/)

Elements | July 2024

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for precious metals and green tech elements. These observations are presented with images and charts laid out efficiently and concisely.

Precious metals, politics, and energy

We've now seen the end of the first half of 2024, with gold closing at USD 2326 and silver at USD 29.15 per troy ounce. Both metals were down slightly in June from their recent highs in May. Nevertheless, gold and silver for the year's first half are up +12.81% and +22.47%, respectively, in USD. Meanwhile, the dollar has been strong against the euro (+2.8%) and the Swedish krona (+5.0%) during the year's first six months.

Perhaps the most high-profile event of June is the debate between the presidential candidates in the United States. It's hard not to wonder how such a low level ("low energy") of politics in the most powerful country in the world will end.

But we'll leave it there for now while promising to return to the issue as we get closer to the election and how the various outcomes may affect gold, silver and all other metals.

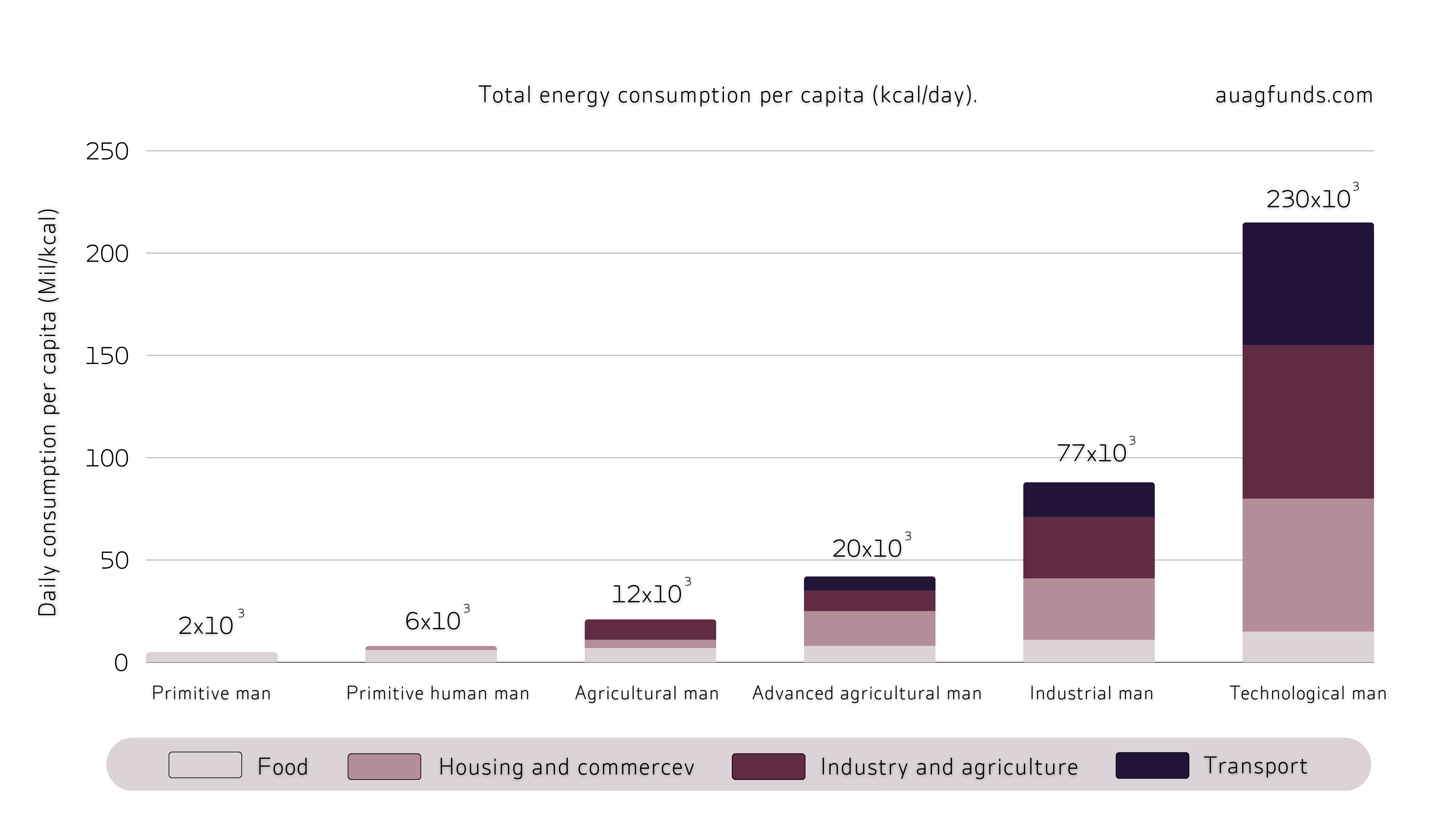

Instead, we'll look closer at the interesting energy issue that will affect the world so much over the next 5, 10, 20 years. Historically, the development of humanity has been related to our ability to create an expanded supply of cost-effective energy. However, the question is whether the cost of energy will become cheaper or more expensive in the future.

Some factors driving increased demand are:

- A larger and larger share of the world's population is living at a higher standard of living and will, therefore, consume more and more energy.

- The 'third metal age' fueled by the world's electrification has taken off and is energy-intensive.

- The latest addition is AI, which is expected to consume large amounts of energy.

