/)

Elements | January 2024

Elements is AuAg's monthly letter highlighting macroeconomic observations from the previous month. Our focus is on events that impact the investment environment for precious metals and green tech elements. These observations are presented with images and charts laid out efficiently and concisely.

Will the underperformers of 2023 become the success stories of 2024?

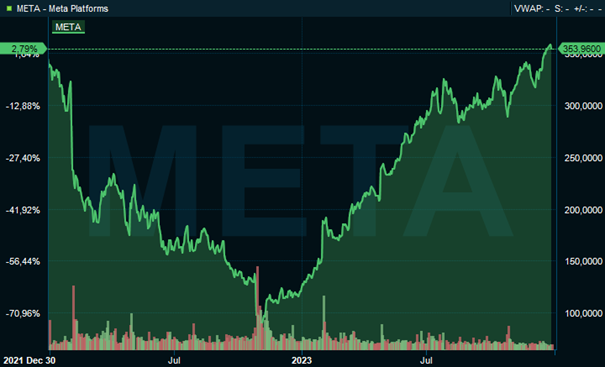

In 2023, the underperformers of 2022 turned into winners. For instance, Meta (Facebook/Instagram), part of the so-called "Magnificent 7," experienced a staggering increase of +194% in its stock value in USD. Yet, when we consider the two-year return, it stands at a modest +2.79%. This raises the question: will the underperformers of 2023 become the success stories of 2024?

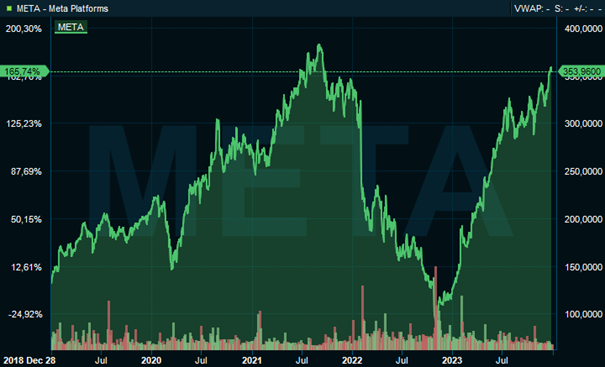

When evaluating stock performance over a longer period, such as five years or more, drastic fluctuations become evident. For example, Meta's stock is up +165.74% over this time frame.

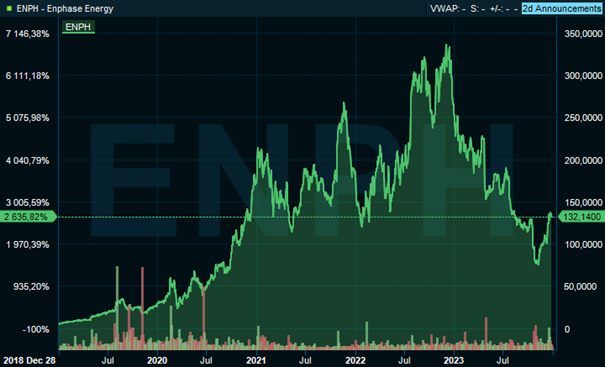

In 2023, certain sectors saw strong performance in specific segments while others lagged significantly. Many "Green-Tech darlings," like Enphase Energy, plummeted by -50% or more. However, a five-year retrospective shows Enphase with an astounding return of +2635%.

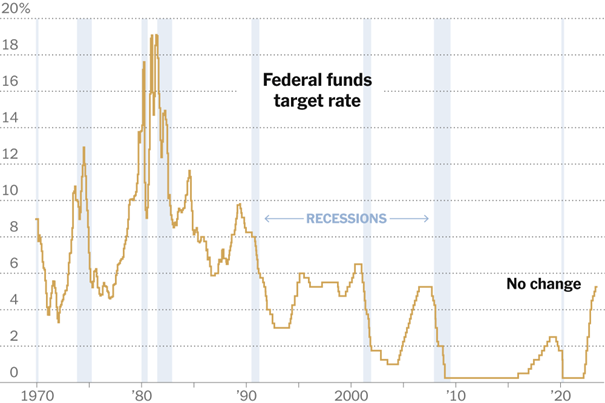

Companies that were not sensitive to interest rate changes and incorporated AI into their operations were the favourites in 2023. In contrast, small caps, emerging markets, and other sectors sensitive to interest rates underperformed. With expectations for interest rates to decline, we may see a reversal in 2024 compared to 2023.

At the same time, our perspective is that interest rates will decrease. This is not because we believe there has been effective control over the rise in consumer prices but rather because there is an impending need to "rescue" the financial system. This system faces the threat of collapse if interest rates are not promptly reduced during 2024. It is important to note that historically, the Federal Reserve has tended to reduce rates more quickly than it raises them, and for the past five decades, we have consistently seen lower lows in rate cycles.

Therefore, we would not be surprised if interest rates are reduced much more swiftly and to a lower level than the market currently anticipates. Up to now, the stock market has responded positively to the prospect of declining interest rates and the hope for what is termed a "soft landing". However, we consider a "soft landing" to be unlikely and therefore anticipate considerable risks within the stock market once it recognizes that the reductions in rates are aimed at rescuing the financial system rather than as a result of successfully curbing the pace of price increases. Should market volatility ensue, we also expect that central banks will promptly implement various measures, such as quantitative easing (QE), which will, in turn, stimulate a resurgence in the markets.

Featured content this month

Use our unique "Research Centre" on an ongoing basis to take part in our current view of the market and the macro environment. We communicate all the time. Here are a few media links from the past month:

/)

Börsveckan with Alpcot - Guest is Eric Strand

/)

Professional fencer became a fund manager

The experience Eric Strand gained from professional fencing contributed to his determination and success as an asset manager.

/)

IG Markets - Could gold benefit from expected Fed rate cuts, weaker dollar and government stimulus?

The funds

AuAg's investment solutions are essential building blocks in any portfolio. They aim to deliver positive long-term returns with a low correlation to traditional investment strategies.

/)

/)

/)