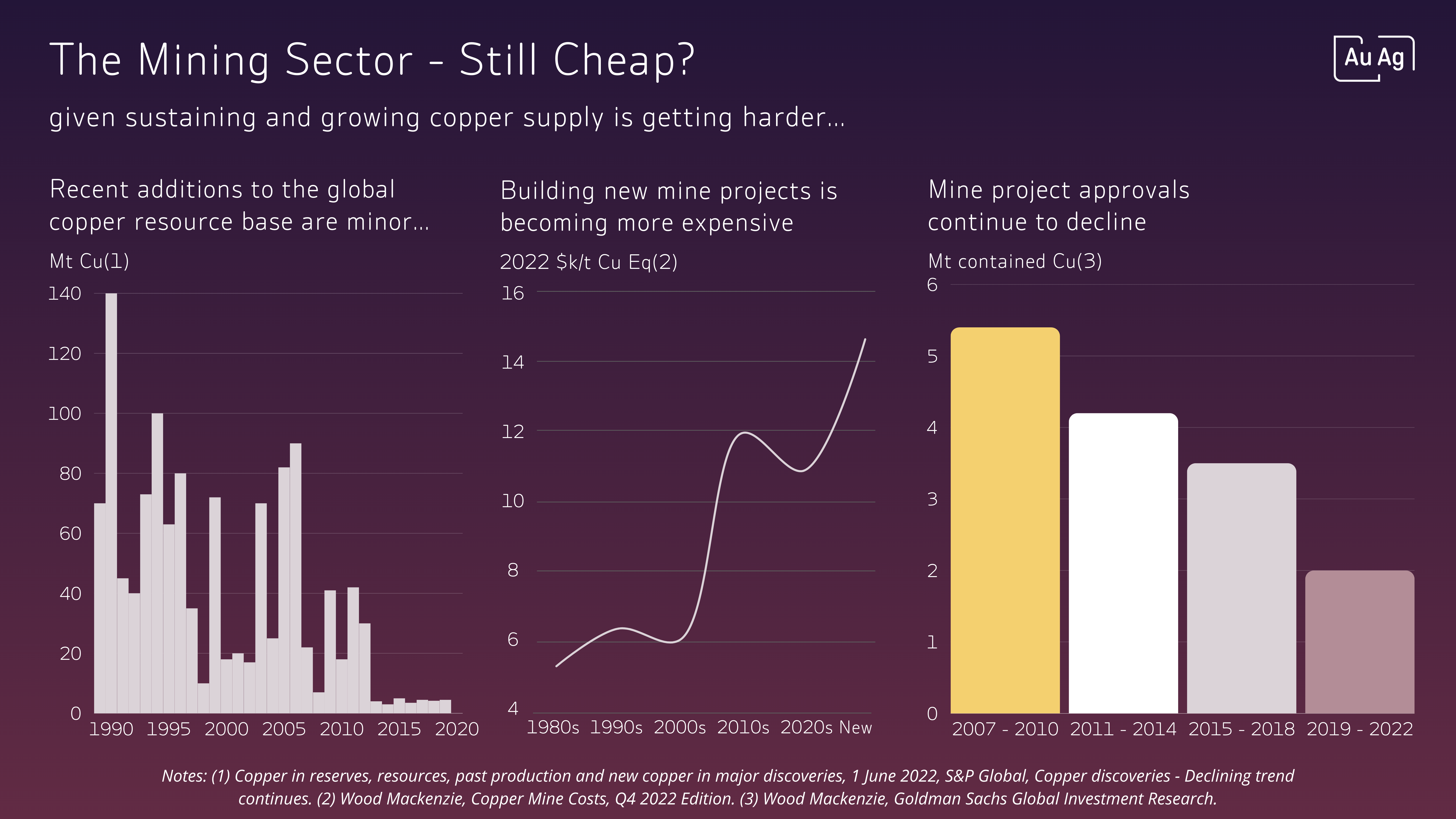

As the image below illustrates, three additional factors are at play. For several years, there has been a scarcity of new supply (1/3), the cost of starting new projects has increased significantly (2/3), and we can also note that the size of the copper reserves from the permits granted for new mining projects over the last 15 years has decreased by more than 50% (3/3). Difficulties in obtaining permits, higher costs to start new projects, and uncertain jurisdictions benefit strong mining companies that currently have good reserves to extract from.

As the image below illustrates, three additional factors are at play. For several years, there has been a scarcity of new supply (1/3), the cost of starting new projects has increased significantly (2/3), and we can also note that the size of the copper reserves from the permits granted for new mining projects over the last 15 years has decreased by more than 50% (3/3). Difficulties in obtaining permits, higher costs to start new projects, and uncertain jurisdictions benefit strong mining companies that currently have good reserves to extract from.