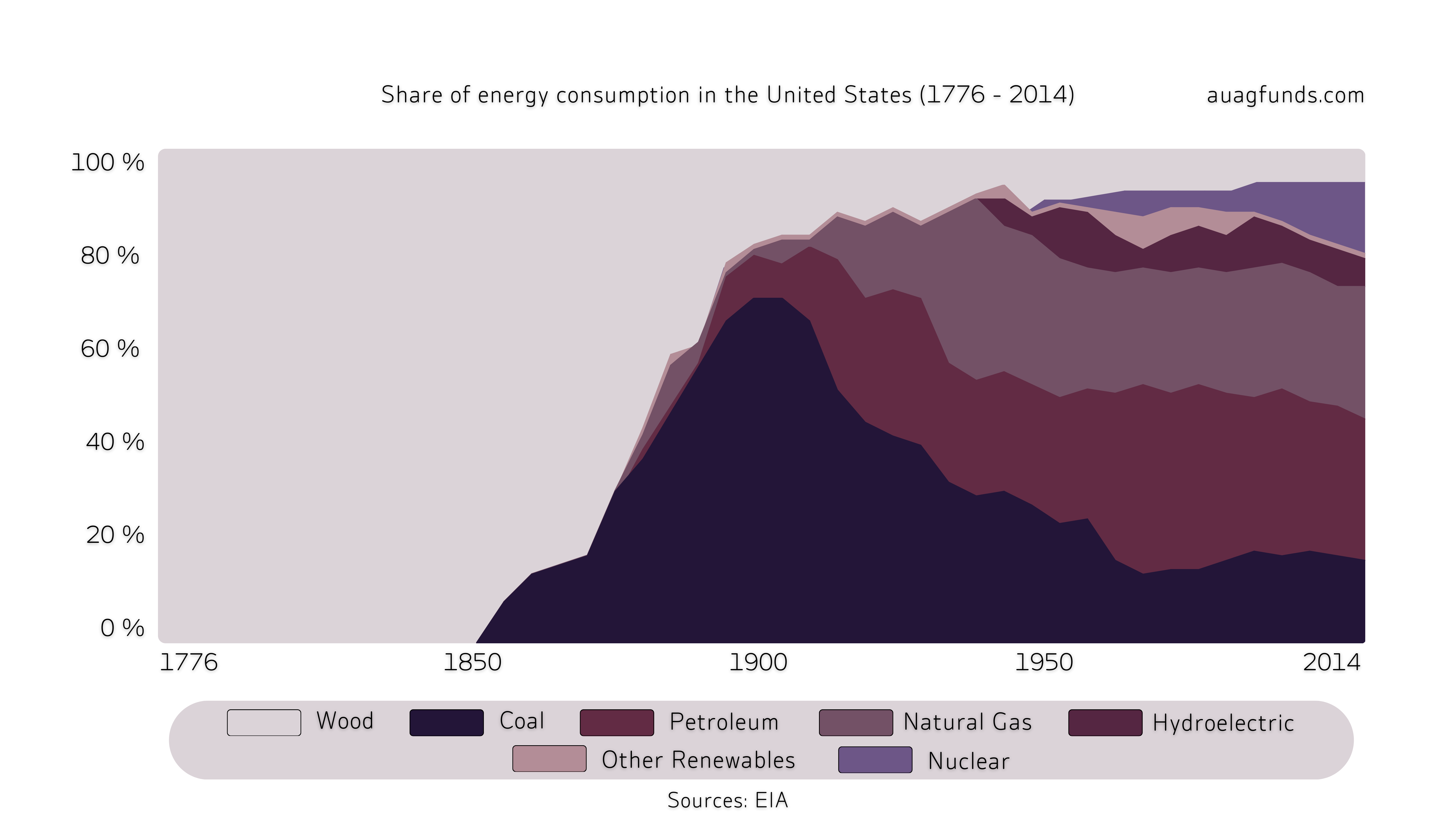

From wood to coal to oil/natural gas to...

Oil has dominated our energy supply for the past few decades but is now under heavy questioning. At the same time, oil's attractiveness is increasing as its price has come under downward pressure. With its large shale oil production, the United States, previously dependent on oil imports, has emerged as the world's largest oil producer, ahead of Saudi Arabia and Russia. Meanwhile, the Ukrainian war forced Russia to sell oil cheaply to countries such as India, China, and Saudi Arabia, which also put pressure on the price of oil in the world market.

