/)

Elements | May 2024

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for precious metals and green tech elements. These observations are presented with images and charts laid out efficiently and concisely.

Is price inflation here to stay?

Many people think that central banks can manage price inflation, a belief that makes sense given that controlling inflation is part of their mission. Yet, it's worth questioning this role, especially since it's often the central banks' soft monetary policies that have significantly contributed to the price inflation we see.

We want to clarify that we do not believe interest rates will start to decrease in the future solely because the price inflation rate has declined. Instead, there will always be a sense of being "forced" to lower interest rates. This is because the interest costs for individuals, companies, and countries increasingly strain the financial system, ultimately leading to a dependence on a cycle of rate reductions. In these political times, an impending recession will not be allowed to persist for long.

Monetary inflation arises when more money is created and circulates within the system, causing each unit of currency to lose value (decreasing purchasing power). This type of inflation stems from growing levels of debt and stimulative fiscal policies. Gradually, monetary inflation leads to price inflation.

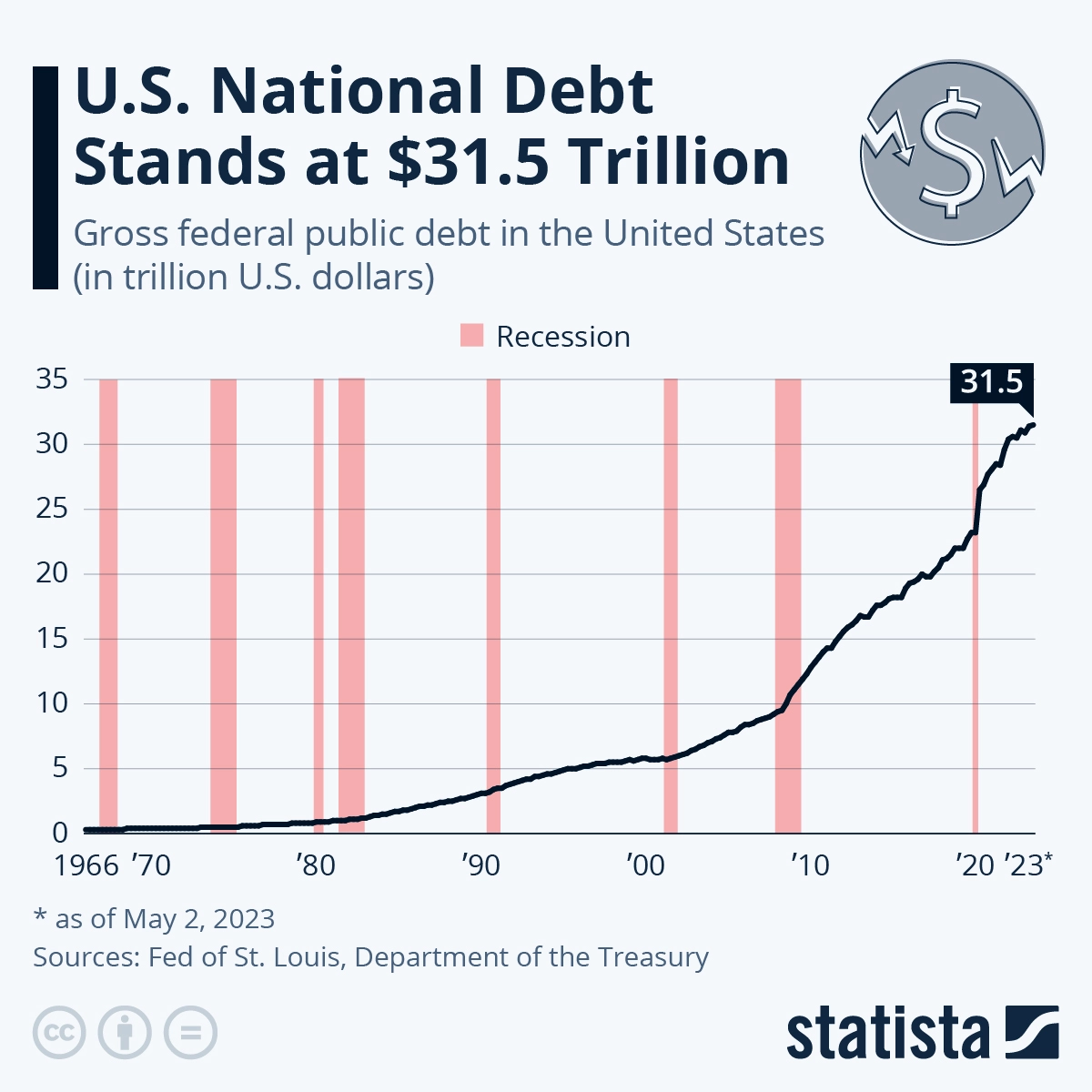

Currently, the Federal Reserve is refraining from reducing interest rates; instead, the United States is exacerbating the situation with substantial budget deficits and a general increase in debt (as seen in the chart below) to keep the economy going.

