/)

Elements | June 2024

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for precious metals and green tech elements. These observations are presented with images and charts laid out efficiently and concisely.

China is purchasing large quantities of precious metals

In May, the turmoil and wars in the world have continued, with little hope of improvement. At the same time, we have witnessed how the political circus in the US continues to reach new heights. In this month's newsletter, however, we focus on something else: silver and China.

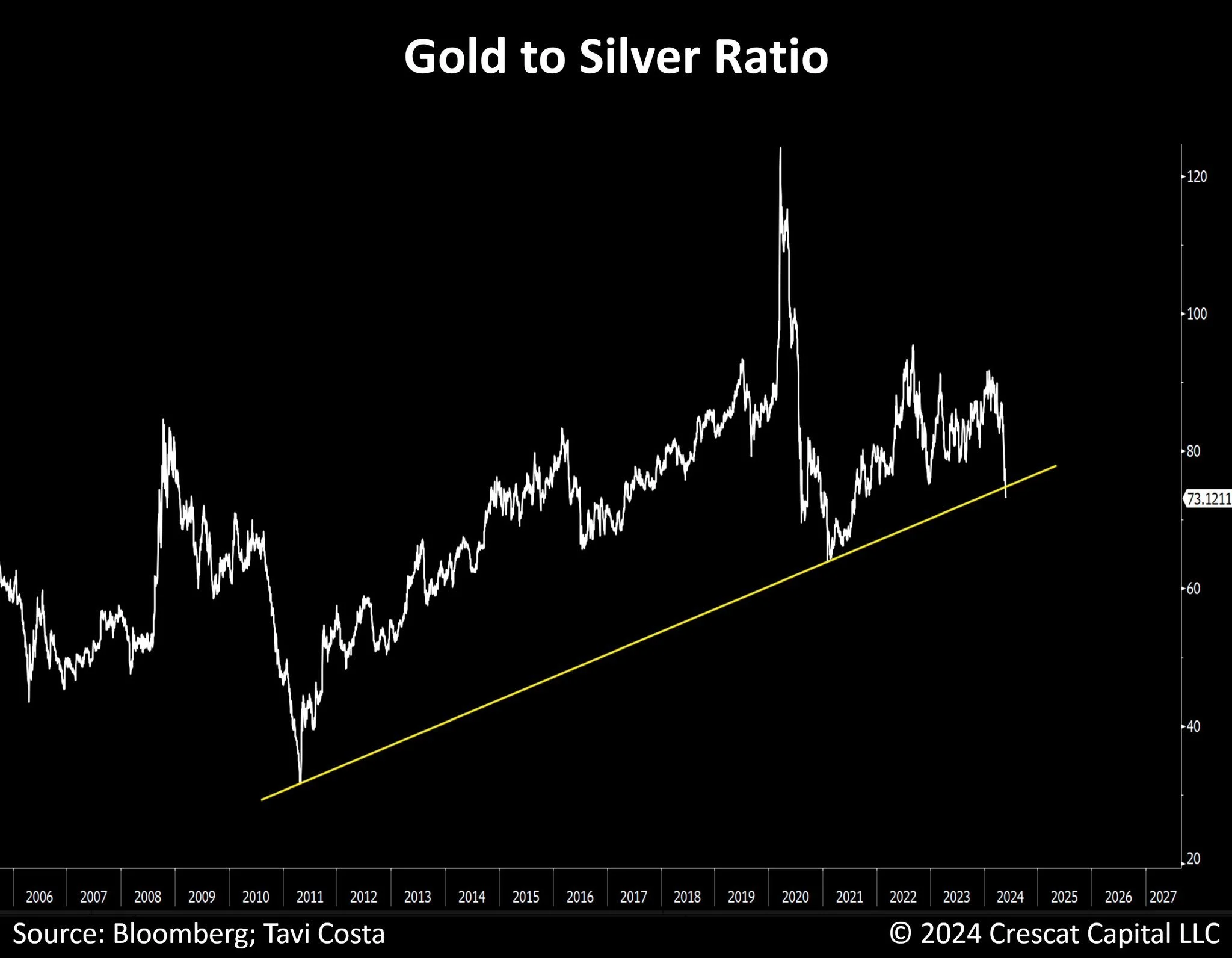

In our Outlook for 2024, we saw the gold price reaching 2475 and the Gold:Silver Ratio (GSR) moving downwards during the year, from 87:1 to 70:1. Such a move would give us a silver price of USD 35 per troy ounce. This could be seen as a bold statement at the beginning of the year, but we have already come a long way. The silver price is now around USD 30 and was, for a few days, above USD 32. An increase of 28 per cent after five months makes our outlook for the silver price, which