Alternative energy sources are emerging

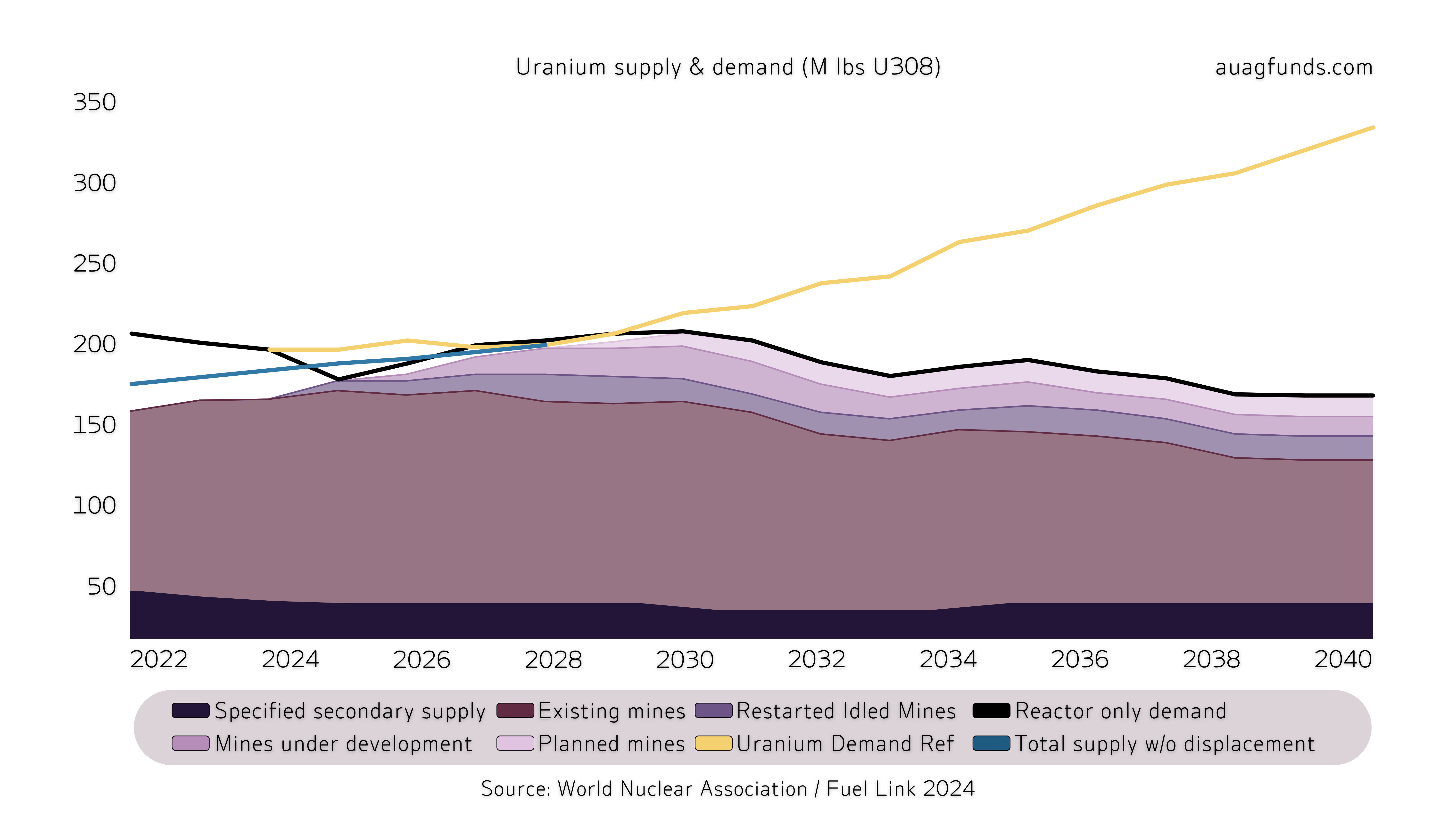

In the context of the green transition, with increased demand for alternative energy generation, nuclear power has emerged as part of the solution. However, this will lead to a sharp rise in the price of uranium as demand exceeds the supply. This may favour the uranium mining companies (producers).