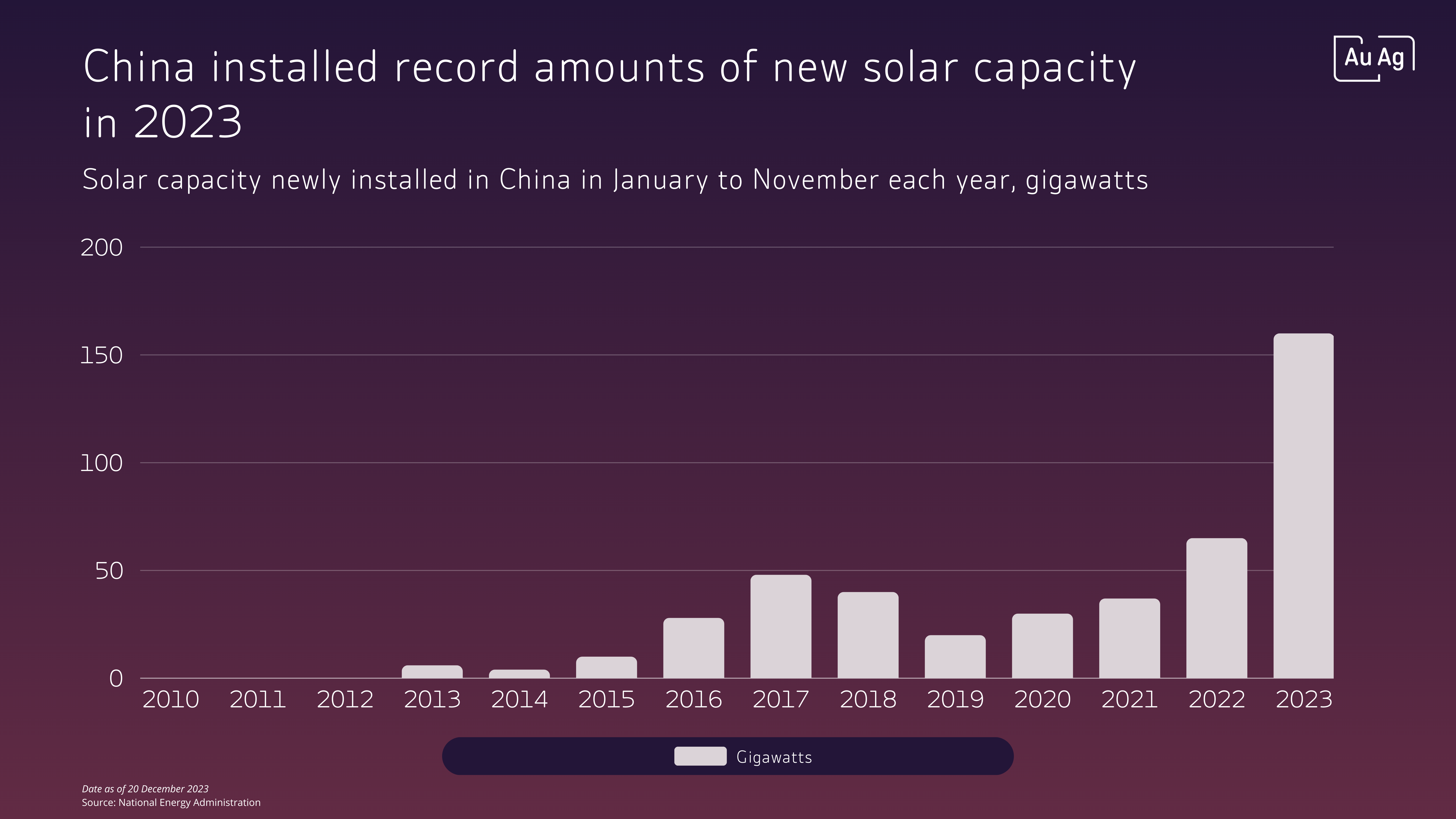

The price of copper has been pressured due to concerns about China's recovery from Covid-related shutdowns and the acceleration of their real estate crisis. However, since the summer of 2023, China's net import of copper has picked up, mainly because the country has built copper-intensive solar parks with a capacity of over 200 gigawatts. This is more than double the amount made in 2022, which was 84.7 gigawatts, and more than any other country has built in total.

The price of copper has been pressured due to concerns about China's recovery from Covid-related shutdowns and the acceleration of their real estate crisis. However, since the summer of 2023, China's net import of copper has picked up, mainly because the country has built copper-intensive solar parks with a capacity of over 200 gigawatts. This is more than double the amount made in 2022, which was 84.7 gigawatts, and more than any other country has built in total.