would give +48 per cent for the year, clearly relevant. The strong silver price has given silver mining companies real upward momentum since March, as we have seen in AuAg Silver Bullets' returns. One of our goals with the fund is to have a better composition of holdings than the portfolio of the world's largest ETF for silver mining companies. With a smarter fund construction, we have had an excess return of +31 per cent (since inception) after costs compared to the ETF.

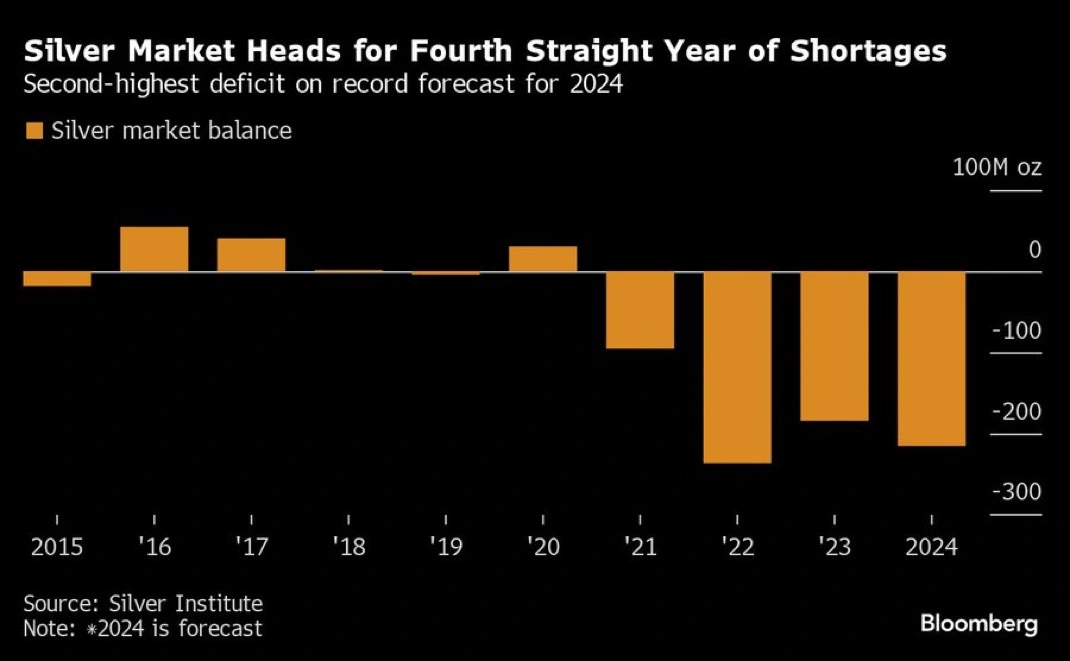

Silver is an element with unique properties and is particularly important in the electrification of our world. This is because silver is the metal that conducts electricity and heat the best of all metals. For several years, we have had a silver market with an 'artificially' low price for the commodity, inhibiting the incentives to start new projects and mines. At the same time, industrial demand for silver has increased. We now see that this has led to a structural deficit, and it looks like all available silver reserves (above ground) will soon be depleted.