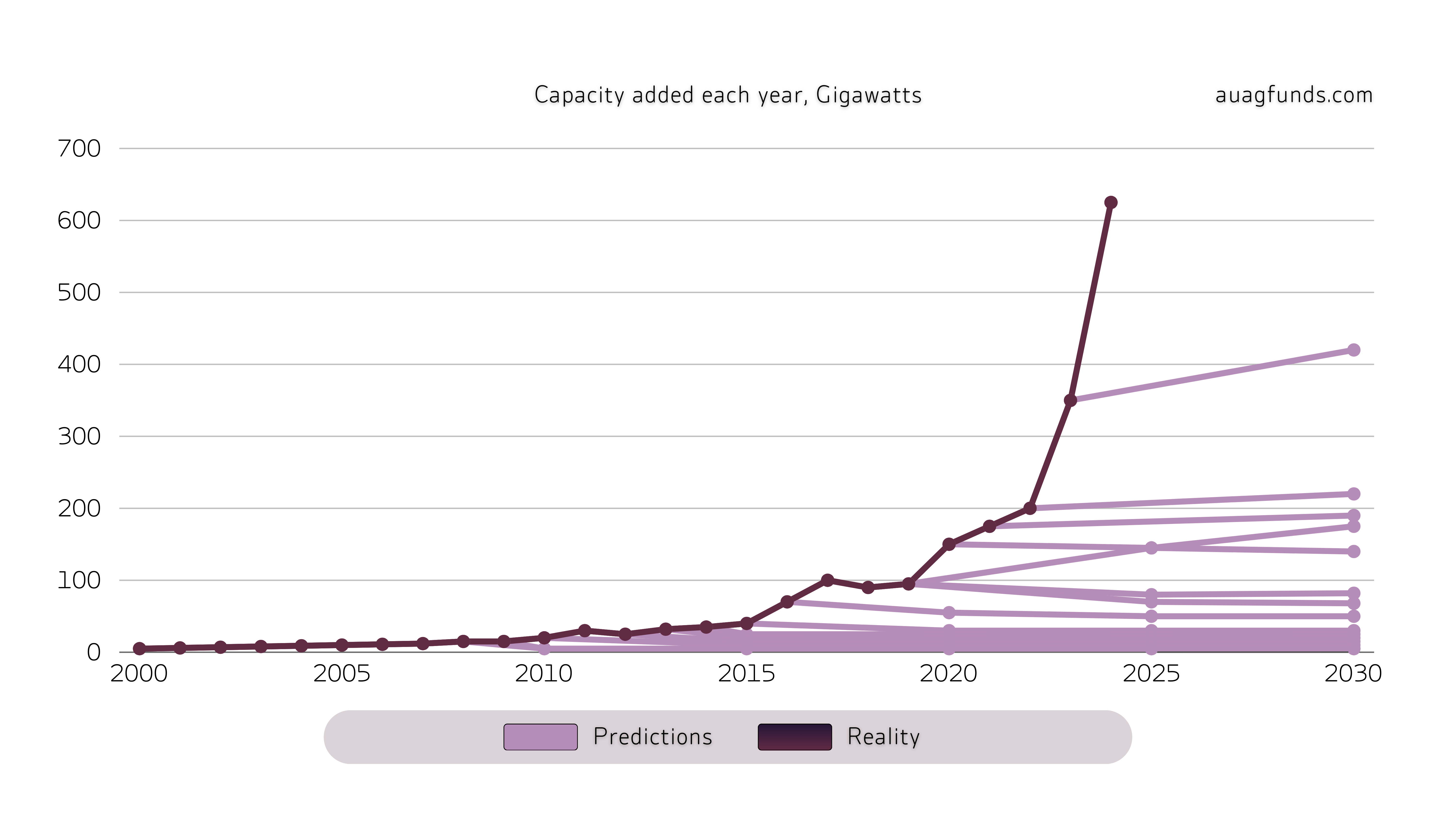

However, solar energy, in particular, has grown massively in recent years. Growth beats all international forecasts, and China is leading in this development.

However, solar energy, in particular, has grown massively in recent years. Growth beats all international forecasts, and China is leading in this development.