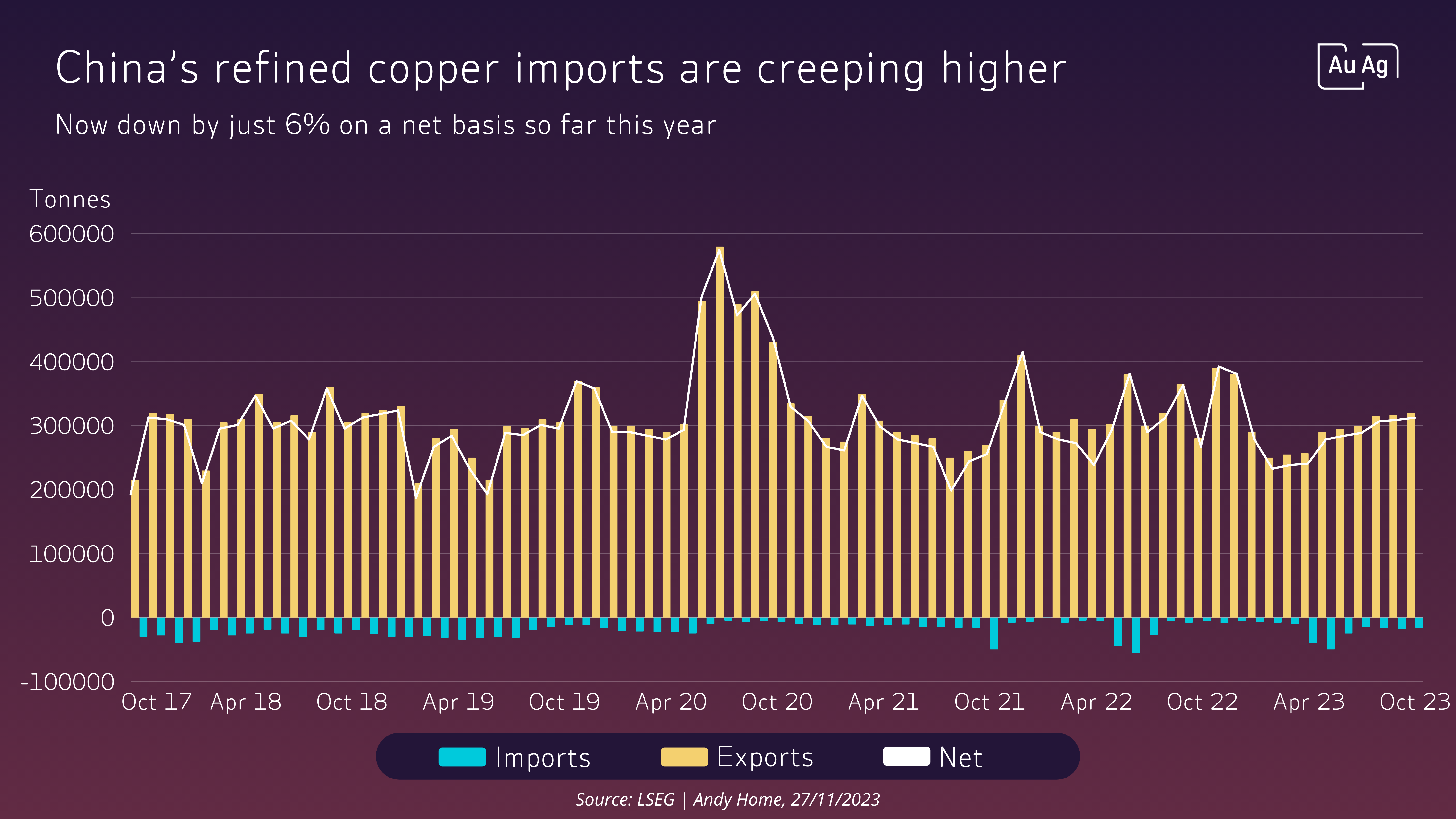

With expanded stimuli in China to support the real estate sector, a turnaround in the construction sector could create an even greater need for copper. This would further accelerate and strengthen the demand trend (the image below shows the turnaround in China's net import from the low levels in April 2023).

With expanded stimuli in China to support the real estate sector, a turnaround in the construction sector could create an even greater need for copper. This would further accelerate and strengthen the demand trend (the image below shows the turnaround in China's net import from the low levels in April 2023).