Is a new kind of price inflation on the way?

However, price inflation is also affected by other underlying structural factors that will create further price inflation in the future. Higher interest rates from central banks cannot influence or control these factors.

The 50-year trend of cheaper and cheaper production is now near a historical turning point. This model, which previously had the effect of keeping price inflation down, will soon disappear. "The End of Cheap Labor" is a trend that will lead to higher prices as it becomes more expensive to produce. There is an effort to produce cheaper products in the future by moving production to India and some African countries. However, there are differences in how effectively work is performed, with China standing out for its super high work discipline.

AuAg strongly advocates for a true market economy. However, today's distorted market economy has made certain individuals and companies extraordinarily wealthy, reminiscent of times thousands of years ago when they could build pyramids and vast cathedrals. A more grim definition of money might be "owning other people's time." From a humanistic viewpoint, it raises the question: should we regard ourselves as a single world rather than separate countries if such development entails a form of "semi-slavery" just to make shopping cheaper?

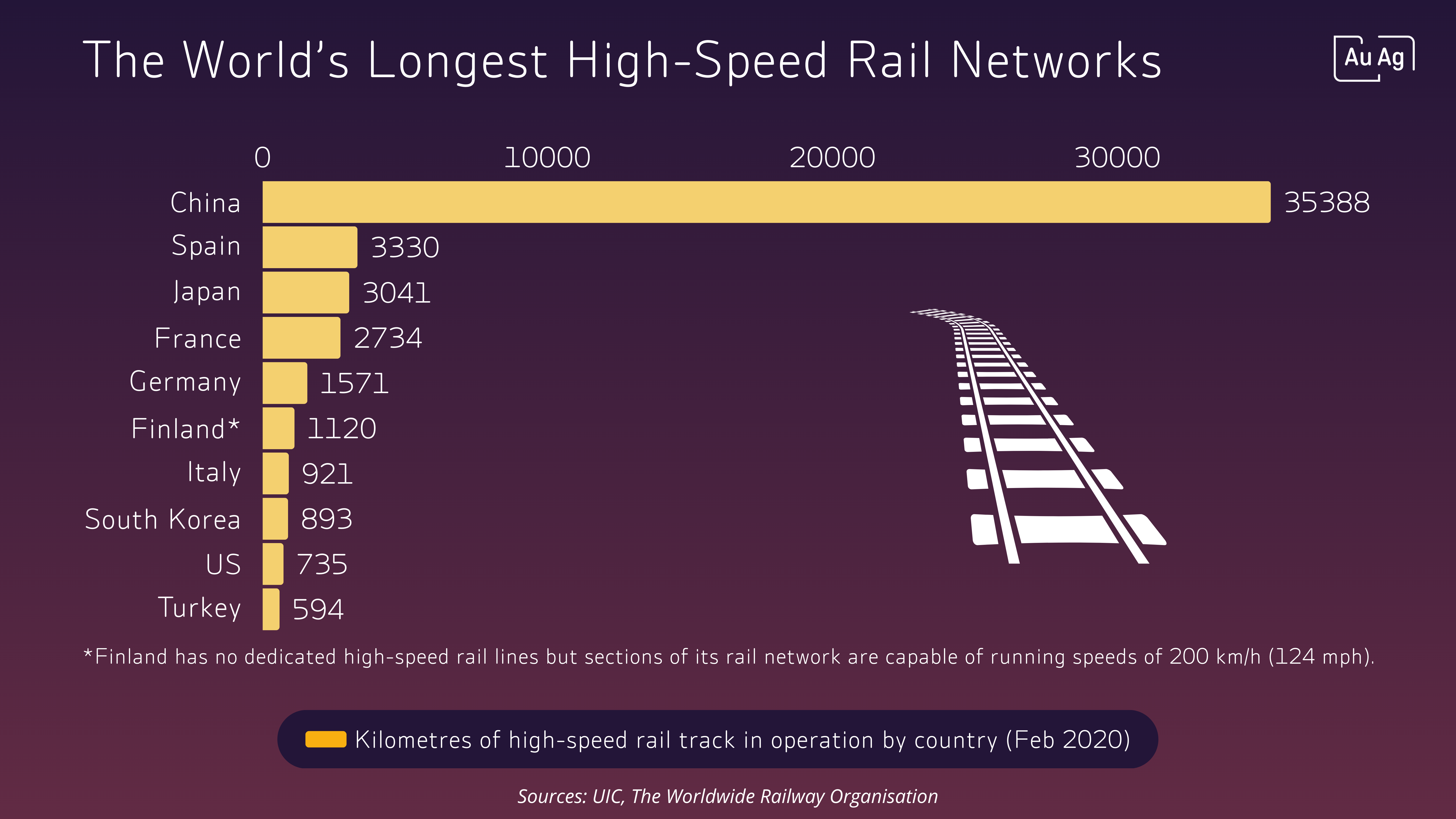

Another global structural change is the rapid growth of the middle class in countries like China and India. An example is China's big investments in high-speed rail networks; see the illustration below. When an additional 1 or 2 billion people begin purchasing the same goods and products that have been popular in the West, it introduces an entirely new level of competition for purchases on the world market. This is in contrast with the market competition observed among companies.

Another global structural change is the rapid growth of the middle class in countries like China and India. An example is China's big investments in high-speed rail networks; see the illustration below. When an additional 1 or 2 billion people begin purchasing the same goods and products that have been popular in the West, it introduces an entirely new level of competition for purchases on the world market. This is in contrast with the market competition observed among companies.

Furthermore, this middle class is not only increasing in size but also in wealth, which in turn intensifies the competition for slightly more expensive consumer goods.