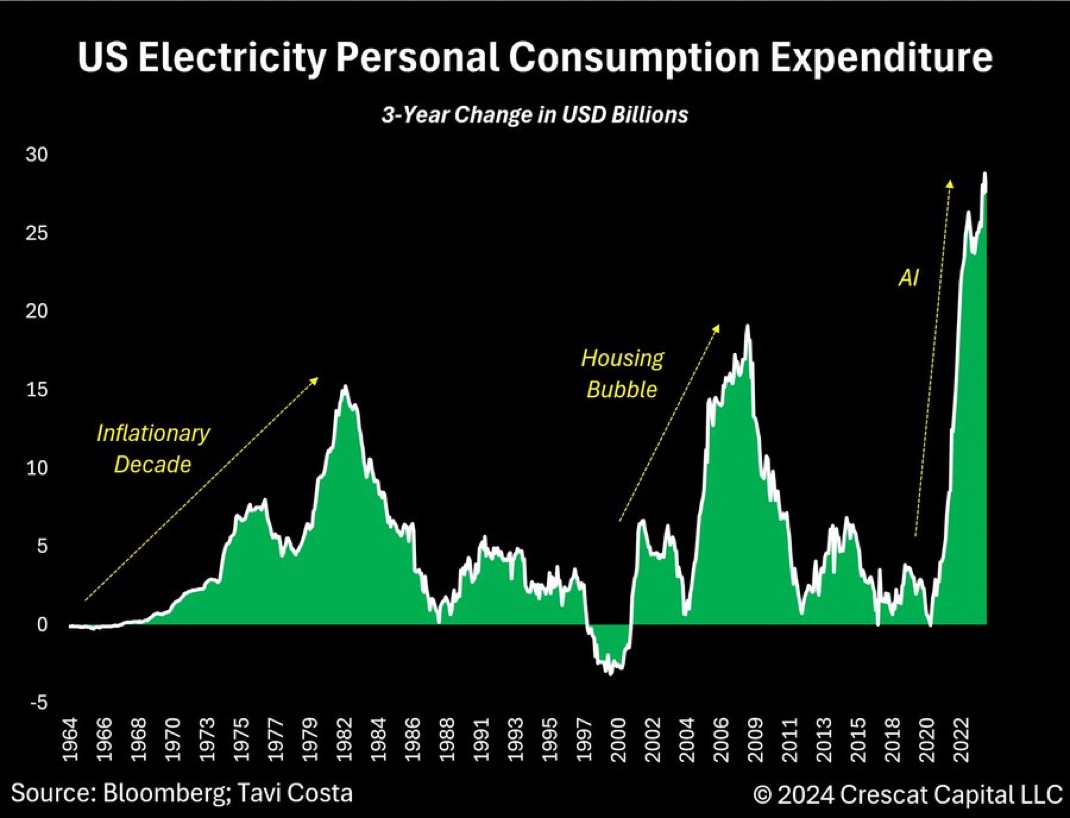

Consumption, price and inflation

Another piece of the puzzle is how much consumers pay for their electricity. We are now observing a sharp increase that is already greater than during the inflationary period of the 1970s and the housing bubble up to 2007. This phenomenon will require continued monitoring as to how it continues to develop.

Fusion. Infinite energy?

Fusion. Infinite energy?

Is the solution perhaps fusion power, as the sun does? In the sun's centre, hydrogen atoms are forced together under enormous pressure. This causes the hydrogen atoms to fuse and become helium, creating a chain reaction that releases incredible amounts of energy. Without the sun's power, the Earth would live in total darkness. There would be no wind and no rain, plants would not grow, and the planet would freeze and thus no longer be able to sustain life.

The sun's mass is about 330,000 times the mass of the Earth and represents about 99.86% of the solar system's total mass. With a core temperature of about 15 million °C, every second, the sun produces about 650,000 times as much energy as the Earth consumes in a whole year!

Before scientists can utilise fusion energy as a power source, they must create advanced nuclear fusion reactors that can withstand high temperatures, up to 100-150 million °C. Tungsten has one of the highest melting points of all the elements on Earth. Mixing tungsten with small amounts of other metals, such as nickel and iron, creates an alloy tougher than tungsten alone while retaining its high melting temperature.