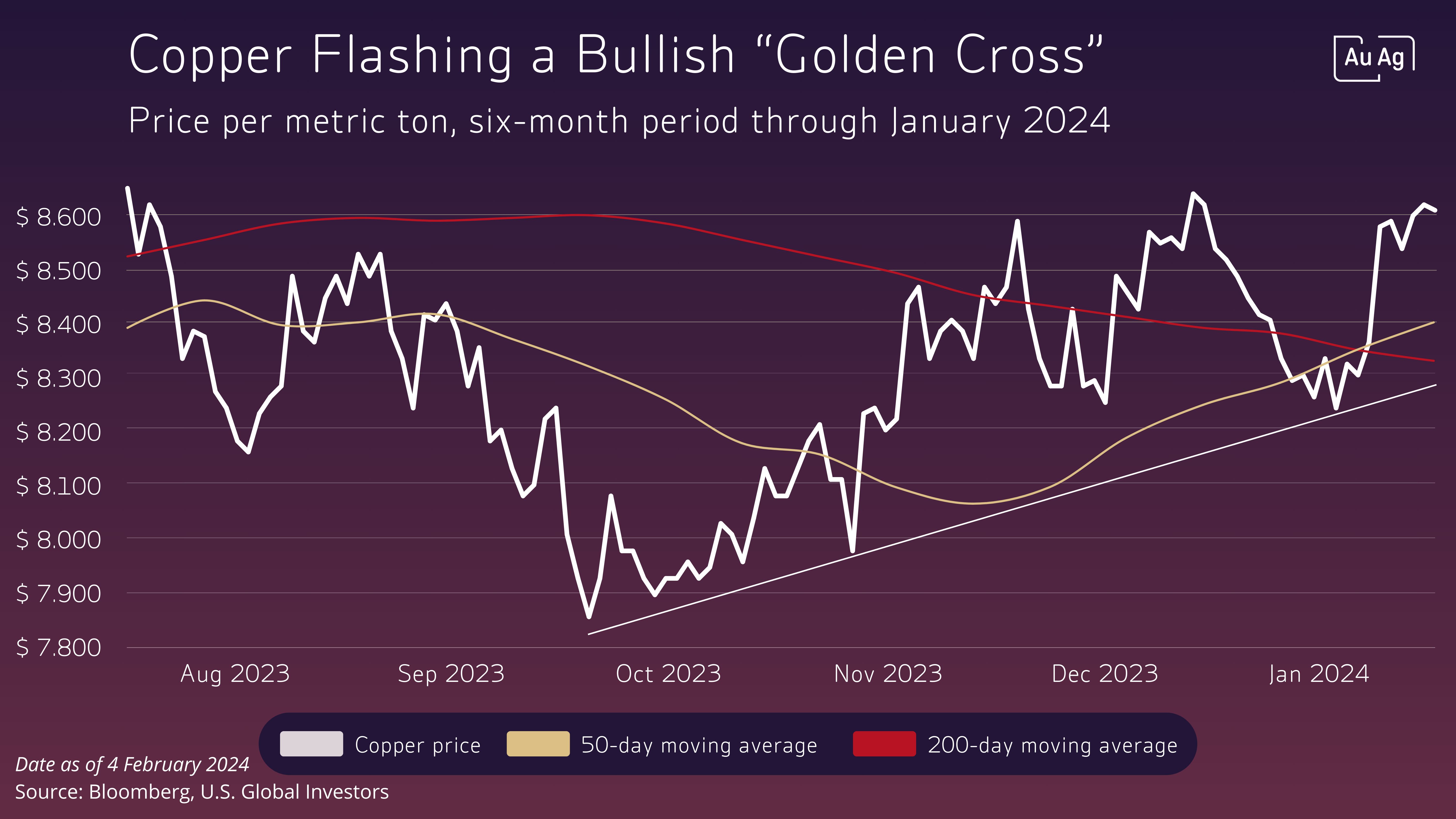

Since the fall of 2023, the price of copper has slowly begun to trend upwards. Analysts from Goldman Sachs see a likely rise to 15,000 USD per ton over the next two years. This would correspond to an increase of +75% in the price of copper.

Since the fall of 2023, the price of copper has slowly begun to trend upwards. Analysts from Goldman Sachs see a likely rise to 15,000 USD per ton over the next two years. This would correspond to an increase of +75% in the price of copper.

Copper is truly "the new oil" and is difficult, or practically impossible, to replace when it comes to the electrification of our world. Copper has the highest conductivity of all metals (after silver). Additionally, it has favourable properties at various temperatures and is easy to shape and process. Copper also has excellent resistance to oxidation and corrosion.

If you want to add copper exposure to your portfolio, check out our funds AuAg Essential Metals and AuAg Precious Green.

The funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

/)

/)

/)

/)

/)