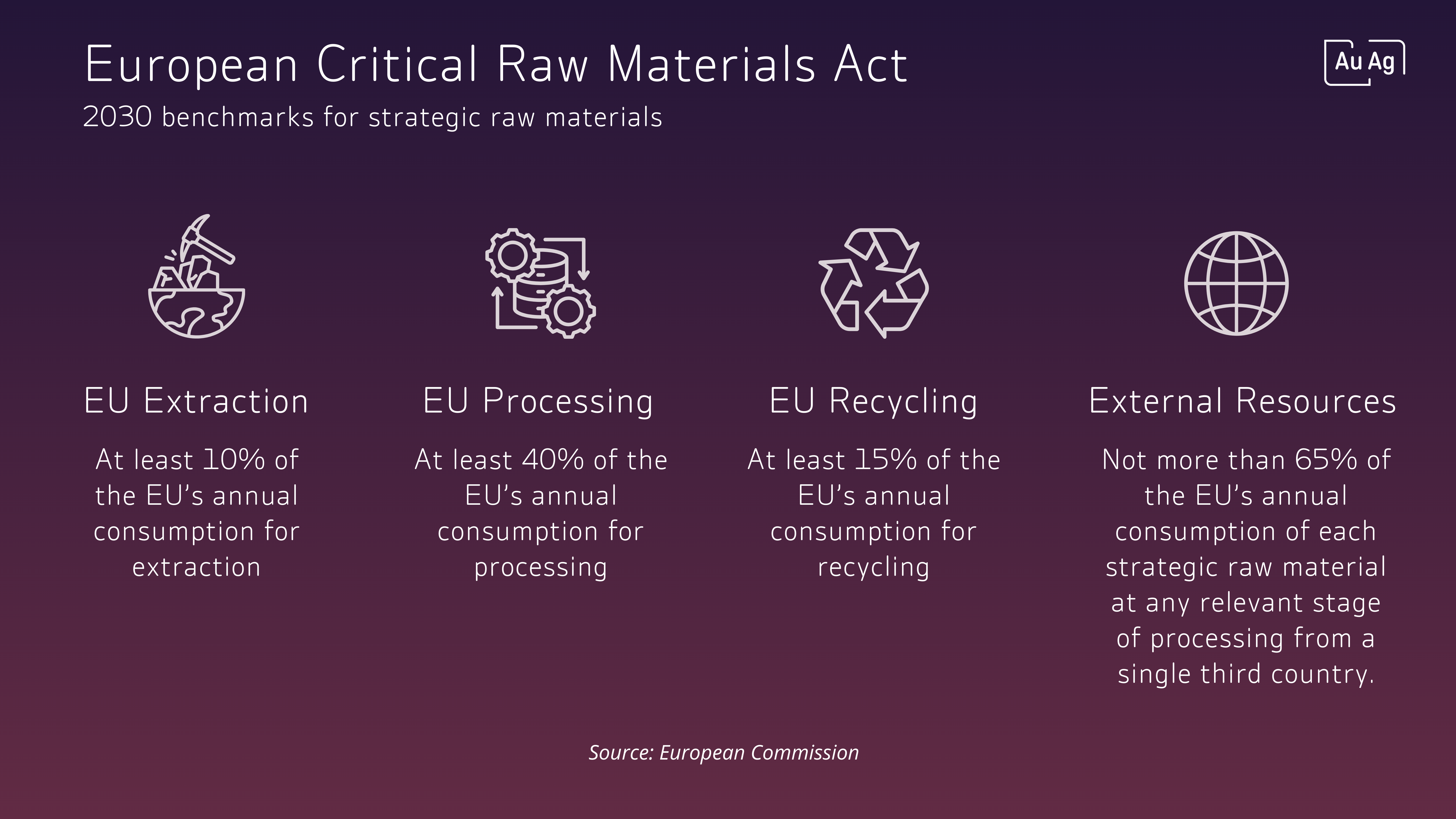

In recent years, we have witnessed a political shift globally, moving from fifty years of globalisation to a new period of deglobalisation. This shift is evident in the extraction and further processing of all essential metals. There are valid reasons for not wanting to be as dependent on certain countries as in the past. While globalisation has significantly influenced price inflation, deglobalisation will also have an impact, albeit in the opposite direction. Producing locally will be safer, but definitely not cheaper.

In recent years, we have witnessed a political shift globally, moving from fifty years of globalisation to a new period of deglobalisation. This shift is evident in the extraction and further processing of all essential metals. There are valid reasons for not wanting to be as dependent on certain countries as in the past. While globalisation has significantly influenced price inflation, deglobalisation will also have an impact, albeit in the opposite direction. Producing locally will be safer, but definitely not cheaper.

Are there factors that can reduce price inflation?

Are there factors that can reduce price inflation?

High debt levels could have a deflationary effect, as the rising costs of paying interest on these debts reduce disposable income. However, price inflation primarily arises not from people having too much money from employment but, as previously mentioned, from excessive money printing.

Decreased consumption due to high debt costs will likely create challenges for companies, leading to reduced sales of goods and services. This, in turn, forces companies to cut costs and reduce their workforce, resulting in higher unemployment and further financial strain on the system. This situation often spirals into fiscal stimuli, leading to increased budget deficits and higher levels of debt, which is another form of monetary inflation.