Over the past 4.6 billion years, the amount of helium and its location in the sun have gradually changed. The proportion of helium in the corona has increased from about 24 % to about 60 % due to fusion, and some of the helium and heavy elements have moved from the photosphere towards the centre of the sun due to gravity.

Over the past 4.6 billion years, the amount of helium and its location in the sun have gradually changed. The proportion of helium in the corona has increased from about 24 % to about 60 % due to fusion, and some of the helium and heavy elements have moved from the photosphere towards the centre of the sun due to gravity.

Gradually, an inner helium core has begun to form that cannot fuse because the sun's core is not currently hot or dense enough to fuse helium. When the hydrogen fuel runs out, stars like the sun swell into red giants hundreds of times larger, swallowing up any neighbouring planets. In this way, the sun will swallow Mercury, Venus and Earth in about five billion years.

But that's a long way off and we believe in a Golden Future for humanity!

The funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

Reasons to invest in gold, silver, and mining companies in 2024

A brief summary of the most important trends and themes for gold, silver and mining companies in 2024.

/)

AuAg Live - #2 Live on Instagram with Eric Strand

/)

Triple-digit gains for the gold miners? AuAg Funds' Eric Strand makes the case

While the Federal Reserve is delaying rate cuts due to inflation, the economy is still getting lots of support, noted Eric Strand, founder and portfolio manager of AuAg Funds.

/)

/)

/)