Silver is an element with unique properties and is particularly important in the electrification of our world. This is because silver is the metal that conducts electricity and heat the best of all metals. For several years, we have had a silver market with an 'artificially' low price for the commodity, inhibiting the incentives to start new projects and mines. At the same time, industrial demand for silver has increased. We now see that this has led to a structural deficit, and it looks like all available silver reserves (above ground) will soon be depleted.

Silver is the only metal with simultaneous strong demand from industry and investors. In the event of a physical shortage, this unique dual-demand situationcan lead to explosive price increases. With only 30 per cent of all silver mined coming from so-called 'primary silver mining companies', these companies will be in a very strong position in the coming years. Mining companies always extract several metals, and the companies focusing on silver are called 'primary silver mining companies'. We want to own as many of these mining companies as possible in the AuAg Silver Bullet fund.

China is also buying gold, lots of gold

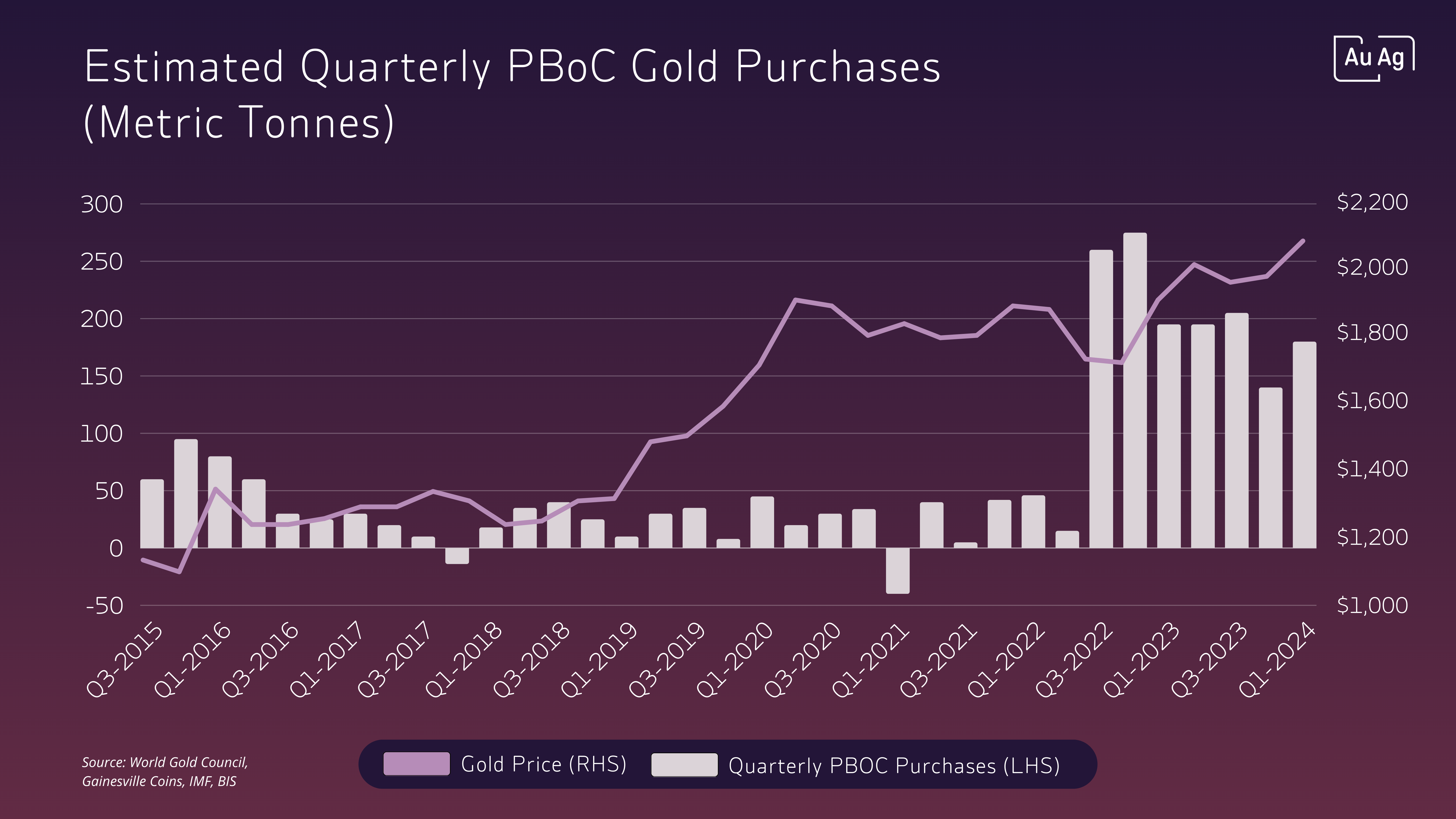

China has been rapidly selling off US fixed-income securities to buy more and more gold. Many central banks worldwide, led by China, are increasing their gold reserves. In a world where we are going towards increased de-globalisation, more countries are gradually trying to reduce their dependence on the US dollar.

In China, many investors have also increased their gold and silver purchases after a long period in which other assets with exposure to the Chinese stock and property markets performed poorly. A possible devaluation of the Chinese currency has also increased investors' willingness to buy gold and silver.

China has shown a strong interest in increasing its gold reserves, especially in the last two years. Record gold purchases by global central banks in recent years have been fueled by China's massive appetite for gold. Regarding silver as an investment, India and its populationhave also been among the top buyers.

China has shown a strong interest in increasing its gold reserves, especially in the last two years. Record gold purchases by global central banks in recent years have been fueled by China's massive appetite for gold. Regarding silver as an investment, India and its populationhave also been among the top buyers.