We remain highly optimistic about the future, thanks to human innovation. However, it is important to acknowledge that developing new products in sectors such as automobiles and mobile phones has generally led to more expensive products year after year.

A new trend in the mining sector

A new trend in the mining sector

Over the past year, we have witnessed an increasing number of mergers and acquisitions within the mining sector. The most recent is BHP's attempt to acquire AngloAmerican. This could potentially lead to a bidding war as several companies compete for growth. It will be interesting to see where the premium lands if the deal is eventually finalised and approved.

Many companies in the sector are currently seeking to increase production because the prices of various metals continue to rise due to a significant increase in demand, both now and projected in the future. As a result, the cash reserves of large companies are growing substantially.

Unlike previous periods of high metal prices, companies are now focusing more on being shareholder-friendly, offering high dividends and conducting share buybacks in conjunction with reducing their debt levels. Additionally, we observe that large companies are choosing not to invest in new reserves but instead prefer to acquire already producing and profitable companies to expand their own businesses.

They are being cautious with new, uncertain ventures that may take a long time and prove costly. This trend of acquiring existing producers also has widespread effects on the market. This development does not increase the total extraction of metals in a global market that demands more. This will lead to further effects that drive up the prices of commodities, thereby increasing profitability for these companies even more.

The funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

#1 Live på Instagram med Eric Strand

Video fra AuAg Funds livestream torsdag kveld 7. mars 2024 med Eric Strand.

/)

Reasons to invest in gold, silver, and mining companies in 2024

A brief summary of the most important trends and themes for gold, silver and mining companies in 2024.

/)

/)

/)

/)