China, paper money, tea, global trade, silver and opium

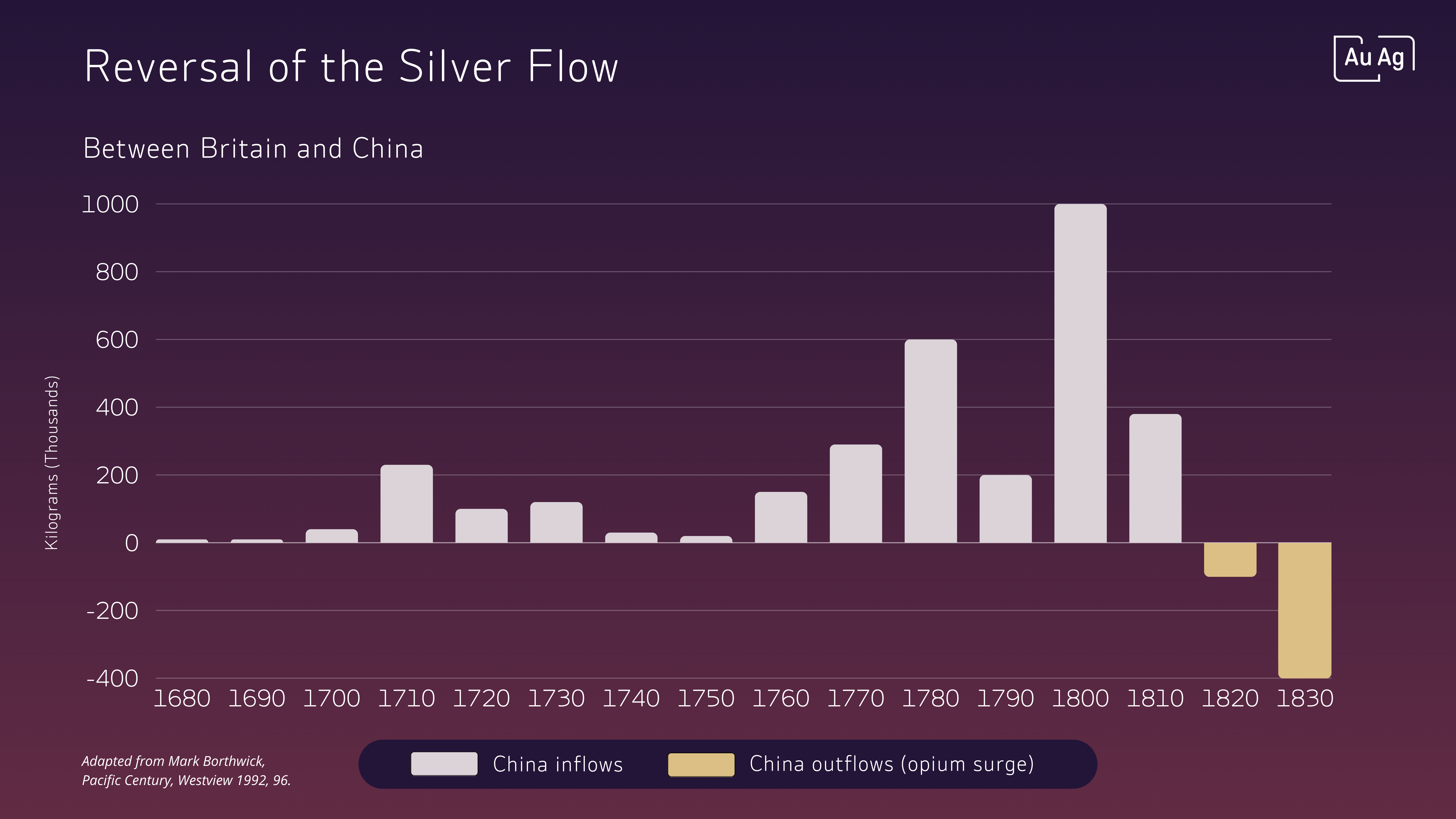

China was the first country in the world to create and use paper money. But, like most paper money systems, it ended up 'printing too much' to finance its deficits. This happened in the 16th century and resulted in a return to a money system based on silver. In the late 16th century, silver was the means of payment that linked America, Europe, and Asia and laid the foundations for the development of global trade and a global economy.

In the 18th century, the demand for Chinese luxury goods (especially silk, porcelain and tea) created an imbalance in trade between China and Britain. As China was not interested in European products, only silver, large quantities of silver were shipped to China, and Britain's silver reserves were depleted quickly.

In an attempt to get the silver back to the UK, the idea was conceived to start growing opium in India and then 'export' it via smugglers into China. In a short time, the Chinese became addicted to the drug and quickly consumed more and more. The influx of drugs eventually reversed the Chinese trade surplus, drained the economy of silver and dramatically increased the number of opium addicts in the country.

In 1836, the Emperor of China decided to make opium illegal while confiscating several assets related to the opium trade. The British, offended by the seizure of their property, sent a large naval expedition to China. This is how the first Opium War began. Britain's industrialised military power in the war proved far superior to China's. 'The "Treaty of Nanking", which ended the war in 1842, imposed many restrictions on Chinese sovereignty, and this was when Hong Kong became a British colony.

In 1836, the Emperor of China decided to make opium illegal while confiscating several assets related to the opium trade. The British, offended by the seizure of their property, sent a large naval expedition to China. This is how the first Opium War began. Britain's industrialised military power in the war proved far superior to China's. 'The "Treaty of Nanking", which ended the war in 1842, imposed many restrictions on Chinese sovereignty, and this was when Hong Kong became a British colony.

The funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

Reasons to invest in gold, silver, and mining companies in 2024

A brief summary of the most important trends and themes for gold, silver and mining companies in 2024.

/)

AuAg Live - #2 Live on Instagram with Eric Strand

/)

Triple-digit gains for the gold miners? AuAg Funds' Eric Strand makes the case

While the Federal Reserve is delaying rate cuts due to inflation, the economy is still getting lots of support, noted Eric Strand, founder and portfolio manager of AuAg Funds.

/)

/)

/)